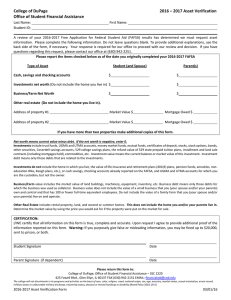

College of DuPage 2016‐2017 V1 Worksheet Independent Office of Student Financial Assistance Last Name:

College

of

DuPage

`

Office

of

Student

Financial

Assistance

Last

Name:

2016

‐

2017

V1

Worksheet

Independent

First

Name:

___________________________

Student

ID:

Your 2016 ‐ 2017 Free Application for Federal Student Aid (FAFSA) was selected for “ VERIFICATION ” by the Federal

Processor/Institution.

This means we are required to confirm the information you reported on your FAFSA.

If there is conflicting information, we may make a correction to your FAFSA and/or ask for additional information.

Failure to submit requested documents will result in your financial aid not being processed.

If you have questions about verification, contact the College of DuPage Office of Student Financial Assistance as soon as possible so that your financial aid will not be delayed.

A.

Household Size – In the box below, please list the people in your household that you (and if married, your spouse) financially support more than 50%.

The following people should be included:

Yourself

Your spouse, if married at the time you originally submitted your FAFSA

You or your spouse’s children if you and/or your spouse will provide more than 50% of their support from July 1,

2016 through June 30, 2017, even if the children do not live with you and/or spouse.

Support includes, but is not limited to, housing, clothes, medical, dental, transportation, payment of college costs, etc.

Other people if they now live with you and/or your spouse and you and/or your spouse provide more than 50% of their support and will continue to provide more than 50% of their support from July 1, 2016 through June

30, 2017.

Support includes, but is not limited to, housing, clothes, medical, dental, transportation, payment of college costs, etc.

Include the name of the college for any household member who will be enrolled at least half time in a degree, diploma, or certificate program at an eligible postsecondary educational institution any time between July 1, 2016 and June 30,

2017.

If more space is needed, attach a separate page with the student’s name and Student ID at the top.

Full Name Age Relationship to student

Name of

College

Will be Enrolled at

Least Half Time

Missy Jones (example) 18 Sister College of DuPage Yes

1.

2.

3.

4.

5.

6.

B.

In 2014 or 2015 , did you or anyone in your household (those listed in Section A of this form) receive benefits from the

Supplement Nutrition Assistance Program ( SNAP )?

YES

NO

C.

Student

Income

and

Tax

Information

– Answer each question as it applies to you:

1) Did you work in 2015?

Answer yes, even if you were paid in cash.

YES

2) Did you file a 2015 Federal Tax Return?

YES

NO

NO

2016 ‐ 2017 V1 Worksheet Independent 1 02/02/16

Student’s Name: ID:

* If a foreign tax return was filed, please provide us with a copy of the translated foreign tax return.

3)

IF

YOU

DID

NOT

FILE

A

2015

FEDERAL

TAX

RETURN

BUT

WORKED,

attach copies of all 2015 IRS W2 and/or 1099

forms.

EMPLOYER’S NAME 2015 income W2/1099 Attached?

Suzy’s Auto Body Shop (example) $2,000.00(example) Yes(example)

1.

2.

3.

D.

Spouse

Income

and

Tax

Information

– Answer each question as it applies to the spouse whose information you listed on your 2016 ‐ 2017 FAFSA and is included in Section A:

1) Did your spouse work in 2015?

Answer yes, even if paid in cash.

3.

4.

5.

Suzy’s Auto Body Shop (example)

1.

2.

YES

NO

2) Did your spouse file a 2015 Federal Tax Return?

YES NO

* If a foreign tax return was filed, please provide us with a copy of

the translated foreign tax return.

3)

IF

YOUR

SPOUSE

DID

NOT

FILE

A

2015

FEDERAL

TAX

RETURN

BUT

WORKED,

attach copies of all 2015 IRS W2

and/or 1099 forms.

EMPLOYER’S NAME

2015 income W2/1099 Attached?

$2,000.00

(example) Yes (example)

CERTIFICATION:

I/WE certify that all information on this form is true, complete and accurate.

Upon request I agree to provide additional proof of the information reported on this form.

Warning: If you purposely give false or misleading information, you may be fined up to $20,000, sent to prison, or both.

Student Signature Date

Please

return

this

form

to:

College of DuPage, Office of Student Financial Assistance – SSC 2220

425 Fawell Blvd., Glen Ellyn, IL 60137 FAX (630) 942 ‐ 2151 EMAIL: financialaid@cod.edu

The college will not discriminate in its programs and activities on the basis of race, color, religion, creed, national origin, sex, age, ancestry, marital status, sexual orientation, arrest record, military status or unfavorable military discharge, citizenship status, physical or mental handicap or disability (Board Policy 5010; 20 ‐ 5).

2016 ‐ 2017 V1 Worksheet Independent 2 02/02/16