TO: Faculty and Staff FROM:

advertisement

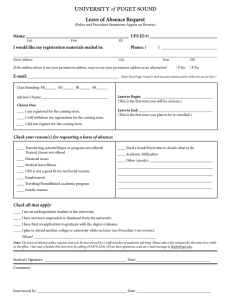

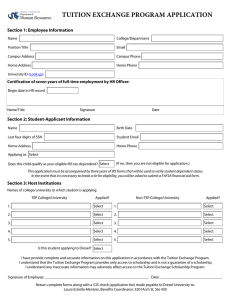

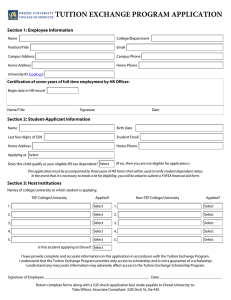

TO: FROM: DATE: SUBJECT: Faculty and Staff Education Benefits Committee (EBC) April 20, 2016 Annual Report from the Education Benefits Committee (EBC) I. Introduction and Overview The university seeks to minimize abrupt changes in the education benefits program given the importance of the benefit for faculty and staff as they plan for the education of their dependent children. In order to facilitate long-range planning and communication of changes, the Education Benefits Committee (EBC) was formed in fall 2013. The committee is charged with analyzing faculty, staff and dependent demographic information, monitoring education benefits utilization and trends, developing short- and long-term cost projections, and making recommendations to the vice president for finance and administration (VPFA) in the context of competitive compensation, a balanced benefits budget and university budget. The formation of the EBC responds to the 2012 recommendation of the ad hoc Benefits Task Force (BenTF), which recognized the importance of ongoing monitoring and assessment of education benefits, and recommended creating an ongoing committee to analyze education benefits, make recommendations, and communicate to the campus community. Committee members are appointed by the VPFA in consultation with the academic vice president. The committee will include one to two faculty, one to two staff, and one to two human resources representatives. One of the human resources representatives serve as chair. Members typically serve at least two years given the complexity of issues associated with education benefits and the steep learning curve involved. Faculty and staff serving on the committee for FY2014-15 were: Cindy Matern (chair), associate vice president for human resources/career & employment services Ally Bujacich, director of capital development, facilities services John Hanson, professor of chemistry Kenni Simons, human resources benefits manager, will be replacing Cindy Matern as the chair of the committee for FY2015-16. A new faculty member and a new staff member will also join the committee this year. During the last year, the EBC analyzed actual benefit utilization and expense data against the projections made by the BenTF in 2012. Simultaneously, the EBC updated projected benefit usage through AY2025 with the demographic information collected in late 2014 and with the 8% increase to the Open Tuition Scholarship (OTS) that was endorsed by the president’s cabinet in 2014 and became effective in AY14-15. Based on the analysis, the EBC has the following findings: AY15-16 is the last year that new students may utilize the sunsetting Northwest Independent Colleges Tuition Exchange Scholarship (NIC) program. The other member institutions sent a higher than usual number of incoming freshman students to Puget Sound in AY14-15 (six) and in AY15-16 (four). Even with an unusually large number of incoming students taking advantage of the NIC program, we project that the education benefits budget will be sufficient to handle this expense. Given uncertainties inherent in forecasting, it is possible that education benefit expenses may exceed the budget in some future years, but an education benefits reserve fund (EBRF) was established four years ago to handle such situations. For the past 4 years unused funds from the education benefits budget have been placed into the EBRF so that it is now fully funded ($1,250,000) and can be used to handle fluctuations in usage that may result in periods when education benefit utilization exceeds the budget. Since our projections indicate no long-term financial problems with the current education benefits program, the EBC did not recommend any changes in the education benefits program for this fiscal year. The EBC will continue to track actual benefit usage and expenses against the budget and future projections and consider whether to recommend changes to the benefit on an annual basis. As we continue to record historical data and collect demographic information, and with the sunsetting of the NIC program, we are gaining increased confidence in the accuracy of our modeling of future education benefit usage. Detailed utilization information and modeling methods and results may be found in sections II and III, below. The EBC also wants to remind parents that children are eligible for education benefits only if they are considered dependents by the IRS; under current IRS guidelines, dependent children must be younger than 24 years old (unless they are permanently and totally disabled). The EBC plans to operate within the following annual timeline: o Early winter: Pull demographic data for faculty, staff and their dependent children following benefits open enrollment. Update the EBC model with demographic data and usage/expense data. o Mid-winter: Finalize the updated EBC model and invite input from the campus community about education benefits. o Early spring: Submit to the VPFA recommended changes (if any) to the education benefits program. o Late spring or summer: Provide an annual report to campus about the activities, findings and recommendations of the EBC. II. Education Benefits Utilization for 2012-13,2013-14, and 2014-15 Based on the 2012 recommendations of the Benefits Task Force, the Education Benefits Policy was revised three years ago. The current Education Benefits Policy is available here. Table 1 below shows the number of dependents who have utilized various types of education benefits over the past three years. Table 1. Education benefits utilization for 2012-13,2013-14, and 2014-15 2012-13 Freshman Sophomore Junior Senior Total Distribution of eligible PS dependents (79 eligible dependents born 9/2/1990-9/1/1994) 2013-14 Freshman Sophomore Junior Senior Total Distribution of eligible PS dependents (94 eligible dependents born 9/2/1991-9/1/1995) Remission TE Exports TE Imports NIC Exports NIC Imports NWLA Open Tuition GF Cash Grant No Benefit Used a b c d e f g h i 4 5 7 11 27 34% 3 5 3 1 12 15% 1 1 1 3 6 1 2 2 7 12 15% 2 2 3 1 8 0 0 1 0 1 1% 6 3 3 4 16 20% 0 0 0 0 0 0% 14% 7 4 6 9 26 28% 4 3 5 3 15 16% 1 1 1 1 4 0 1 2 2 5 5% 3 1 2 3 9 1 1 0 1 3 3% 6 4 4 3 17 18% 1 0 0 0 1 1% 29% 2014-15 Freshman Sophomore Junior Senior Total Distribution of eligible PS dependents (91 eligible dependents born 9/2/1992-9/1/1996) a 4 7 5 7 23 25% 2 5 3 5 15 16% 2 1 1 1 5 2 0 1 2 5 5% 6 3 1 2 12 2 1 1 0 4 4% 8 6 3 3 20 22% 0 1 0 0 1 1% 25% Remission: Dependents of Puget Sound faculty and staff receiving tuition remission at Puget Sound. b TE Exports: Dependents of Puget Sound faculty and staff receiving a national Tuition Exchange Scholarship from another institution to attend that other institution. c TE Imports: Dependents of faculty and staff from other institutions attending Puget Sound and receiving a national Tuition Exchange Scholarship from Puget Sound to attend Puget Sound. d NIC Exports: Dependents of Puget Sound faculty and staff receiving a Northwest Independent Colleges Tuition Exchange Scholarship from Lewis & Clark, Reed, Whitman or Willamette to attend that other institution. e NIC Imports: Dependents of faculty and staff from Lewis & Clark, Reed, Whitman or Willamette receiving a Northwest Independent Colleges Tuition Exchange Scholarship from Puget Sound to attend Puget Sound. f NWLA: Dependents of Puget Sound faculty and staff receiving a Northwest Liberal Arts Scholarship from Puget Sound to attend Lewis & Clark, Reed, Whitman or Willamette. g Open Tuition: Dependents of Puget Sound faculty and staff receiving an Open Tuition Scholarship from Puget Sound to attend another institution. h GF Cash Grant: Dependents of former Puget Sound faculty and staff receiving a grandfathered Cash Grant Scholarship from Puget Sound to attend another institution. I No Benefit Used: Estimate of eligible dependents of Puget Sound faculty and staff not using an education benefit. The education benefits expenses for 2012-13, 2013-14, and 2014-15 are shown in Table 2. In all of these years the education benefits expenses were lower than the education benefits budget and the excess budget funds were added to the EBRF. At the end of the 2014-15 fiscal the EBRF had reached its cap of $1.25 million. Table 2. Education benefits expenses for 2012-13, 2013-14, and 2014-15 (all amounts in $1000s) TE NIC Open GF Cash Other Total Year Remission Imports Imports NWLA Tuition Grant Benefits a Expenses 20121041 155 328 4 104 0 428 2060 13 2013937 126 354 94 112 23 335 1980 14 2014922 163 518 130 136 10 287 2166 15 a “Other benefits” are education benefits utilized by faculty and staff members or their spouses/partners. Budget 2535 2535 2535 III. Modeling Methods and Results We are continuing to use a Microsoft Excel-based model to project Puget Sound’s expected annual education benefits expenses for the next ten-year period. What follows is a description of 1) the underlying data, assumptions and uncertainties of the model, 2) the current modeling results and 3) their implications. Underlying Data, Assumptions, and Uncertainties The model incorporates demographic data from the survey of dependents that is included as part of benefits enrollment process each year. There is a five-year waiting period before dependents become eligible for education benefits. Consequently, we expect the model to be highly reliable in its estimate of the total number of Puget Sound dependents eligible for education benefits over the next five years. For the five year period after that (years 6 to 10), there is more uncertainty since it is possible that new faculty and staff hired in the next five years will have dependents who will become eligible for benefits during the year-6 to year-10 window. It is also possible that faculty and staff may leave, thus lowering the total number of eligible dependents. We have not incorporated any method in the model to correct for possible changes in the number of eligible dependents during the year-6 to year-10 window. We assume that the eligible dependents that reach college age during a given year comprise the pool from which new students accessing the education benefits come (with the exception of dependents from other institutions receiving a tuition exchange scholarship from Puget Sound, i.e., TE imports and NIC imports in the model). We further assume that ongoing students will continue accessing the same education benefits for four years in a row. Both of these assumptions are oversimplifications (e.g., some dependents are younger or older than others when they graduate from high school, some dependents take a gap year following high school and then enroll in college). While breakdowns in these assumptions will change the exact numbers that enroll in any given year, the EBC’s modeling approach should provide a reasonably good average estimate of usage over a multi-year time frame. Table 3 shows our current projections for the number of benefits eligible dependents reaching college age in each of the next 10 years. “College age” in our model is defined as being age 18-22 as of September 1 of the academic year in question. Table 3. Projected numbers of benefit-eligible dependents (first-year students) FY16 FY17 FY18 FY19 FY20 FY21 FY22 21 17 19 26 21 20 14 FY23 24 FY24 16 FY25 13 While we feel fairly confident (at least over a five year period) in our estimates of the number of benefit-eligible dependents, an important source of uncertainty in the model is the estimate of how those dependents will distribute themselves among the different benefit categories: University of Puget Sound Tuition Remission (Remission) National Tuition Exchange Scholarship (TE) Northwest Independent Colleges Tuition Exchange Scholarship (NIC) Northwest Liberal Arts Scholarship (NWLA) Open Tuition Scholarship (OT) Dependents not using an education benefit We have three years of usage data with the new Education Benefits Policy (see Table 1) and have used that information to modify our distribution projection percentages from those originally used in the BenTF model (Table 4). The percentages in Table 4 reflect the distribution from the Benefit Eligible Dependents pool, while those expressed as actual numbers (TE Imports and NIC Imports) are the numbers of dependent students from other institutions that are attending Puget Sound as part of a tuition exchange program. These tuition exchange “import” students are expensed against Puget Sound’s education benefits budget, while “export” students are expensed by the receiving institution. Table 4. Distribution of education benefits use for first-year students – actual and model projections Actual Average for FY13-FY15 Expected for FY16 Model for FY17 and beyond Remission 29% TE Exports 16% TE Imports 1 NIC Exports 9% NIC Imports 4 24% 33% 12% 10% 2 3 5% 0% 4 0 NWLA 3% Open Tuition 20% GF Cash Grant 1% No Benefit Used 23% 5% 17% 27% 25% 1% 0 24% 15% Despite an additional year of data, which generally supports the utilization projections that we have previously used, we recognize that the data set is still too small to reflect significant trends that might differ from initial projections. Until additional data is built over time, there are still significant uncertainties in the utilization projections. If, after a reasonable amount of data is collected, utilization trends emerge that significantly differ from our current projections, the EBC will adjust future projections accordingly. As expected, remission is one of the most heavily used education benefits, and also the most costly. Approximately onethird of the benefit-eligible dependents use this benefit and it accounts for approximately one-half of the education benefits expense. We don’t anticipate any large changes in average usage over the next few years. We do anticipate that the per student cost of the remission benefit will continue to rise, and we have accounted for that in the model by using the modeled tuition increases in the university’s long range financial model, which is subject to change. TE exports (dependents of Puget Sound faculty and staff receiving a national Tuition Exchange Scholarship from another institution to attend that other institution) have continued to have higher utilization than average. We have estimated a lower percentage in years going forward. The TE exports do not require any direct payment from Puget Sound, and consequently, showing a lower number in future years is a “conservative” estimate – meaning that we may see more cost savings than this suggests. But over the long term, the number of TE exports from Puget Sound must be balanced by an equal number of TE imports. In the past, Puget Sound built up quite a bit of “credit” with the TE program (i.e., we had more TE imports than exports). We are currently exporting more TE students than we are importing, so, as our credit is depleted, we will need to increase the number of TE import scholarships we award, which is why in the model the number of TE import scholarships is increased from a single scholarship in FY13 and FY14, to two scholarships in FY15 and FY16, to three scholarships in subsequent years. Providing three TE import scholarships per year is consistent with the long term average number of TE exports that Puget Sound has utilized historically. Consequently, if we are eventually awarding three TE import scholarships each year, the total number of scholarships that need to be supported in any given year will eventually be 12, since each scholarship lasts for the four years that a student attends Puget Sound. In the model, we have estimated that the cost of each TE import scholarship will increase by $750/year. This is an estimate based on past increases of $500-$1,000 per year, but it is important to note that Puget Sound doesn’t control the amount of the annual increase, which is dictated by the Tuition Exchange, Inc. organization. The NIC program is sunsetting, and AY15-16 is the last year that new students will be offered a NIC scholarship. Once accepted, a student may continue the scholarship to graduation. Utilization of this benefit by dependents of Puget Sound faculty and staff (NIC exports) has been relatively low in recent years (one new freshman in FY13, none in FY14, two in FY15, and two in AY15-16; prior to FY13, the number of NIC exports averaged approximately four per year). Puget Sound doesn’t pay for NIC exports from our education budget; the receiving schools (Lewis & Clark, Reed, Whitman and Willamette) provide the scholarship and incur the expense. However, the Puget Sound education benefits budget must pay full Puget Sound tuition for each NIC import. One of the largest sources of uncertainty in our modeling has been estimating the number of NIC imports. From 2005 to 2014, the number of NIC imports averaged slightly over two per year. In FY13, FY14, and FY15 we had two, three and six NIC imports, respectively. Further, in this fiscal year (FY16) we have four imports. The relatively large numbers of NIC imports in FY15 and FY16 has a significant impact on the education benefits budget. The budget cost for a NIC import scholarship is the full cost of tuition at Puget Sound. As we did for remission, we have modeled the Puget Sound tuition in any given year using modeled tuition increases from the university’s long-range financial model. The NWLA scholarship was established following the announcement that the NIC program would be sunsetting, with NIC scholarships no longer offered after fall 2015. Since the NWLA scholarship has only been in place for three years, and since some of the schools were still available to Puget Sound through the NIC program, we expect that future utilization of the NWLA benefit will increase significantly. Essentially, we have altered our distribution projections using the assumption that the number of students who would have in the past utilized the NIC program, will in the future use the NWLA program since it offers a significant scholarship to the same four northwest peer schools. Since the NWLA benefit is not available for faculty or staff hired after 6/30/2012, it will become decreasingly utilized over time. We have not factored this into our modeling yet, since this is expected to happen very gradually, but eventually we expect that participation in the NWLA program will decline. The cost of each scholarship in this program is 75% of Puget Sound’s tuition, up to the total tuition at the institution attended. For modeling purposes we have simply used 75% of the estimated tuition at Puget Sound, which is generally fairly comparable to the median tuition at the other four NWLA institutions. We expect that the Open Tuition scholarship (OTS) will be more widely utilized as the NIC program is phased out in the near term and as the NWLA benefit is decreasingly utilized in the longer term. Even if we are able to accurately estimate the number of students utilizing the OTS in a given year, we are still left with the challenge of estimating the average expense of the OTS for these students. Since the amount of the OTS varies based on the parent’s length of service at Puget Sound, and since the tuition at some institutions (e.g., technical and community colleges) is less than the full OTS amount, it is difficult to develop an algorithm to estimate the actual average expense. Consequently, we have taken the expedient approach of simply estimating the average expense based on the average cost observed the previous year multiplied by the percentage increase in tuition at Puget Sound (as a proxy for the increase in tuition at other institutions) and the percentage increase in the maximum benefit. This approach has proven to be fairly accurate. In FY14-15 the average OTS was $6,789. (The maximum benefit is $10,800/year.) One of the most surprising results to us from our analysis of utilization patterns is the observation that approximately 23% of eligible dependents do not utilize any of the education benefits available to them, a trend that continued in AY14-15. We anticipate that some eligible dependents who currently do not use benefits may elect to utilize the OTS as time passes; so, for now, our model conservatively assumes that 15% of eligible dependents will not use any benefits. As described for the various education benefit programs listed above, we have built into our model estimates for increasing education benefit expenses over time (using the rate of increase in Puget Sound tuition as modeled in the university’s long range financial model). In addition, the education benefits budget will also need to increase over time; otherwise, it will quickly be overwhelmed by tuition increases. Although there was no increase in the education benefits budget between FY14 and FY15 due to other financial exigencies (i.e. above inflation increases in other compensation categories, including medical benefits), the budget was increased by 3.1% for FY16 and in our future projections we have assumed that it increases at the percentage modeled for Puget Sound’s tuition increases. Modeling Results Table 5 provides a summary of the projected budget implications over a 10-year period from our current EBC model. We provide three rows of data: Row 1: “Expense” – the projected total cost of education benefits. Row 2: “Variance” -- the difference between the estimated education benefits budget and the estimated expense each fiscal year. Years in which the estimated expense exceeds the budget are shown in parentheses. Row 2: “Reserve” -- the estimated funds in the Education Benefits Reserve Fund (EBRF) at the end of each fiscal year, never exceeding the approved $1.25 million cap. The values for 14-15 are the actual amounts for that fiscal year, the rest are projections based on our model. In this model we keep the current benefits structure unchanged. For example, the Open Tuition (OT) scholarship remains fixed at $10,800. We further assume that the rate of increase in the Education Benefits budget is the same as the modeled increase in Puget Sound tuition. Table 5. Current EBC model (2015-09-25) projections (all amounts in $1000s) Year 14-15 15-16 16-17 17-18 18-19 19-20 20-21 21-22 22-23 23-24 24-25 Expense Variance Reserve 2166 369 1250 2510 103 1250 2687 18 1250 2705 92 1250 2793 96 1250 2861 121 1250 3063 17 1250 3053 127 1250 3138 145 1250 3065 324 1250 2975 524 1250 We project that education benefit expenses will be greater than normal for the next few years, due in part to the large number of incoming students using the NIC scholarship. Nevertheless, our model projects that the budget will be adequate to cover these expenses, although uncertainties in the modeling mean that it is possible that expenses may exceed budget in some years. Over the past three years the unexpended portion of the education benefits budget has been used to fully fund the EBRF, which now stands at its capped value of $1,250,000. Thus, we anticipate no difficulty in covering any upcoming deficits by utilizing the EBRF. The AY15-16 is the last year that new students can participate in the NIC program, and consequently the uncertainties and expenses related to this program will disappear in the future. The EBC seeks to balance two competing interests. On the one hand, we want to provide the maximum education benefit for current faculty, staff, and their families, consistent with the education benefits budget. On the other hand, we don’t want to create an education benefit program that is unsustainable, and then have to cut the program for future recipients. Our modeling suggests that we are doing a good job of maintaining a balance between expenses and budget, and consequently we do not recommend any change in the education benefits program at this time. IV. Puget Sound’s Education Benefits Budget and Comparison to Peer Institutions The EBC is charged with considering education benefits in the context of competitive compensation and a balanced benefits budget and balanced university budget overall, To that end, we have looked at the size of the education benefits budget relative to other Puget Sound benefits (Figure 1), and in comparison to education benefits at comparable institutions (Figures 2 and 3). Education benefits are one component of the university’s overall benefits budget and are among the group of three benefits – medical, retirement and education benefits – that comprise approximately two-thirds of the university’s overall benefits spending (Figure 1). The EBC notes that during the ten year period from FY06 to FY15, the overall benefits budget increased by 53% ($6.54 million), with the most significant increases occurring in medical expenses (up $2.9 million, 107%) and education benefits (up 1.0 million, 65%). Education benefits currently comprise 14.6% of the total benefits budget. Figure 1. University of Puget Sound benefits budget by fiscal year (in millions) $20 $18 $16 $14 $12 $10 $8 $6 $4 $2 $FY07 FY08 FY09 Education Benefits FY10 FY11 Medical FY12 Retirement FY13 FY14 FY15 All Other Benefits* FY16 *E.g. FICA, early retirement, postretirement medical, life, AD&D, disability insurance, retirement plan expenses, workers compensation, unemployment, EAP, accrued leave liability Relative to our northwest peer institutions we rank second (Figure 2) and relative to our Pacific coast peers we rank third (Figure 3) in the amount of dollars spent on education benefits on a per FTE basis. Thus, we feel that our current benefit is competitive with that offered at Puget Sound’s regional peer institutions. Next year we plan to do additional comparisons to Puget Sound’s recently identified list of comparison institutions. And, in addition to analyzing the overall funding allocated to education benefits, we hope to do a more careful comparison of the nature of these benefits at each school (e.g. eligibility, types of scholarships, amount of scholarships, etc.). Figure 2. Dollars spent on education benefits per faculty and staff FTE – northwest peers – 2012 to 2014 $3,500 $3,000 $3,015 $2,755 $2,833 $2,500 $2,000 $1,500 $1,000 $500 $0 FY12 FY13 FY14 Puget Sound NW Peer Median Lewis & Clark* Reed Whitman Willamette *Lewis & Clark did not participate in this survey in 2013. Figure 3. Dollars spent on education benefits per faculty and staff FTE – PACCON schools – 2013-14 $5,000 $4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 $2,755