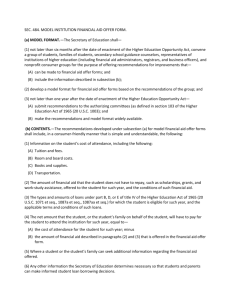

One Hundred Tenth Congress of the United States of America H. R. 6

advertisement