Thefts, Floods, Fires…. OH MY! A primer on renter’s insurance

advertisement

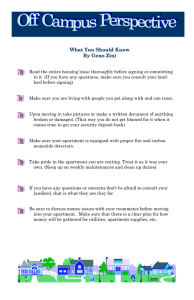

Thefts, Floods, Fires…. OH MY! A primer on renter’s insurance Off-Campus Student Services offcampus@ups.edu 879-3374 COMMON MYTHS 1. My landlord’s insurance covers me. This is a common misconception among renters, and it is untrue in almost all situations. Your landlord carries insurance that will cover his loss in a situation where the building is destroyed or damaged in some way. Your landlord is covered in case someone (including a tenant) is injured on the property, though not in your apartment. COMMON MYTHS 2. Renters insurance is expensive. The truth is that an average renter can get complete coverage for a couple hundred dollars or less a year, depending on where she lives. COMMON MYTHS 3. My roommate has it, so I don’t need it. The truth is that your roommate’s insurance will cover their possessions, but it will not cover yours unless you are listed on their policy. It is possible (and even encouraged) for roommates to get a single policy to cover all inhabitants and possessions in the apartment. Things To Consider 1. Replacement Cost vs. Actual Cost A basic policy usually provides for the actual cash value of your belongings after depreciation. If you have expensive electronics or other pricey items, you might want to consider replacement cost coverage instead. In this case, you would be reimbursed for the complete current cost of buying the new item. Of course, replacement cost coverage is more expensive, but may be worth it in many cases. Things To Consider 2. Deductibles Like any insurance policy, renters insurance will have deductibles. This is the amount of loss you will have to cover out of pocket before receiving any money from the insurance company. The higher the deductible, the lower the premium, but you must balance your ability to cover the deductible with the monthly premium savings. Things To Consider 3. Endorsements Like homeowners insurance, renters insurance usually won’t cover you for “acts of God” such as floods and earthquakes. You can get endorsements for these however, and you should seriously consider them. Endorsements can also be used to extend the amount of coverage on the policy or the incidents which are covered. Things To Consider 4. Loss of Use Coverage If something happens, like a fire for instance, that means you can’t live in your apartment or rental home for a period of time, you may have to live in a hotel and eat meals out. Your renters insurance can and should cover such “loss of use” just as your auto insurance covers a rental car while yours is in the shop. Things To Consider 5. Liability Your basic renters insurance will include liability coverage should someone be injured in your rental unit. As with car insurance, there is a per-incident limit on this coverage, and you should make sure this is high enough. Increasing liability coverage will often not increase premiums much at all. Things To Consider 6. Floaters for Special Items If you have such items as valuable jewelry, antiques, furs, or other big-ticket items, they often will not be completely covered under a basic policy. To fully cover these items from loss, you will want what is called a floater. These are essentially separate policies covering only these items and can be very inexpensive relative to the replacement cost of the items. Things To Consider 7. Appraisals If you do have such things as antiques, jewelry, furs, or other items not easily replaced but highly valuable, you may need to have an insurance appraisal done so you can have the coverage you need as well as the paperwork you will need to prove its worth. These appraisals, as well as a complete inventory of the items in your rental unit, should be kept somewhere outside your apartment or at least in a fireproof safe. Often, you will be able to place copies of such paperwork with your insurance agent. Things To Consider 8. Inventory Inventory the possessions you would most want or need replaced were they to be lost as well as any big-ticket items for which you may need special coverage. This could include your stereo and computer equipment, antiques, jewelry, appliances, and furniture. Gather details of make, model, serial number, age and costs (both purchase and current replacement) and put them in a spreadsheet and print it or write them down. Remember to put this list in a fireproof safe or somewhere outside of your rental unit. Also, take photos of as many items as possible for identification purposes and keep these pictures with your list. How Do I Find a Provider? 1. Parents/Guardians The first place you may want to look is to your parents or guardians. You might already be covered under their homeowner’s policy depending on your age and living situation. However, it is likely that any coverage under your parents’ policy is limited and may not cover all of your belongings or what is important to you. How Do I Find a Provider? 2. Current Auto Insurance Policy The second place you should look is to your current auto insurance policy. If you already have a policy that covers your vehicle, chances are that the same company offers homeowners and renters insurances as well. This could save you money because some companies offer discounts when you have two or more policies with them. Plus, it condenses your bills into one. How Do I Find a Provider? 3. Shop Around Even if your current auto insurance provider offers renters insurance, you should still shop around. Other companies may have better rates or policies. Do your research by calling different insurance agencies or looking them up online. Prevent Theft 1. Crime Free Housing Program The Tacoma Crime Free Housing Program, developed by the Tacoma Police, Human Rights, Fire, and Public Works Departments, is designed to help landlords and tenants develop partnerships in a neighborhood environment and foster a safe living environment free of illegal activity. Encourage your landlord to get certified in the CFHP or find out if your rental unit is already certified by looking at this website…. https://www.cityoftacoma.org/cms/one.aspx?objectId=5693 2. Lock Your Doors 3. Report Anything Suspicious Tacoma Police Non-Emergency: (253) 798-4721 UPS Campus Security Services: (253) 879-3311