Working Paper THE ECONOMICS OF INTERNATIONAL AID Ravi Kanbur

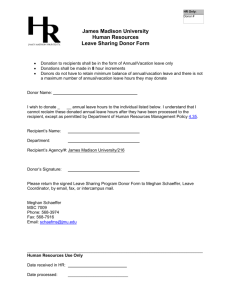

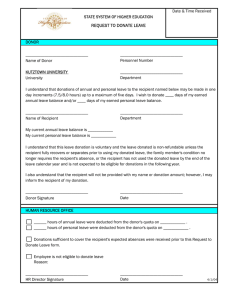

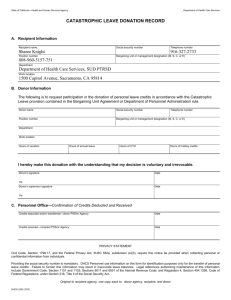

advertisement