Document 12131292

advertisement

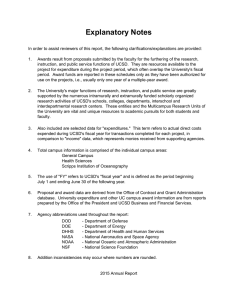

External & Business Affairs - Business & Financial Servics Divisional Strategy Map/Action Plan Summary, 2012-13 Customer Financial/Stakeholder Internal I1 - Simplify procedures & reduce workload for academic & clinical F1- Enhance UCSD’s system of control departments so we maintain the public trust of our I2 - Within limited resources, maintain stewardship of campus and donor the most critical support services & resources that will sustain the excellence of F2- (Ext Affairs) Engage alumni, UCSD’s academic and clinical programs External & C1 - Provide our customers with parents, friends & other stakeholders I3 - Enhance methods of Business intuitive & flexible tools so they can be in meaningful interaction that foster communicating with our key Affairs successful pride, advocacy & private support for stakeholders UCSD I4 - Reduce cycle time & improve the F3 - (Ext Affairs) Research identify, & performance of our essential support secure support & financial investments services to student, faculty & staff in UCSD I5 - In the area of technology, provide advanced tools & applications that will provide outstanding services for students, faculty & staff I6- Provide our customers with intuitive & flexible tools so that they can be successful (F1) Maximize existing resources while (C1) Enhance the way we identifying opportunities to secure communicate with BFS customers additional revenue (C2) Develop a comprehensive system (F2) Safeguard business resources, Business & that provides information and data and processes while providing Financial guidance to BFS customers visibility and access. Services (C3) Establish relationships and (F3) Reduce costs, optimize return on promote partnerships with customers investment and report results to stakeholders (I1) Analyze and deliver technology solutions that promote efficiency and mitigate risk (I2) Simplify processes/procedures and reduce workload for internal and campus departments. (I3) Develop business process metrics that illustrate how we are doing and drive improvements Learning & Growth L1 - Create a work environment for our staff that promotes their development, encourages their creativity & provide them with the skills to be successful L2 - Disseminate, promote & put into action UCSD’s Principles of Community (L1) Capture and share employee knowledge that enhances employee growth and learning, in addition to facilitate succession planning (L2) Sustain and enhance employee training to encourage and facilitate individual growth and benefit operational efficiency (L3) Raise awareness of the benefits of working at UCSD/BFS External & Business Affairs - Business & Financial Servics Divisional Strategy Map/Action Plan Summary, 2012-13 Customer Cashiers Disbursements Financial/Stakeholder (F1) Establish and periodically review organizational strategies/objectives to ensure deadlines and targets are met (C3)Establish relationships and (F2) Complete the Continuity promote partnerships with customers Emergency Plan for Cashiers using the (C1)Enhance how we communicate UC Ready tool and reach out to our customers (F2) Review and evaluate current (C2) Explore & collaborate on the internal controls processes/procedures opportunity to be part of the BFS-wide to highlight opportunities for CRM tool to better serve campus units streamlining while ensuring as well as students compliance with BUS-49 and properly safeguarding University assets (C1) Add new and enhance existing customer communication methods including updating web based training, adding FAQs to Blink topic pages, and delivering interactive training for essential processes and procedures (C2) Evaluate the development of a Disbursements dashboard to provide customers transparency to workload metrics, status of unpaid invoices and better understanding of Disbursements roles and responsibilities (C1) Introduce a new customer relationship service management application. Internal (I1) Analyze and deliver technology solutions that promote efficiency and improve internal controls Learning & Growth (L2) Sustain and enhance employee training to encourage and facilitate individual growth and benefit operational efficiency (I2) Simplify payment processes/procedures to reduce (L3) Raise awareness of the benefits of workload as well as improve efficiency working at UCSD/BFS and internal controls (L1) Improve quality of work life (I2) Reduce the issuance of paper checks by fast-tracking transitioning to electronic payment methods including (F2) Provide staff with advanced Payment Plus and ACH training on regulatory and policy (I2) Develop training and marketing changes so they can support campus plan for MyPayments rollout to include customers by providing guidance Financial Roles implementation and administration (F1) Update ACL to new platform for (I1) Manage the Marketplace invoice improved reporting and management processing and payment to align with for Purchase-to-Pay and Procurement business requirements and identify, Card modules track, and implements improvement to SciQuest Settlement including workflow, bugs, and updated functionality (L1) Increase the frequency and broaden the communication of new processes and changes to current processes to all of Disbursements staff (L2) Provide opportunities for training in internal BFS/UCSD process improvements and new process as well as on the UCSD Standards External & Business Affairs - Business & Financial Servics Divisional Strategy Map/Action Plan Summary, 2012-13 Customer Financial/Stakeholder Internal (I1) Close open internal audit findings related to balance sheet account management. Assess and identify high (C1) Support BFS efforts to standardize risk accounts and focus on them to and enhance customer support improve our reconciliation metrics. (C2) Improve our ability to provide Investigate and recommend an solid and reliable tax advice and (F2) Support campus efforts to manage automated software tool to help support to BFS Divisions, the campus the transition of the OP funding reconcile the thousands of monthly and medical center streams transactions in these accounts. GA/ Equip (C3) Continue to train campus users to Improve the visibility of balance sheet Mgt use our new Campus Asset (F2) Lead BFS efforts to define new reconciliation metrics to provide Management System policy on Agency accounts and affiliate campus and BFS insight into the (C2) Roll out new STIP management agreements attention being paid to reconciliations tool to increase the flexibility and (I2) Create and maintain GA Blink reliability of our quarterly STIP content to replace support previously distributions to the campus and provided by the ACT Blink team medical center (I1) Identify and strengthen control weaknesses in our accounting and financial reporting Material Support Services (C3) Increase marketing efforts through Blink teasers, notices, and Marketplace site to obtain exposure for services offered through Material Support Services. (Moving Service, SelfStore, Special Programs, Surplus Sales, Shipping, Receiving/Distribution) (F1) Rent remaining Self-Store units, review and document procedures for Surplus Sales non-inventoried items and guidelines for material pickups (I2) Update MSS Receiving procedures in collaboration with Marketplace to ensure a common voice in the policies/procedures for receiving goods at UCSD (I1) Order new CNG Trucks (five )for MSS Receiving, update computer system for Stores and Receiving operation. Complete Continuity Plan Learning & Growth (L1) Create and maintain our emergency action plans and our business continuity plan for GA (L2) Fully support and advocate staff training and development. Support BFS efforts to develop a new hire orientation product/presentation for new staff to highlight GA & Eq Mgt (L2) Consider opportunities to reorganize General Accounting in light of upcoming retirements, staff losses and workload (L1) Develop internal SharePoint site for employees in MSS to increase communication (L2) Implement plan that has been developed to increase/improve communication and appreciation for staff External & Business Affairs - Business & Financial Servics Divisional Strategy Map/Action Plan Summary, 2012-13 Customer OPAFS (C3) SPORT – Communication and (F3) Gift Processing – Roles and Training, Internal Department Responsibilities, Leadership Growth Relations (GAO Disbursements Payroll) and Communication – Build better relations (C1) Provide a forum for customers to provide real time feedback through face to face interactions and point of service surveys, and to use the Procure- information to continuously measure ment & and improve our customer service Contracts performance. (C3) Proactively engage with customers regarding high dollar value orders especially those that require issuing RFPs. Payroll Financial/Stakeholder (C2) My Time Entry (MTE) campus wide implementation and training (C2) Promote and develop Payroll BLINK content (C3) Implement biweekly pay cycle transition for monthly rated covered employees Internal Learning & Growth (I2) Final redistribution of awards to VC Teams, Formal communication of progress, Staff Training Tools Development (L2) Analyst to Accountant Exempt (I3) Performance Standards and transition assignments Measure Metrics and Reporting, Identify redundant and high risk processes, and fix SPORT (I1) Implement at least 2 modules of the AEC Soft application purchased by UCOP on Supplier Portal Management and Contact Management. (F3) Successfully consolidate buying (I2) Implement a spend analytics channels to Marketplace and Express program to automate metrics Card, eliminating the IFIS channel and reporting, improve identification of transitioning customers. savings opportunities, and improve spend visibility. (I3) Publish a data dashboard highlighting overall P&C metrics and department specific metrics (L2) Continue to provide cross training opportunities for staff. Expand customer support by cross training additional staff to assist with customer inquiries. (I1) Identify and develop Web based tutorials. (I2) Increase availability of Data in the (F3) Decrease paper check distribution Data Warehouse % by soliciting direct deposit and pay (I2) Elimination of Final Wages process cards for both students and staff and establish new procedures for these types of payments (I1) Participate in the design and training of UCPATH, UC's new Payroll Personnel system (L1) Develop and implement cross training and rotational opportunities in preparation of the roll out of UCPATH (L2) Promote staff development training External & Business Affairs - Business & Financial Servics Divisional Strategy Map/Action Plan Summary, 2012-13 Customer Student Business Services Travel Financial/Stakeholder (F3) Implement a Travelex payment conduit to facilitate international (C2) Implement a more flexible financial transactions payment system that will allow (F3) Analyze an accounts receivable students to see their entire financial system to communicate across UCSD UCSD profile and to direct payments to vendors to identify credit risks and the charges that they wish to be paid reduce bad debt expense for the whole university (C2) Continue to improve customer response system by enhancing use of Foot Prints features (C3) Build partnerships via Q&A sessions and Open House, and share info via Webinars, list serve announcements, and live sessions Internal Learning & Growth (I2) Finalize the automated Loan Exit processing system. (I1) Clean out transactions identified in last year's goal of ISIS general ledger reconciliations. (I2) Investigating SmartCard technologies for the UCSD identification cards (L1) As part of the re-tasking of the LAO Unit, provide cross training opportunities for our staff (L2) Continue to explore opportunities of staff development (L1) Through the Multicard systems for consulting services, staff will be able to learn about the horizons of technology (I2) Launch MyTravel 3.0 to replace TravelLink. Update team utilities to (F2) Pursue model of immediate airfare replace IFIS review and approval with reconciliation online review and approval (F3) Grow Connexxus use and online (I2) Enhance MyEvents adding the bookings to minimize cost option to pay Travel Card which will (F3) Expand Travel Event Planner/TEP eliminate paper claims Card program and streamline TEP (I3) Attain 90% direct deposit for audit process employee travelers, hosts, and meeting coordinators (L1) Strengthen team communications and publish written team vision, procedures, standards, and escalation process (L2) Grow knowledge and skills of Operations team to be fluent in both travel and entertainment policy and processes, replacing current model of travel specialists vs. entertainment specialists