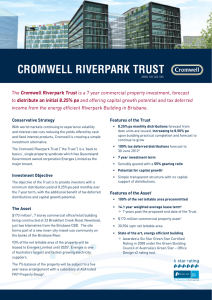

Cromwell Riverpark Trust March 2009 Fund Features

advertisement