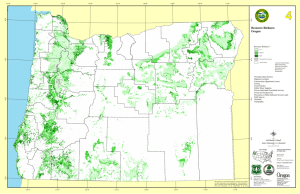

Federal Land Management and County Government: 1908-2008

advertisement