2012 Financial Report University of Puget Sound

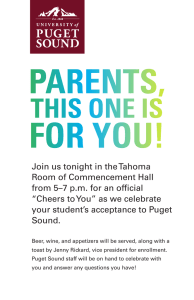

advertisement