Departmental Record-Keeping Guidelines for Cash Receipting

advertisement

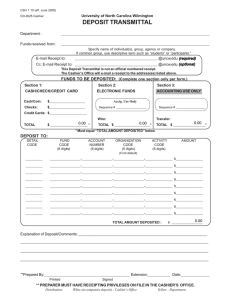

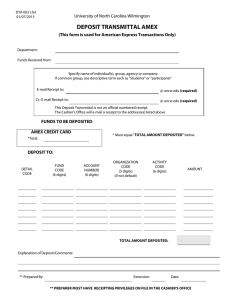

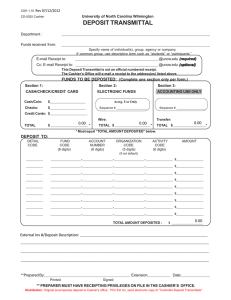

Departmental Record-Keeping Guidelines for Cash Receipting (For Departments Receiving Cash as a Normal Part of their Operation) These guidelines are provided to assist departments with the receipting process to meet their requirements, while complying with University and State policies and procedures. These guidelines are to be used in conjunction with Administrative Policy CSH 1.10, Cash Receipts. A log or receipt book must be maintained by department when: Money is received in any form Receipt transactions average more than five per day Individual receipts are frequently required Log Must include date received, received from, received by, amount received, date to cashier, and (once generated) a receipt number. (See sample log: Exhibit A.) Receipt Book Must be used when a department issues receipts to customers/participants and may be used instead of, or in addition to, the log. Reconciliation Perform reconciliation prior to deposit with the Cashier’s Office as follows: Total amount from log OR receipt book transactions to deposit $ ____________________ Total amount from UNCW Deposit Transmittal $ ____________________ Total amount cash/checks/credit cards counted for deposit: Cash $____________ Checks $___________ Credit Cards $_____________ (d) $ ____________________ (a) (b) (c) (a+b+c=d) (all above totals must equal) When above amounts do not agree, they must be researched and reported to the appropriate departmental budget authority prior to depositing funds. Missing payments must be reported to the Comptroller’s Office and University Police. All departmental records are subject to Internal Audit review. All checks must be endorsed with the State Treasurer’s deposit stamp (issued by Cashier’s Office). Each batch of checks requires two matching calculator tapes, with no batch having more than 50 items. Deposit Transmittal Instructions Deposit Transmittal forms (2-part) are available from Printing Services. Deposit Transmittals may be customized to meet your departmental needs; with pre-printed account numbers, department name, etc. When completing the Deposit Transmittal: Ensure the total amount to be deposited is adequately documented. If multiple deposits are being submitted, attach a calculator tape denoting the total amount of all deposits. Do not indicate G/L account numbers on the Deposit Transmittal as accounts to which deposits will be made unless prior authorization is received from the Comptroller. G/L account numbers always start with 0 (example: 0XXXXX-XXXX). The original copy of the Deposit Transmittal accompanies the deposit. The department retains the duplicate copy. Hand-carry deposits to the Cashier’s Office. Do not mail deposits, regardless of contents. For convenience, during regular business hours only, a drop box is provided and located inside James Hall outside the Cashier’s Office. Once the deposit is made, a receipt is provided via e-mail to the designated person’s e-mail address. The department is responsible for verification of the accuracy of posting. The department records the cashier’s receipt number on a log or receipt book. An additional method includes attaching and/or matching the receipt to the departmental Deposit Transmittal copy. Upon verification, if any error is detected, you must immediately notify the Cashier’s Office for correction. If you submitted the Deposit Transmittal containing an incorrect FRS account number, you must request Accounting to make a corrective journal entry to your FRS account. All deposits are due to the Cashier’s Office by 2 p.m. You will receive a receipt via e-mail by the next business day. The transaction is posted on the following day to your departmental account. You should be able to compare your records with the electronic receipt to your departmental account (FRS), usually within two business days after submission to the Cashier’s Office. Wires and ACH Receipts If a department anticipates receiving electronic payments, the Cashier’s Office must be notified in advance to allow proper coordination between the University, bank, and State Treasurer’s Office.