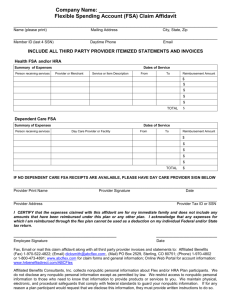

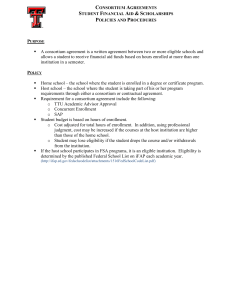

2016 Flexible Benefits Plan Election Guide

advertisement