Selling Goods & Services Internal Control Workshop Financial Services Division April 2011

advertisement

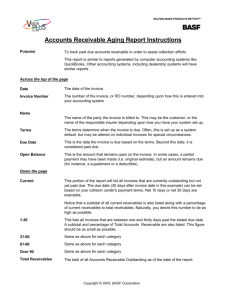

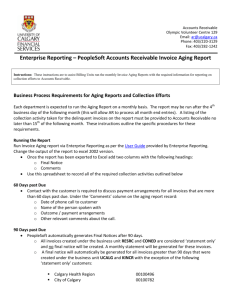

Internal Control Workshop Selling Goods & Services Financial Services Division April 2011 Selling Goods & Services We are focusing on three key components of selling goods and services for enhancing the internal controls that exist at the university. The three key components of the selling process are: • Invoicing • Accounts Receivable and • Deferred Revenue Why is this Important Enhancing the three components of selling goods and services is important to the institution for a number of reasons, including: • Ensures that the university receives all monies owed to it • Ensures that there is an accurate record of who owes the university money • Ensures the complete, accurate and timely processing and recording of sales revenue • Assesses the credit worthiness of our customers • Minimizes the cost of accounts receivable processes • Ensures compliance with approved university policies and procedures • Provides timely and complete information to support management decision making • Ensures accurate financial reports for the university Invoicing Invoices record the billing of customers for goods or services that are provided. The invoice needs to include all the details of the sale and also needs to be recorded in UniFi. Opportunities for Improvement Through the internal control self-assessment two areas have been identified where improvements could be made to invoicing processes at the university. The two areas identified are: • All invoices are recorded by the end of the next business day following the date of the sale • All sales to non-university customers, that are not paid at the point of sale, are recorded as accounts receivable in UniFi Impact on the University Effective invoicing processes have a number of direct impacts on the university, including: • Minimize the risk of lost revenue from unrecorded sales • Create and maintain a positive reputation with customers Easy to Implement Changes Rather than trying to address all of the processes around invoicing, we want to focus on some easy changes that can be made to enhance university processes. The following are intended to be some Selling Goods & Services April 18, 2011 Page 1 of 6 enhancements to existing processes that can be made with minimal effort but significant institutional impact. Use of Sales Invoice Sales Invoice documents should be issued on the date of the sales transaction. The invoice should also be recorded to UniFi no later than the next business day. A standard invoice template is available on the Financial Services Division website as an “Accounts Receivable Invoice Template.” If your unit does not have an invoice template or preprinted invoices, please use this template for your sales invoices. If you do have an existing template, please ensure it includes all of the required information noted below. Your invoices should contain the following information: • The selling unit’s name, address, telephone and/or email contact information • Sales invoice number o If you do not have pre-numbered invoices or department invoice numbers, you can use the journal voucher document numbers received when recording the transaction in UniFi • Customer number established by the university or the department CFOAPAL where the cash receipt should be coded • Invoice date (the date that the invoiced goods/services were supplied to the customer) • The customer’s purchase order or purchase agreement/contract number, if required by the customer • The customer’s legal name and mailing address • The university’s GST registration number R11927 9313 RT0001 • Details of the products and services being sold, including quantities and pricing, which are agreed to the customer’s purchase order/agreement documents • Appropriate taxes detailed on the invoice • The university’s payment terms and charges that will be assessed to the customer if they do not remit payment in accordance with the stated terms. For any charges that will be recorded to central accounts receivable, you should include the terms “Net 30 days from invoice date. Late payment charges of 1.5% compounded monthly, 19.6% yearly, on all past due balances.” • Instruction to make cheques payable to the University of Saskatchewan • Instruction that the customer’s payment is to be sent directly to the university’s Treasury Department mailing address: Treasury, University of Saskatchewan E40 105 Administration Place Saskatoon, SK S7N 5A2 • Advice that the identified university customer number and sales invoice number should be documented in the customer’s payment submission o Including these details will help ensure that the payment is deposited to the correct CFOAPAL Selling Goods & Services April 18, 2011 Page 2 of 6 Recording the Sales Invoice in UniFi If your unit does not have an automated feed to UniFi, invoices should be recorded daily using a journal voucher. The journal voucher can be used as the invoice number if a separate journal voucher is created for each invoice. If you have a different department invoice numbering method, include the invoice number in the transaction description or the document reference field in the journal voucher. If payment is received at the time of sale, the invoice is recorded when the daily cash report is prepared. When payment is not received at the point of sale a journal voucher should be recorded in UniFi by the end of the next business day following the date of the sales transaction. Sample journal vouchers to record sales are illustrated below. Table 1 - Sale to Another University Department C F O A P A Debit 1 1 1 CFOAPAL provided by Customer 1,000.00 Your fund Your org 78001 Program Activity Your fund Your org 78002 Program Activity Total 1,000.00 Some internal sales may require the addition of sales taxes Credit 500.00 500.00 1,000.00 Billing Product sale Service sale Table 2 - Sale to a Central Accounts Receivable Customer C F O A P 1 1 1 1 1 Customer fund Your fund Your fund 100052 100134 9000 Your org Your org Your org Your org 70001 56001 56002 20101 20103 1000 Program Program Program Program Total A Debit Credit 1,100.00 Activity Activity Activity Activity 1,100.00 500.00 500.00 50.00 50.00 1,100.00 Receivable Product sale Service sale GST collected PST collected Table 3 - Sale to a Departmental Accounts Receivable Customer C F O A P A Debit 1 1 1 1 1 Your Fund Your fund Your fund 100052 100134 Your org Your org Your org Your org Your org 11001 56001 56002 20101 20103 Program Program Program Program Program Total Activity Activity Activity Activity Activity 1,100.00 1,100.00 Credit 500.00 500.00 50.00 50.00 1,100.00 Receivable Product sale Service sale GST collected PST collected From these examples, you can see there is a difference in the way the sale is recorded depending on whether it is a sale to another university unit or to a customer outside the university. There is also a difference in the way the transaction is recorded depending on whether you are using the university’s central accounts receivable or whether you are managing the receivable in your own department. Regardless of the nature of the sale, it is important to ensure appropriate taxes are assessed based on the customer and the nature of the sale. Selling Goods & Services April 18, 2011 Page 3 of 6 Accounts Receivable An accounts receivable arises when a customer has obtained a good or service but has not yet paid for that good or service. Until the payment is received, an account receivable is recorded on the balance sheet. Opportunities for Improvement Through the internal control self-assessment two areas have been identified where improvements could be made in the way accounts receivable are managed. The two areas identified are: • A documented procedure to grant credit to customers • Management of departmental receivables through a monthly aged trial balance that is reconciled to the balance(s) in UniFi Impact on the University Ensuring that university units have effective accounts receivable processes has a number of direct impacts on the university, including: • Creating and maintaining a positive reputation with stakeholders both within and outside the university • Safeguarding university assets • Improving positive cash flow Easy to Implement Changes Rather than trying to address all of the processes around invoicing and accounts receivable, we want to focus on some easy changes that can be made to enhance university processes. The following are intended to be some enhancements to existing processes that can be made with minimal effort but significant institutional impact. Authorizing Credit to Customers When customers are granted the ability to buy goods or services and pay at a later date, the university is taking on the risk that some customers may not pay. Credit granting processes try to minimize the risk to the university by having confidence that credit customers will pay their bills. It is important to ensure that the process used in your unit to determine which customers will be granted credit is documented, communicated and applied consistently by all staff involved in the account receivable process. Units that bill customers are responsible for determining the credit worthiness of their customers, whether the receivables are managed in the department or by the university centrally. At a minimum you should document your current process. If a credit granting process is not in place in your department, one should be developed considering the following: • What is the past knowledge and experience of the customer? • Is this a high profile customer with a well established credible business reputation? • Government agencies, churches and non-profit organizations have a higher assurance of collection Selling Goods & Services April 18, 2011 Page 4 of 6 • • Request and maintain a customer profile form that includes details of the customer’s current financial and bank or supplier references External credit agencies may provide additional credit information on customers Monthly Aged Trial Balance On-going management of receivables is an important part of the business process. One key tool for receivable management is the preparation and review of a monthly aged trial balance. An aged trial balance summarizes outstanding customer invoices by the time that has elapsed since they were issued. The older the invoices are, the greater the risk that they will not be collected. Preparing this report will provide a management tool to identify customers or invoices that may require attention and follow-up. Table 4 - Sample Aged Trial Balance Customer Customer 1 Customer 2 ⁞ Customer 99 Total 0-30 Days 100.00 31-60 Days 850.00 61-90 Days 91-120 Days 120+ Days 50.00 1,178.69 Total 950.00 1228.69 100.00 85.00 935.00 35.00 85.00 1,178.69 120.00 2,298.69 Reconciliation to UniFi When a unit maintains their own receivables, it is important to ensure that the record of invoices agrees to what has been posted to UniFi. This applies to units when they are issuing invoices that are not recorded through the central accounts receivable system. On a monthly basis, the total of all outstanding invoices as listed on the aged trial balance should be agreed to the account balance in UniFi. Any variances should be investigated or resolved. Table 5 - Sample Accounts Receivable Reconciliation Aged Trial Balance per department tracking Add: Amounts in UniFi not on department records Less: Payments in UniFi not on department records Adjusted Department receivable balance 2,298.69 UniFi Receivable Account Balance Chart-Fund-11001 Add: Invoices not yet recorded in UniFi Less: Payments not yet recorded in UniFi Adjusted UniFi Receivable balance 2,298.69 2,298.69 2,298.69 The two adjusted balances should agree. Any amounts that were adjusted should be followed-up and recorded. This will ensure that they are not carried forward to the subsequent month’s reconciliation. Deferred Revenue Deferred revenue results in situations where payment is received from a customer before the good or service is delivered. This occurs commonly for activities on campus such as conferences and courses. This can also occur with the sales of other goods or services. Selling Goods & Services April 18, 2011 Page 5 of 6 Opportunities for Improvement Through the internal control self-assessment it has been determined that there is an opportunity to improve the recording of deferred revenue when payments are received in advance of the point-of-sale transaction. Impact on the University Ensuring that university units have effective invoicing processes has a number of direct impacts on the university, including: • Ensures the accurate accounting of university revenues • Provides information to assist in good decision making by unit managers Easy to Implement Changes Rather than trying to address all of the processes around recording revenue, we want to focus on some easy changes that can be made to enhance university processes. The following are intended to be some enhancements to existing processes that can be made with minimal effort but significant institutional impact. Processing and Recording Cash Receipts When you know the cash you have received is intended to pay for goods or services that will not be delivered until sometime in the future, the cash deposit should be recorded to deferred revenue (account 22002.) This is particularly important when the delivery of the good or service will happen after a month, quarter or year end. If you are not able to distinguish future cash sales and current sales at the time the cash report is prepared, an adjustment should be made at month end to move any revenue for which the good or service has not been delivered to deferred revenue. Earning Deferred Revenue When the good or service is delivered to the customer, a journal voucher must be recorded to move the cash receipt from deferred revenue to revenue. Table 6 - Sample Deferred Revenue Journal Voucher C 1 1 1 1 1 F Your fund Your fund Your fund 100052 100134 Total Selling Goods & Services O Your org Your org Your org Your org Your org A 22002 56001 56002 20101 20103 P Program Program Program Program Program Debit 330.00 330.00 April 18, 2011 Credit 150.00 150.00 15.00 15.00 330.00 Page 6 of 6