Document 12028462

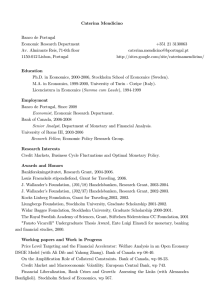

advertisement