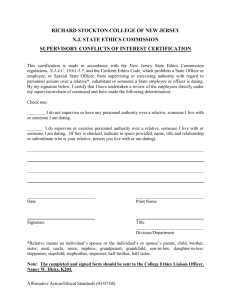

State of New Jersey S E

advertisement