MINUTES EMPLOYMENT BENEFITS COMMITTEE August 19, 2010 Members Present

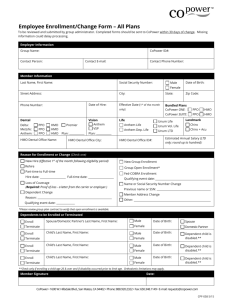

advertisement

MINUTES EMPLOYMENT BENEFITS COMMITTEE August 19, 2010 Members Present Don Clothier Debbie Copp Brenda Freese - Chair Suzanne Gilmore Don Harrison Members Absent Alisa Dougless Chad Johnson Frank Lawler Jannie Porter Darryl McCullough – Vice Chair Sue-Anna Miller Scott Moses Frances Wen Justin Wert Simone Pulat Will Wayne Ex Officio Members Barbara Abercrombie Julius Hilburn Nick Kelly The meeting was called to order by the Chair at 1:35 pm. I. Approval of Minutes The July minutes were approved with no changes. II. 2011 Health and Dental Insurance Renewal Negotiations have been finalized for the 2011 health and dental renewals. During negotiations it was agreed that BCBS would remove a substantial portion of their risk margin since the claims data is now more mature and therefore more reliable. BCBS had another month of claims to include in their analysis which turned out to be favorable for OU. Final rates will be based on the following: ** PPO – 4.3% ** HMO - 11.1% *** Community Care HMO – 12% OU contributions are based on the PPO plan, providing all employees with a 4.3% increase in Sooner Credits for healthcare. OU expects to absorb approximately $2.8 million of the total increase and employees $2.4 million. HMO continues to have higher percentage increase than PPO option. Factors contributing to the HMO’s higher percentage increase year to year: Adverse selection: Members with chronic conditions or those with foreseeable high cost events tend to migrate to the HMO. This allows them to control and plan for out of pocket costs. Higher benefit utilization. Members on the HMO plan seek more medical services. HMO benefit design provides a high level of benefits. Copays are low for many expensive services such as MRI’s, outpatient surgery, and inpatient hospital stays. Discussions are ongoing about wellness incentives. Discussions are focused on finding activities that will allow deductibles, copays, and out of pocket amounts to be reduced. Premiums for the BCBS indemnity plan for Medicare eligible retirees will be reduced by 36.5%. This was due to: Claims experience lower than anticipated Healthcare reform efforts, particularly in the prescription drug area Elimination of some risk margin by BCBS Delta Dental rates will increase 10%. There will be no rate increase on ancillary benefits (LTD, AD&D, Vision, etc.) Next Steps Submit for Regents approval in September Continue discussions with BCBS regarding a rate cap for 2012. Given the most recent year’s increases and considering budget challenges expected in 2012, fundamental changes may be required for benefit plan designs. Question: Don Harrison suggested that the cost drivers on the HMO plan be targeted as a potential means of controlling increases. Response: Julius explained that increases are based on the HMO plan as a whole, not one or two specific services. He described for the group how HMOs have evolved from a highly managed healthcare model to a less stringently managed model, such as OU’s current plan. Comment: Scott told the group he has read that costs are contained when Health Savings Accounts (HSA) and high deductible plans are used across the board. Response: Julius told the group that using a model with an HSA would be a major change, requiring increased employee out-of-pocket expenses but relatively lower premiums. However, all options are on the table for evaluation in 2012. Comment: Julius told the group that while plan design changes were explored with BCBS during negotiations for 2011, the modest decreases in premium did not justify the required changes. Motion: A motion was made by Sue Anna Miller to recommend the final negotiated rates to the Board of Regents at the September 2010 Regents Meeting. Debbie Copp provided a second to the motion, and all members present voted in favor. ** On August 25th, after the EBC meeting, the Oklahoma Supreme Court overturned a law requiring a 1% fee on all health claims, which was passed during the 2010 legislative session. As a result BCBS removed an additional 1% from the finalized OU rate increase. *** On September 10th, subsequent to the EBC meeting, Community Care agreed to lower their 2011 renewal rates from12% to 9%. III. FSA, COBRA, and Retiree Billing RFP The RFP committee heard presentations from three vendors on August 16, 2010. All bids are below current costs. Pricing will be finalized and presentations will be evaluated over the next week. It is anticipated a vendor will be selected in time for the Regents Meeting in September. IV. Wellness Update The 1st annual 5K run and 1 mile walk will be held on August 28, 2010 at 7:30 a.m. Fall screenings are coming up and information will be available in the next few weeks with details. WeightWatchers at work will be starting back up in September. OU employees lost approximately 1 ton of weight last year A smoking cessation class will be offered in the fall. Houston Huffman has lowered the monthly employee membership fee to $10. Nick reminded the group about Blue Points. Employees can earn prizes by tracking health progress. Comment: Darryl McCullough suggested adding information about healthy eating and/or healthy recipes to our monthly wellness mailings. V. Updates from the Chief Human Resources Officer Human Resources is working to finalize dates for open enrollment. There has not been a decision made with regard to retiree medical. The Record Keeper project is continuing to move forward The Retirement Plans Management Committee will meet on October 11, 2010 Two new members were added to the committee in the spring. Question: What is the current timeline for implementation of the record keeper? Response: The timeline continues to move, but the earliest implementation can be expected is likely spring 2011. VI. Other Business Brenda Freese will write the EBC recommendation to approve rates for 2011. Brenda will begin working on a draft of the 2010 EBC Annual Report. The next EBC meeting will be Thursday, September 16, 2010. The meeting was adjourned at 2:55 p.m.