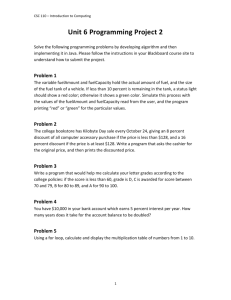

Energy Price Indices and Discount Factors for

advertisement