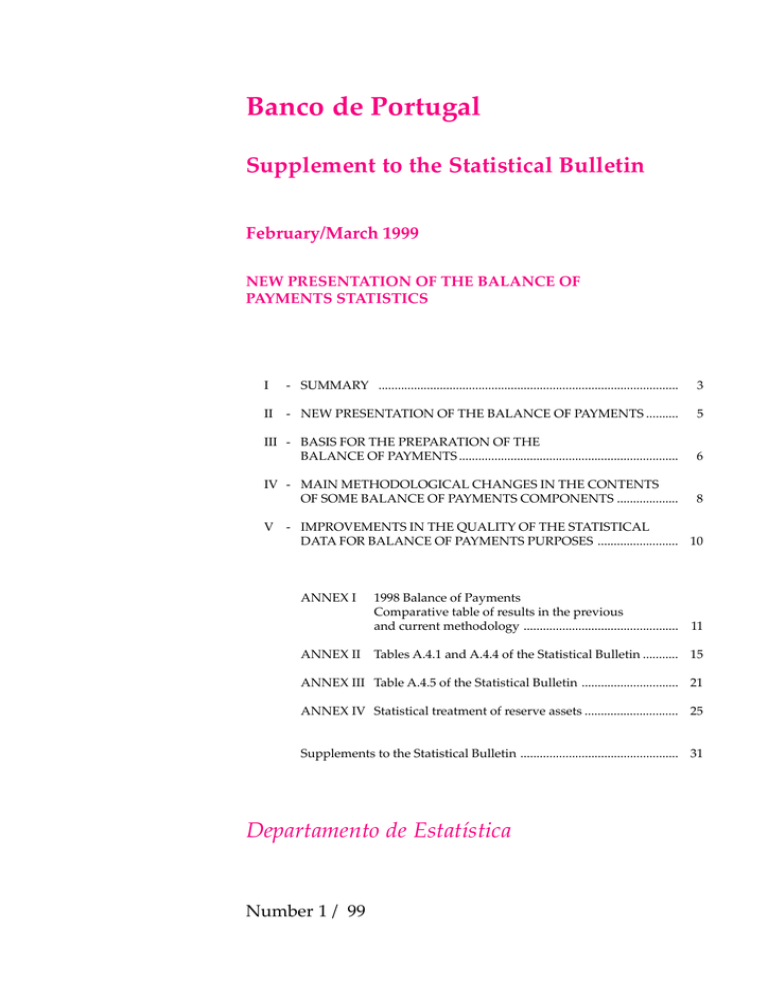

Banco de Portugal Supplement to the Statistical Bulletin February/March 1999

advertisement