Copenhagen Consensus Challenge Paper

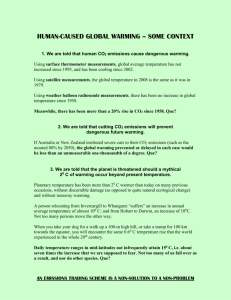

advertisement