The Economic Significance of Travel to the North Lake Tahoe Area

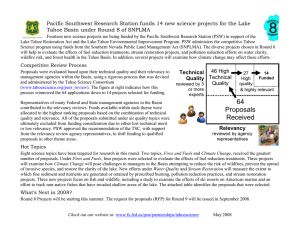

advertisement