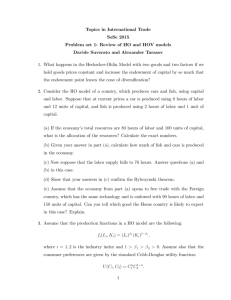

An Account of Global Factor Trade By R. D D

advertisement