CEO leans on experience to guide McLeodUSA Des Moines Register

advertisement

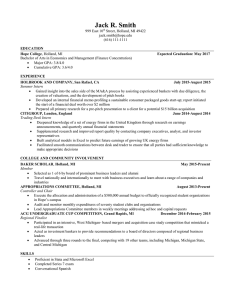

Go To Top Des Moines Register 02/20/06 CEO leans on experience to guide McLeodUSA Holland takes over company he once considered a competitor By FRANK VINLUAN REGISTER BUSINESS WRITER Shortly after McLeodUSA announced Royce Holland would become its new chief executive, Holland got an e-mail from the man who gave the company his name. Clark McLeod jokingly asked Holland if he planned to rename the company HollandUSA. That exchange represented Holland’s welcome to the Cedar Rapids telecommunications company he once called a competitor. Holland, 57, founder and chief executive of Dallas-based Allegiance Telecom, rode a surging technology wave in the late 1990s that took the stock prices of many telecom companies to dizzying heights. But the growth and expectations for the industry could not be sustained. Allegiance, McLeod and many others entered bankruptcy. McLeod last month emerged from its second bankruptcy reorganization in four years. As Holland takes charge of McLeod, a company that once aspired to become a national phone company, he now talks about new Internet services and a Midwest focus. “We’ve moved from being behind the curve to hopefully being in the pack,” he said. “Hopefully, we’ll take a leadership position, at least in this part of the country.” Holland is regarded as a telecom pioneer. He was president and a co-founder of MFS Communications Co. Founded in 1988, MFS became one of the largest competitors to the local Bell phone companies. At its peak, MFS had operations throughout North America, Europe and Asia before WorldCom purchased it in 1996. In 1997, Holland co-founded Allegiance Telecom, similar in size and scope to McLeodUSA. Caught in the telecom industry downturn, Allegiance entered bankruptcy in May 2003. XO Communications purchased Allegiance nearly a year later for $322 million, and Holland left the company. But Holland had steered Allegiance on a road to profitability, said Craig Claussen, vice president of Chicago telecom research firm New Paradigm Resources Group. Claussen said Holland could do the same for McLeod. “He’s one that always manages to pull a rabbit out of a hat,” Claussen said. Holland comes to his new job with lessons from his old one. Allegiance grew too fast, as did McLeod, Holland said. Revenue never kept pace with projections. The newly reorganized McLeod has less debt. McLeod’s second bankruptcy reorganization wiped away $677 million in debt. But boosting revenue still poses a challenge, even for a trimmer, McLeod. Nearly a year ago, the company announced it was seeking a partner or buyer. In documents filed with federal regulators, the company said the difficulty competing against larger companies factored in its decision to seek a buyer. Holland said he won’t shy from competition. The company is still targeting smalland medium-sized businesses. But McLeod is selling more than phone service. It provides an array of services via the Internet, including Internet phone calling, Web site hosting and video conferencing. The good news for McLeod is demand for that business is growing. The Yankee Group research firm projects that Internet calling will grow at a compound annual growth rate of 31 percent between 2005 and 2010. The bad news for McLeod is that many telecom players, large and small, are entering that market. Both Qwest and AT&T have been promoting their Internet phone service to business customers. LightEdge Solutions, a Des Moines technology company, offers similar voice and data services. Earlier this month, LightEdge expanded its eastern Iowa reach with the purchase of a Quad Cities Internet provider. Anthony Townsend, management information systems professor at Iowa State University, was unfamiliar with Holland’s work. But he said that as more services move to the Internet, there should be room in the market for companies like McLeod. Business customers are looking for a company that can help manage their Internet services, Townsend said. Sometimes a smaller regional player is more responsive to individual needs than a large, national company. “It’s a market niche for that one-off kind of specialized technology,” Townsend said. “It’s large in scope, but it’s not large on the scale that a Qwest or AT&T wants to mess with.” Townsend said some large companies prefer to have a packaged technology product that can be sold to many different customers. Smaller competitors can carve a niche by tailoring their offerings to each customer's needs. But some people don’t regard McLeod as a small, regional company. McLeod’s network stretches across the Midwest and Rocky Mountain states. It reaches as far west as Seattle and as far south as the Gulf Coast. Holland has offices in Dallas and Cedar Rapids. He will continue living in Dallas while commuting periodically to Cedar Rapids. Holland conceded that McLeod’s large footprint could spread its staff and resources. He said his plan is to emphasize services in the heartland. States like Wyoming, Montana and Arkansas will still be served. But they won’t get the same sales push as Iowa, Illinois, Wisconsin and Minnesota. So now, six months after cost-cutting led to layoffs of 240 of the company’s employees, Holland is hanging up a help wanted sign for sales staff. Holland hopes that direct sales in targeted states will generate more revenue. Claussen, the New Paradigm Resources Group analyst, said he thinks Holland’s Midwest focus is a good strategy. But he added that there are no assurances McLeod will succeed. If McLeod can respond more quickly to customers with a better product and better customer service, the company will be competitive. “If they’re not, they’ll become extinct,” Claussen said.