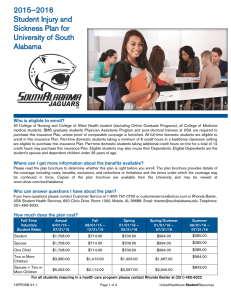

UnitedHealthcare SignatureValue Alliance Offered By UnitedHealthcare of California

advertisement