Westpac Subordinated Notes II - WBCHB

advertisement

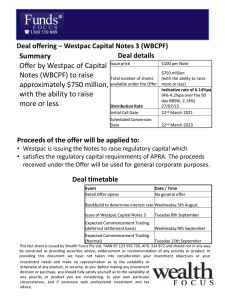

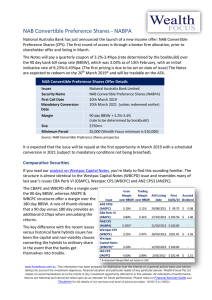

Westpac Subordinated Notes II - WBCHB Westpac Bank has just announced the launch of a new income offer: Westpac Subordinated Notes II. The first round of access is through a broker firm allocation, prior to shareholder offer and listing in August. The Notes will pay a quarterly coupon of 2.30%-2.45% (rate determined by the bookbuild) over the 90 day bank bill swap rate (BBSW), which was 2.76% as of 12th July, with an initial indicative rate of 5.06%-5.21%pa. (The first pricing is due to be set on date of issue) The Notes are expected to redeem on the 22nd August 2018* and will be tradable on the ASX. Westpac Capital Notes Offer Details Issuer Security Name First Call Date Mandatory Conversion Date Westpac Banking Corporation Westpac Subordinated Notes II (WBCHB) 22nd August 2018 22nd August 2023 (unless redeemed earlier) Margin 90 day BBSW + 2.30%-2.45% (rate to be determined by bookbuild) $750m+ $5,000 (Wealth Focus minimum is $10,000) Size Minimum Parcel Source: Westpac Subordinated Notes II prospectus It is expected that the issue will be repaid at the first opportunity in August 2018 with a scheduled conversion in 2023 (subject to mandatory conditions not being breached). We have covered the features in of fixed income hybrids on numerous occasions over the last 2 years. We would suggest investors who are looking for a basic understanding of how these products work, watch our online video An Introduction to Fixed Income Comparative Securities The structure of this issue is similar to last year’s ANZ, NAB and Westpac Subordinated Notes issues. The primary difference is this latest Westpac issue contains a nonviability conversion clause in the event that the companies get themselves into trouble. Arguably, the closest comparable is Westpac previous Subordinated Notes issues (WBCHA). Issue ANZ Sub. Notes (ANZHA) NAB Sub. Notes (NABHB) Westpac Sub. Notes (WBCHA) Westpac Sub. Notes ii (WBCHB) Issue Trading Margin Margin Price Accrued over BBSW over BBSW Issue Date 12/07/13 dividend 2.75% 2.14% 20/03/2012 $ 102.50 $ 0.55 2.75% 2.29% 18/06/2012 $102.00 $ 0.58 2.75% 2.23% 23/08/2012 $ 102.69 $ 0.98 2.30%* 8/08/2013 $ 100.00 * Anticipated Margin - Not yet listed on ASX www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/07/13 Our analysis For investors wondering why this issue is at a lower margin than the recent ANZ Capital Notes - We would like to remind investors that the bank Subordinated Notes sit higher in the debt structure than the majority of listed hybrids such as WBCPA. As such, these Notes, trade at a lower margin, reflecting the additional security this issue has over the majority of listed bank hybrids. WBCHA currently trades at $102.69 including a $0.98 accrued dividend (ex. div on 9th August 2013), with an effective margin to expected maturity of 2.23%pa. Similarly ANZHA and NABHB trade at an effective margin of 2.14%pa and 2.29%pa over the BBSW. The main difference in considering Westpac Subordinated Notes II versus the existing issues on market is the longer duration of this issue. Relative to the recent issues with an initial call date in 4 years, this issue’s initial call date is 5 years. As we have highlighted in our recent analysis of ANZ Capital Notes, investors should expect to be compensated for tying up their capital for a longer period. Furthermore, the addition of a non-viability clause means investors should also be compensated for this additional risk should the bank no longer be viable. The result is that it can be a difficult comparison for investors as relative to the trading margin of the current issues, WBCHB offers a higher margin. Using the same analysis as we did with the ANZ Capital Notes issue, we can consider the Bank Bill Swap Rate (BBSW), the rate that banks’ lend money to each other at, to view what the banks themselves consider a reasonable margin to be compensated for the longer term. This would indicate 2.50% is a fair margin. Further factoring in that the wholesale market yield curve is slightly flatter, and a margin of 0.3% for the non-viability clause, we would assess a fair margin as 2.75% over the BBSW. BBSW Yield Curve and the latest Big 4 Subordinated Notes issues 5% 4% 3% ANZHA WBCHA 2% WBCHB NABHB 1% 0 1 2 3 4 5 6 7 8 9 10 We have transposed the BBSW yield curve on to last year’s Big 4 Subordinated Notes issues to asses a fair margin on WBCHB. www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/07/13 Our View on Westpac Subordinated Notes II This month’s raising of $1 Billion for ANZ Capital Notes once again highlights how investors are just throwing money at any of the bank hybrids. As we highlighted in that analysis, unlike last year’s hybrids, this year’s Subordinated Notes issues have reduced attractiveness with margin compression. Banks are now very aware of just how hungry investors are for fixed income products which offer higher rates than term deposits. The new Westpac issue has little to offer investors. We expect there will be strong support from Westpac’s in-house advisers and existing WBCPA investors who are being offered the opportunity to roll into the new product, leaving very little on the table for new investors. Our view is that the longer duration and the non-viability clause needs to be rewarded with a margin in excess of 2.75% over the BBSW and with this expected to come in at 2.30% over the BBSW, investors are not being rewarded for the additional risk of this issue. Existing WBCPA investors should sit out and wait for the redemption in September. By contrast there are investors with the view that the risk of an Australian bank falling on hard times is negligible and just be happy that you are locking in a margin of 2.3% over the BBSW for the next 5 years. If you are one of those investors and looking for an allocation, we can get you one, but we think investors should give this issue thumbs down with both hands. Key features • Indicative floating yield of 5.06-5.21%pa - based on current 90 BBSW of 2.76% and bookbuild margin range of 2.30-2.45%. • Option to redeem at year 5 with scheduled conversion at year 10 - Westpac has the option to convert in September 2018 or on any subsequent dividend payment date. • Ordinary dividend restrictions - applies on the non payment of WBCHB dividends • Automatic conversion under the Non-Viability clause • Redemption highly likely in 5 years - although WBCHB has a 10 year maturity, we think Westpac will redeem/convert at the first call date in August 2018. Major incentives for redemption/conversion include the potential for reputational damage and risk of credit rating downgrade, leading to an increased cost of funding on future debt issues. Note: Westpac Subordinated Notes II will be listed on the ASX and as such the price of the Note’s will be subject to market movements. Investor’s selling on market may receive a price lower (or higher) than the issue price. Investors looking for an allocation can contact us on 1300 559 869 We encourage you to view our online presentation An Introduction to Fixed Income www.fundsfocus.com.au. This information has been prepared for distribution over the internet on a general advice basis and without taking into account the investment objectives, financial situation and particular needs of any particular person. Wealth Focus Pty Ltd makes no recommendations as to the merits of any investment opportunity referred to in this website. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance. Please read our Financial Services Guide and Disclaimer for full details of our services and level of advice provided. 02/07/13