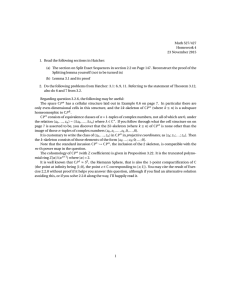

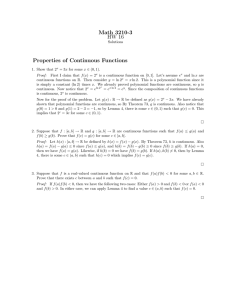

An Elementary Theory of Global Supply Chains Please share

advertisement