Cost Share/match Process:

advertisement

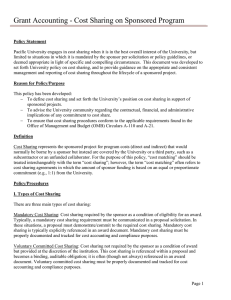

Cost Share/match Process: Requires departmental Cost Share sub‐fund for academic year buy‐out (release time) salary and benefits and other expenses. Work with John Finn (2‐7562, finnj@uncw.edu) on establishment of cost share sub‐ fund. John will need a detailed budget by fiscal year of cost share for budget establishment in banner. Departments are required to complete any HR paperwork needed for buy‐outs (release time). John Finn will work with departments for accurate information for paperwork. Training is available. Please contact John Finn for schedule of training opportunities. Once setup, departments use the sub‐funds as normal based upon the established cost share budget. See JIT – New Cost Share Fund for instructions on how to set up cost share fund. Only items which would be allowable under the applicable cost principles, if charged to the project, may be included as the awardees’ contribution to cost sharing. Contributions may be made from any non‐ Federal sources, including non‐Federal grants or contract, and may be cash or in‐kind (see OMB Circular A‐110, Section 23 ‐http://www.whitehouse.gov/omb/circulars_a110#23 ). Federal awards may not be used as cost‐share on any project. Failure to provide the level of cost‐sharing reflected in the approved award budget may results in sponsor termination of award, disallowance of award costs and/or refund of award funds to sponsor. Information related to cost sharing can be found in OMB Circular A‐110, Sub Part C.23 “Cost Sharing or Matching.” (http://www.whitehouse.gov/omb/circulars_a110#23) Information on cost principles can be found in OMB Circular A‐21 (Cost Principles for Educational Institutions ‐ http://www.whitehouse.gov/omb/circulars_a021_2004#c). To calculate cost sharing: Add all eligible project costs for your project to determine the total project cost. This is the total amount that is required to complete the project as described in the proposal (minus any ineligible costs). Calculate cost sharing required percentage for sponsor portion. Example: Total project costs = $1,000 Sponsor requires 25% cost sharing or match $1,000 X .25 = $250.00 = Cost Sharing – Institutional funds $1,000 x .75 = $750.00 = Sponsor funding for total project What is effort certification? • Effort reporting is a federally‐mandated process by which the salary charged to a sponsored project is certified as being reasonable in relation to the effort expended on that project. The OMB Circular (A‐21) requires faculty and staff involved in federally sponsored research to report activities for which they are compensated each academic term, or no less than every six months. The sponsor uses the reports to confirm that effort expended by an individual working on the research matched what the sponsor paid. Effort certification is your university’s process for reviewing, validating, and certifying the work effort performed by its faculty and staff in support of a sponsored research project. A systematic certification process and formal report ensure that your institution is always prepared to respond to sponsors with the required information. • Most faculty organized research effort is either charged directly to the sponsor, or is considered mandatory or voluntary committed cost sharing. Both mandatory and voluntary committed cost sharing are consistent with the terms and conditions of a sponsored agreement. On the other hand, voluntary uncommitted cost sharing effort is faculty‐donated additional time above that agreed to as part of the award. UNCW’s effort certification does not include certifying a grant recipient’s voluntary uncommitted cost sharing effort. This is effort that is over and above that which is committed and budgeted for in a sponsored agreement. Mandatory and voluntary committed cost share • Mandatory and voluntary committed cost sharing must be properly documented for cost accounting purposes. In addition, Circular A‐21 requires that faculty properly document all their mandatory and voluntary committed effort on research projects funded by both the Federal Government and a private third party (such as a corporation) so that salaries and costs can be allocated appropriately.