UnitedHealthcare SignatureValue Alliance Offered By UnitedHealthcare of California

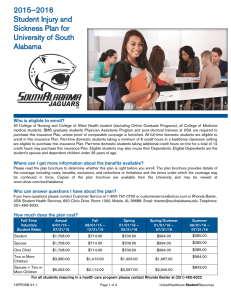

advertisement