Notes to the ”extra” slides to Lecture 2

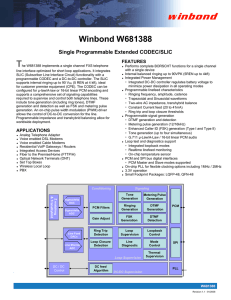

advertisement

RNy 28 August 2009 Notes to the ”extra” slides to Lecture 2 Linear PCM: 1. The slope of the short-run Phillips curve is the same as the partial derivative of the estimated PCM with respect to U_t, aka the impact multiplier. So the answer is -0.4. 2. The long-run PCM is defined by setting π_t = π_t-1= π and U_t=U_t-1=U: meaning that the answer is -2.31. So, if U is increased by one unit, the rate of inflation is expected to be reduced by 0.4 percentage points in the same year. If the change is permanent the effect is 2.31 percentage points in the longrun. 3. If the change is permanent: -0.4, and -1.88 and -2.31. If the change only lasts for one year: -0.4, -0.28 and 0. Semi-log NPC 1. -0.5 and -0.2, since 2. So the slopes are -7.45/2=-3.73 and -7.45/5=-1.49 respectively. So, if the semi-log PCM is the correct model, the linear PCM underestimates the “inflation pressure” of low unemployment rates, and overestimates “inflation pressure” of moderately high unemployment rates. 3. If steady-state inflation is 2.5% for example then it is estimated to be (12.8-2.5)/2.31 = 4.46% from the linear model and exp(13.2-2.5)/7.45) =4.20% from the semi-log model. So, not much difference.