A Compilation of Smart Marketing Articles January 2008 – October 2010

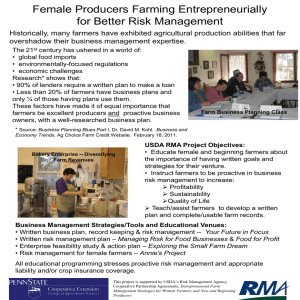

advertisement