ZEF Bonn Debt and Growth

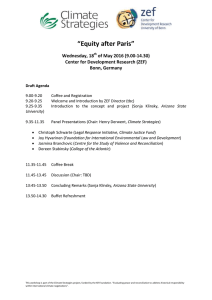

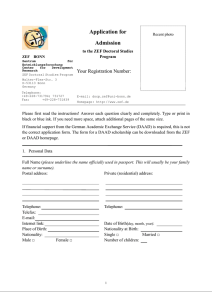

advertisement