Student Accounts & Cashier Services 1098-T Tax Information

advertisement

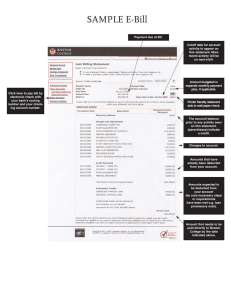

Student Finances First Student Accounts & Cashier Services Spring Billing Information E-bills for Spring pre-registration for undergraduate students were issued on November 17th and are due on December 15th. Non-payment of this bill will result in Spring classes being cancelled. Expected financial aid should be reflected in E-bill. Student classes will be cancelled if the student fails to pay charges not covered by financial aid. Important Dates Spring Teal Payment Plans are available. PLEASE NOTE: You have to enroll in a payment plan each term, plans do not carry over from the fall term. Please visit the TealPay website for more information. Dec Dec Dec Dec Dec Dec Dec 1098-T Tax Information What is a 1098-T? 15 15 16 18 19 19 24 Spring E-bill Payment Due TealPay 4 & 5 Closes Class Cancellation for Non Payment Last Day to Reinstate Classes Registration Re–Opens TealPay 3 & 4 Opens Winter Break Volume 1 Issue 33 December 2014 The 1098-T form is used by eligible educational institutions to report to the IRS qualified tuition and related expenses, as well as scholarships and/or grants. Keeping In Touch and Helpful Links Student Accounts What is the purpose of a 1098-T? What do I do with this form? This form serves to alert students that they may be eligible for federal income tax education credits. Please visit the IRS website for information on available education credits and IRS Publication 970 "Tax Benefits for Education". What additional information is needed? In addition to the information provided on the 1098-T, the student's personal financial records of the amount paid during the calendar year is needed. Payment transactions can be viewed in E-bill. How do I get the 1098-T? Students are encouraged to provide their consent to receive this form electronically. It is the most efficient and cost effective way to receive this tax form. For authorized users (parents) to access the 1098-T as well, the student needs to provide authorized user permission in E-bill. The following steps outline the consent process and authorized user permission: STEP 1: Student’s consent Login to E-bill (www.uncw.edu/E-bill) Select ‘My Profiles’, Select ‘Paperless Options’, Click ‘Change’, Click ‘Accept Consent’, Done! STEP 2: Give Authorized User’s permission to view Electronic 1098-T In E-bill (www.uncw.edu/E-bill) Select the ‘Authorized Users’ tab at top Click ‘Edit’ for an already established Authorized User (or first add a new authorized user) Select ‘yes’ for the second option, would you like to allow this person to view your 1098-T tax statement? Click ‘Update User’, Done! TealPay Payment Plan When is the 1098-T available? Housing & Residence Life The 2014 1098-T will be available in late January 2015 Registrar Auxiliary Services Campus Dining Financial Aid Helpful Links Tutorials Frequently Asked Questions E-Bill The Student Accounts & Cashier Office will be closed during Winter Break. December 24 through January 2, 2015. Please mark your calendar. Contact Information Perkins Loan Recipients UNC Wilmington Cashier’s Office - Student Accounts 601S College Road Wilmington, NC 28403 - 5926 Phone: Fax: 910-962-4281 910-962-7402 Email: Studentaccounts@uncw.edu Email: tealpay@uncw.edu All Perkins Loan recipients must complete a mandatory exit interview. Exit interviews may be completed online at www.mycampusloan.com. Campus Partners will mail you instructions to your permanent address. Contact Constance Evans at 910-962-7419 or evansc@uncw.edu if you would like to make an individual appointment.