Document 11974040

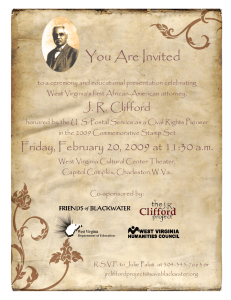

advertisement