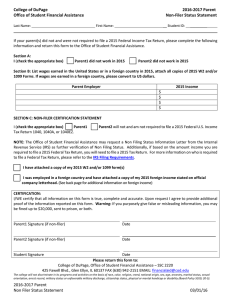

College of DuPage 2015-2016 Parent Office of Student Financial Assistance

advertisement

College of DuPage Office of Student Financial Assistance Last Name: 2015-2016 Parent Non-Filer Status Statement First Name: Student ID: If your parent(s) did not and were not required to file a 2014 Federal Income Tax Return, please complete the following information and return this form to the Office of Student Financial Assistance. Section A: List wages earned in the United States or in a foreign country in 2014, attach copies all of 2014 W2 and/or 1099 Forms. If wages are earned in a foreign country, please convert to US dollars. I (check the appropriate box) Parent 1 Parent 2 did not work in 2014. Parent Employer $ $ $ 2014 Income SECTION B: NON-FILER CERTIFICATION STATEMENT I (check the appropriate box) Parent1 Income Tax Return 1040, 1040A, or 1040EZ. Parent2 will not and am not required to file a 2014 Federal U.S. NOTE: The Office of Student Financial Assistance may request a Non Filing Status Information Letter from the Internal Revenue Service (IRS) as further verification of Non Filing Status. Additionally, if based on the amount income you are required to file a 2014 Federal Tax Return, you will need to file a 2014 Tax Return. For more information on who is required to file a Federal Tax Return, please refer to the IRS Filing Requirements. I have attached a copy of my 2014 W2 and/or 1099 form(s) I was employed in a foreign country and have attached a copy of my 2014 foreign income stated on official company letterhead. (See back page for additional information on foreign income) CERTIFICATION: I/WE certify that all information on this form is true, complete and accurate. Upon request I agree to provide additional proof of the information reported on this form. Warning: If you purposely give false or misleading information, you may be fined up to $20,000, sent to prison, or both. Parent1 Signature (if non-filer) Date Parent2 Signature (if non-filer) Date Student Signature Date Please return this form to: College of DuPage, Office of Student Financial Assistance – SSC 2220 425 Fawell Blvd., Glen Ellyn, IL 60137 FAX (630) 942-2151 EMAIL: financialaid@cod.edu The college will not discriminate in its programs and activities on the basis of race, color, religion, creed, national origin, sex, age, ancestry, marital status, sexual orientation, arrest record, military status or unfavorable military discharge, citizenship status, physical or mental handicap or disability (Board Policy 5010; 20-5). 2015-2016 Parent Non Filer Status Statement 08/31/15 Foreign Income Please give us a wage statement in English and in US dollar amounts based on the exchange rate the day the FAFSA was filed. (A wage statement is the equivalent of a W2 Form). If there is no statement, please provide a statement of earnings from you and/or your spouse’s employer on their company letterhead in English. If your parent(s) filed a foreign tax return, your parent(s) must submit a signed copy of the tax return translated in English and in US dollar amounts based on the exchange rate the day the FAFSA was filed. Your parent(s) must also write in the exchange rate as of the date you signed the FAFSA. Please identify the following items on the translated foreign tax return by circling the amounts for: Adjusted Gross Income – This is the total income plus interest and dividend income minus housing allowances and minus contributions to retirement accounts. (Housing allowances and contributions to retirement accounts are reported separately on the FAFSA.) Income taxes paid Wages earned