2011 U.S. Proxy Voting Guidelines Summary January 27, 2011

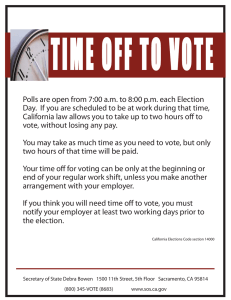

advertisement