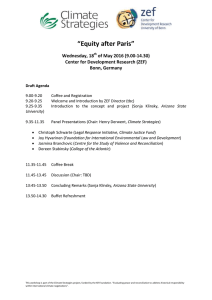

ZEF Bonn The Impact of Rural Enterprises on Household

advertisement