Employee Personal Data The Texas A&M University System

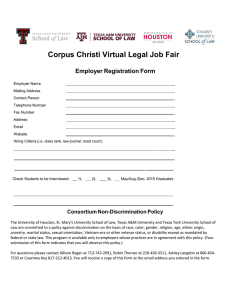

advertisement

Clear Fields

Print Form

HR 181 (9/15)

The Texas A&M University System

Employee Personal Data

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

Name:

Last

First

Middle

UIN:

Birthdate:

Month

Citizenship:

Day

Year

Visa type:

Country

If other than U.S. citizenship

Province for Canadians:

Male

Highest

Female

Education

Level

1–Less than high school

2–High school/GED

4–Baccalaureate degree

5–Master’s degree

7–Special professional (D.D.S., D.V.M., J.D., M.D., etc.)

3–Associate degree

6–Doctoral degree

You are not obligated to respond to the asterisked items below (Veteran and Former Foster Child Status) and on Page 3; however,

your response is important to meet federal and state reporting requirements. Information you provide will remain confidential in

accordance with applicable federal and state regulations. Your employment will not be adversely affected by information you furnish.

EEO Ethnicity/Race (See Page 2.)

*Veteran Status (See Page 2. Check all that apply.)

3-Hispanic or Latino?

Yes If you selected “Yes”, you

will be identified as Hispanic or Latino for federal and

state reporting purposes, even if you select any of the

races below.

Select all that apply.

1–White

2–Black or African American

4–Asian

5–American Indian or Alaska Native

6–Native Hawaiian or Other Pacific Islander

8–Decline to provide information

If you selected more than one race (not including

Hispanic or Latino), you will be identified as “Two or

More Races” for federal and state reporting purposes.

Veteran

Armed Forces Service Medal Veteran

Active Duty Wartime or Campaign Badge Veteran

Recently Separated Veteran (within last three years) If yes,

indicate armed services separation date

Orphan of a Veteran

Surviving Spouse of a Veteran

An option for disabled veterans is provided on Page 3.

*Former Foster Child Status I am 25 years of age or younger

and was under the permanent managing conservatorship of the

Texas Department of Family and Protective Services on the day

Yes

No

preceding my 18th birthday.

Residence address:

Mailing address:

Street:

Street/P.O. Box:

City:

Phone: (

State:

ZIP:

City:

)

State:

Phone: (

ZIP:

)

Do you have relatives who are A&M System employees?

In event of emergency notify:

Name:

Yes

Relationship:

No

If yes, give name, title, relationship and organization:

Address:

City:

Phone: (

State:

ZIP:

)

State law gives you the right to choose whether The Texas A&M University System should allow public access to your home address,

home telephone number, emergency contact information, Social Security number, and whether you have family members. If you do

not declare this personal information as confidential, it will be open to the public. If you are a “peace officer,” your home address

and telephone number are automatically confidential. Mark one box in item 1 and one box in item 2.

1.

Yes, I want my personal information to be confidential.

2.

I am a certified peace officer.

No, I do not want my personal information to be confidential.

I am not a certified peace officer.

Please read and sign Pages 2 and 3 of this form before returning it.

Employer should complete the following for employee:

PIN:

ADLOC:

Emp-Loc code:

Chk-Dist code:

A&M System email address:

Campus or office address:

Street/Bldg:

City:

Office phone: (

Zip Code:

Mail Stop:

1

)

HR 181 (9/15)

This employer is a Government contractor subject to the Vietnam Era Veterans’ Readjustment Assistance Act of 1974, as

amended by the Jobs for Veterans Act of 2002, 38 U.S.C. 4212 (VEVRAA), which requires Government contractors to take affirmative

action to employ and advance in employment: (1) disabled veterans; (2) recently separated veterans; (3) active duty wartime or

campaign badge veterans; and (4) Armed Forces service medal veterans [41 CFR 60-300.5(a)].

As a Government contractor subject to VEVRAA, we are required to submit a report to the United States Department of Labor

each year identifying the number of our employees belonging to each specified “protected veteran” category. If you believe you belong

to any of the categories of protected veterans listed, please indicate by checking the appropriate box (choose all that apply).

If you are a disabled veteran, it would assist us if you tell us whether there are accommodations we could make that would enable

you to perform the essential functions of the job, including special equipment, changes in the physical layout of the job, changes in the

way the job is customarily performed, provision of personal assistance services or other accommodations. This information will assist

us in making reasonable accommodations for your disability. Submission of this information is voluntary and refusal to provide it will

not subject you to any adverse treatment. The information provided will be used only in ways that are not inconsistent with VEVRAA,

as amended.

The information you submit will be kept confidential, except that (i) supervisors and managers may be informed regarding

restrictions on the work or duties of disabled veterans, and regarding necessary accommodations; (ii) first aid and safety personnel

may be informed, when and to the extent appropriate, if you have a condition that might require emergency treatment, and (iii)

Government officials engaged in enforcing laws administered by the Office of Federal Contract Compliance Programs, or enforcing the

Americans with Disabilities Act, may be informed.

Protected veterans may have additional rights under USERRA – the Uniformed Services Employment and Reemployment Rights

Act. In particular, if you were absent from employment in order to perform service in the uniformed service, you may be entitled to be

reemployed by your employer in the position you would have obtained with reasonable certainty if not for the absence due to

service. For more information, call the U.S. Department of Labor’s Veterans Employment and Training Service (VETS), toll-free, at 1866-4-USA-DOL.

The following definitions are provided for your information and assistance in completing the Employee Personal Data form:

EEO Ethnicity/Race

Hispanic or Latino. A person of Cuban, Mexican, Puerto

Rican, South or Central American, or other Spanish culture

or origin, regardless of race.

White. (Not Hispanic or Latino) A person having origins in

any of the original peoples of Europe, the Middle East, or

North Africa.

Black or African American. (Not Hispanic or Latino) A

person having origins in any of the Black racial groups of

Africa.

Asian. (Not Hispanic or Latino) A person having origins in

any of the original peoples of the Far East, Southeast Asia,

or the Indian Subcontinent including, for example,

Cambodia, China, India, Japan, Korea, Malaysia, Pakistan,

the Philippine Islands, Thailand, and Vietnam.

American Indian or Alaska Native. (Not Hispanic or

Latino) A person having origins in any of the original

peoples of North and South America (including Central

America) and who maintains tribal affiliation or community

attachment.

Native Hawaiian or Other Pacific Islander. (Not Hispanic

or Latino) A person having origins in any of the original

peoples of Hawaii, Guam, Samoa, or other Pacific Islands.

*Veteran Status

Veteran. The individual has served in the army, navy, air

force, coast guard, or marine corps of the United States or

the United States Public Health Service, the Texas military

forces, or an auxiliary service of one of those branches of the

armed force, and who has been honorably discharged from

the branch of the service in which the person served.

Armed Forces Service Medal Veteran. The individual is a

veteran who, while serving on active duty in the U.S. military,

ground, naval or air service, participated in a United States

military operation for which an Armed Services Medal was

awarded pursuant to Executive Order 12985 (61 Fed. Reg.

1209).

Active Duty Wartime or Campaign Badge Veteran. The

individual has served on active duty in the U.S. military,

ground, naval or air service during a war or in a campaign or

expedition for which a campaign badge has been authorized,

under the laws administered by the Department of Defense.

A list of campaigns and expeditions meeting this criteria is

on Page 4.

Recently Separated Veteran. The individual is any veteran

during the three-year period beginning on the date of such

veteran’s discharge or release from active duty in the U.S.

military, ground, naval or air service.

Orphan of a Veteran. The individual is an orphan of a

veteran if the veteran was killed on active duty.

Surviving Spouse of a Veteran. The individual is a

surviving spouse of a veteran who has not remarried.

I have read and understand this material and I certify that the information provided by me is true and correct to the best of my

knowledge. This document is executed in good faith.

Original Signature Required

Employee signature

Date

The Texas A&M University System is an Equal Opportunity/Affirmative Action/Veterans/Disability Employer.

2

The Texas A&M University System

HR 181-Disability

(9/14)

Disabled Veteran Status

(continued from the Employee Personal Data form)

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form. Because

this form contains protected health information about you, it will not be placed in your personnel file.

Name:

Last

First

UIN:

Middle

Birthdate:

Month

Do you claim to be a Disabled Veteran*?

Yes

Day

Year

No

A disabled veteran is (1) a veteran of the U.S. military, ground, naval or air service who is entitled to compensation (or who but for the

receipt of military retired pay would be entitled to compensation under laws administered by the Secretary of Veterans’ Affairs or (2) an

individual who was discharged or released from active duty because of a service-connected disability.

*You are not obligated to respond; however, your response is important to meet federal and state reporting requirements. Information

you provide will remain confidential in accordance with applicable federal and state regulations. Your employment will not be adversely

affected by information you furnish.

I have read and understand this material and I certify that the information provided by me is true and correct to the best of my

knowledge. This document is executed in good faith.

Original Signature Required

Employee signature

Date

The Texas A&M University System is an Equal Opportunity/Affirmative Action/Veterans/Disability Employer.

This employer is a Government contractor subject to the Vietnam Era Veterans’ Readjustment Assistance Act of 1974, as

amended by the Jobs for Veterans Act of 2002, 38 U.S.C. 4212 (VEVRAA), which requires Government contractors to take affirmative

action to employ and advance in employment: (1) disabled veterans; (2) recently separated veterans; (3) active duty wartime or

campaign badge veterans; and (4) Armed Forces service medal veterans [41 CFR 60-300.5(a)].

As a Government contractor subject to VEVRAA, we are required to submit a report to the United States Department of Labor

each year identifying the number of our employees belonging to each specified “protected veteran” category. If you believe you belong

to any of the categories of protected veterans listed, please indicate by checking the appropriate box (choose all that apply).

If you are a disabled veteran, it would assist us if you tell us whether there are accommodations we could make that would enable

you to perform the essential functions of the job, including special equipment, changes in the physical layout of the job, changes in the

way the job is customarily performed, provision of personal assistance services or other accommodations. This information will assist

us in making reasonable accommodations for your disability. Submission of this information is voluntary and refusal to provide it will

not subject you to any adverse treatment. The information provided will be used only in ways that are not inconsistent with VEVRAA,

as amended.

The information you submit will be kept confidential, except that (i) supervisors and managers may be informed regarding

restrictions on the work or duties of disabled veterans, and regarding necessary accommodations; (ii) first aid and safety personnel

may be informed, when and to the extent appropriate, if you have a condition that might require emergency treatment, and (iii)

Government officials engaged in enforcing laws administered by the Office of Federal Contract Compliance Programs, or enforcing the

Americans with Disabilities Act, may be informed.

Protected veterans may have additional rights under USERRA – the Uniformed Services Employment and Reemployment Rights

Act. In particular, if you were absent from employment in order to perform service in the uniformed service, you may be entitled to be

reemployed by your employer in the position you would have obtained with reasonable certainty if not for the absence due to service.

For more information, call the U.S. Department of Labor’s Veterans Employment and Training Service (VETS), toll-free, at 1-866-4USA-DOL.

3

OTHER PROTECTED VETERAN STATUS CRITERIA

CAMPAIGN/EXPEDITION

DATES

START

Armed Forces Expeditionary Medal (AFEM)

Afghanistan (Enduring Freedom)

09/11/01

Afghanistan (Iraqi Freedom)

03/19/03

Berlin

08/14/61

Bosnia (Joint Endeavor, Joint Guard

& Joint Forge)

11/20/95

Cambodia

03/29/73

Cambodia Evacuation (Eagle Pull)

04/11/75

Congo

07/14/60

Congo

11/23/64

Cuba

10/24/62

Dominican Republic

04/28/65

El Salvador

01/01/81

Global War on Terrorism

09/11/01

Grenada (Urgent Fury)

10/23/83

Haiti (Uphold Democracy)

09/16/94

Iraq (Northern Watch)

01/01/97

Iraq (Desert Spring)

12/31/98

Iraq (Enduring Freedom)

09/11/01

Iraq (Iraqi Freedom)

03/19/03

Korea

10/01/66

Kosovo

03/24/99

Laos

04/19/61

Lebanon

07/01/58

Lebanon

06/01/83

Libyan Area (Eldorado Canyon)

04/12/86

Mayaguez Operation

05/15/75

Panama (Just Cause)

12/20/89

Persian Gulf (Earnest Will)

07/24/87

Persian Gulf (Desert Thunder)

11/11/98

Persian Gulf (Desert Fox)

12/16/98

Persian Gulf (Southern Watch)

12/01/95

Persian Gulf (Vigilant Sentinel)

12/01/95

Persian Gulf Intercept Operation

12/01/95

Quemoy and Matsu Islands

08/23/58

Somalia (Restore Hope

& United Shield)

12/05/92

Taiwan Straits

08/23/58

Thailand

05/16/62

Vietnam and Thailand

07/01/58

Vietnam Evacuation (Frequent Wind) 04/29/75

Navy Expeditionary Medal and Marine

Corps Medal

Cuba

01/03/61

Indian Ocean/Iran

11/21/79

Iranian/Yemen/Indian Ocean

12/08/78

Lebanon

08/20/82

Liberia (Sharp Edge)

08/05/90

Libyan Area

01/20/86

Panama

04/01/80

Panama

02/01/90

Persian Gulf

02/01/87

Rwanda (Distant Runner)

04/07/94

Thailand

05/16/62

CAMPAIGN/EXPEDITION

END

Other Campaign and Service Medals

Army Occupation of Austria

Army Occupation of Berlin

Army Occupation of Germany

Army Occupation of Japan

China Service Medal (Extended)

Korea Defense Service Medal

Korean Service

Kosovo Campaign Medal (KCM)

Operation Allied Force

Kosovo Campaign Medal (KCM)

Operation Joint Guardian

Kosovo Campaign Medal (KCM)

Operation Allied Harbor

Kosovo Campaign Medal (KCM)

Operation Sustain Hope/Shining Hope

Kosovo Campaign Medal (KCM)

Operation Noble Anvil

Kosovo Campaign Medal (KCM)

Task Force Hawk

Kosovo Campaign Medal (KCM)

Task Force Saber

Kosovo Campaign Medal (KCM)

Task Force Falcon

Kosovo Campaign Medal (KCM)

Task Force Hunter

Navy Occupation of Austria

Navy Occupation of Trieste

SW Asia Service Medal

(Desert Shield/Storm)

Units of the Sixth Fleet (Navy)

Vietnam Service Medal (VSM)

Rwanda (Distant runner)

Thailand

Present

Present

06/01/63

Present

08/15/73

04/13/75

09/01/62

11/27/64

06/01/63

09/21/66

02/01/92

Present

11/21/83

03/31/95

Present

12/31/02

Present

Present

06/30/74

Present

10/07/62

11/01/58

12/01/87

04/17/86

05/15/75

01/31/90

08/01/90

12/22/98

12/22/98

Present

02/01/97

Present

06/01/63

03/31/95

01/01/59

08/10/62

07/03/65

04/30/75

*TBD – To Be Determined

10/23/62

10/20/81

06/06/79

05/31/83

02/21/91

06/27/86

12/19/86

06/13/90

07/23/87

04/18/94

08/10/62

4

HR 181 (9/14)

DATES

START

END

05/09/45

05/09/45

05/09/45

09/03/45

09/02/45

07/28/54

06/27/50

07/27/55

10/02/90

05/05/55

04/27/52

04/01/57

TBD*

07/27/54

03/24/99 06/10/99

06/11/99

TBD*

04/04/99 09/01/99

04/04/99 07/10/99

03/24/99 07/20/99

04/05/99 06/24/99

03/31/99 07/08/99

06/11/99

TBD*

04/01/99 11/01/99

05/08/45 10/25/54

05/08/45 10/25/54

08/02/90

05/09/45

07/04/65

04/07/94

05/16/62

11/30/95

10/25/55

03/28/73

04/18/94

08/10/62

Voluntary Self-Identification of Disability

Form CC-305

OMB Control Number 1250-0005

Expires 1/31/2017

Page 1 of 2

Why are you being asked to complete this form?

Because we do business with the government, we must reach out to, hire, and provide equal opportunity to

qualified people with disabilities.i To help us measure how well we are doing, we are asking you to tell us if

you have a disability or if you ever had a disability. Completing this form is voluntary, but we hope that you will

choose to fill it out. If you are applying for a job, any answer you give will be kept private and will not be used

against you in any way.

If you already work for us, your answer will not be used against you in any way. Because a person may

become disabled at any time, we are required to ask all of our employees to update their information every five

years. You may voluntarily self-identify as having a disability on this form without fear of any punishment

because you did not identify as having a disability earlier.

How do I know if I have a disability?

You are considered to have a disability if you have a physical or mental impairment or medical condition that

substantially limits a major life activity, or if you have a history or record of such an impairment or medical

condition.

Disabilities include, but are not limited to:

•

•

•

•

•

Blindness

Deafness

Cancer

Diabetes

Epilepsy

•

•

•

•

•

Autism

Cerebral Palsy

HIV/AIDS

Schizophrenia

Muscular

dystrophy

•

•

•

•

Bipolar disorder

Major depression

Multiple sclerosis (MS)

Missing limbs or

partially missing limbs

•

•

•

•

Post-traumatic stress disorder (PTSD)

Obsessive compulsive disorder

Impairments requiring the use of a wheelchair

Intellectual disability (previously called mental

retardation)

Please check one of the boxes below:

YES, I HAVE A DISABILITY (or previously had a disability)

NO, I DON’T HAVE A DISABILITY

I DON’T WISH TO ANSWER

Your Name

Today’s Date

5

Voluntary Self-Identification of Disability

Form CC-305

OMB Control Number 1250-0005

Expires 1/31/2017

Page 2 of 2

Reasonable Accommodation Notice

Federal law requires employers to provide reasonable accommodation to qualified individuals with disabilities.

Please tell us if you require a reasonable accommodation to apply for a job or to perform your job. Examples

of reasonable accommodation include making a change to the application process or work procedures,

providing documents in an alternate format, using a sign language interpreter, or using specialized equipment.

i

Section 503 of the Rehabilitation Act of 1973, as amended. For more information about this form or the equal

employment obligations of Federal contractors, visit the U.S. Department of Labor’s Office of Federal Contract

Compliance Programs (OFCCP) website at www.dol.gov/ofccp.

PUBLIC BURDEN STATEMENT: According to the Paperwork Reduction Act of 1995 no persons are required to respond

to a collection of information unless such collection displays a valid OMB control number. This survey should take about 5

minutes to complete.

6

Form W-4 (2016)

Purpose. Complete Form W-4 so that your employer

can withhold the correct federal income tax from your

pay. Consider completing a new Form W-4 each year

and when your personal or financial situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign the form

to validate it. Your exemption for 2016 expires

February 15, 2017. See Pub. 505, Tax Withholding

and Estimated Tax.

Note: If another person can claim you as a dependent

on his or her tax return, you cannot claim exemption

from withholding if your income exceeds $1,050 and

includes more than $350 of unearned income (for

example, interest and dividends).

Exceptions. An employee may be able to claim

exemption from withholding even if the employee is a

dependent, if the employee:

• Is age 65 or older,

• Is blind, or

• Will claim adjustments to income; tax credits; or

itemized deductions, on his or her tax return.

The exceptions do not apply to supplemental wages

greater than $1,000,000.

Basic instructions. If you are not exempt, complete

the Personal Allowances Worksheet below. The

worksheets on page 2 further adjust your

withholding allowances based on itemized

deductions, certain credits, adjustments to income,

or two-earners/multiple jobs situations.

Complete all worksheets that apply. However, you

may claim fewer (or zero) allowances. For regular

wages, withholding must be based on allowances

you claimed and may not be a flat amount or

percentage of wages.

Head of household. Generally, you can claim head

of household filing status on your tax return only if

you are unmarried and pay more than 50% of the

costs of keeping up a home for yourself and your

dependent(s) or other qualifying individuals. See

Pub. 501, Exemptions, Standard Deduction, and

Filing Information, for information.

Tax credits. You can take projected tax credits into account

in figuring your allowable number of withholding allowances.

Credits for child or dependent care expenses and the child

tax credit may be claimed using the Personal Allowances

Worksheet below. See Pub. 505 for information on

converting your other credits into withholding allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends,

consider making estimated tax payments using Form

1040-ES, Estimated Tax for Individuals. Otherwise, you

may owe additional tax. If you have pension or annuity

income, see Pub. 505 to find out if you should adjust

your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a

working spouse or more than one job, figure the

total number of allowances you are entitled to claim

on all jobs using worksheets from only one Form

W-4. Your withholding usually will be most accurate

when all allowances are claimed on the Form W-4

for the highest paying job and zero allowances are

claimed on the others. See Pub. 505 for details.

Nonresident alien. If you are a nonresident alien,

see Notice 1392, Supplemental Form W-4

Instructions for Nonresident Aliens, before

completing this form.

Check your withholding. After your Form W-4 takes

effect, use Pub. 505 to see how the amount you are

having withheld compares to your projected total tax

for 2016. See Pub. 505, especially if your earnings

exceed $130,000 (Single) or $180,000 (Married).

Future developments. Information about any future

developments affecting Form W-4 (such as legislation

enacted after we release it) will be posted at www.irs.gov/w4.

Personal Allowances Worksheet (Keep for your records.)

A

Enter “1” for yourself if no one else can claim you as a dependent . . . . . . . . . . . . . . . . . .

A

• You are single and have only one job; or

Enter “1” if:

B

• You are married, have only one job, and your spouse does not work; or

. . .

• Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) . . . . . . . . . . . . . .

C

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return . . . . . . . .

D

Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above) . .

E

Enter “1” if you have at least $2,000 of child or dependent care expenses for which you plan to claim a credit

. . .

F

(Note: Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $70,000 ($100,000 if married), enter “2” for each eligible child; then less “1” if you

have two to four eligible children or less “2” if you have five or more eligible children.

G

• If your total income will be between $70,000 and $84,000 ($100,000 and $119,000 if married), enter “1” for each eligible child . .

▶

Add lines A through G and enter total here. (Note: This may be different from the number of exemptions you claim on your tax return.)

H

{

B

C

D

E

F

G

H

For accuracy,

complete all

worksheets

that apply.

}

{

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

• If you are single and have more than one job or are married and you and your spouse both work and the combined

earnings from all jobs exceed $50,000 ($20,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2

to avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Separate here and give Form W-4 to your employer. Keep the top part for your records.

Form

W-4

Department of the Treasury

Internal Revenue Service

1

Employee's Withholding Allowance Certificate

OMB No. 1545-0074

▶ Whether you are entitled to claim a certain number of allowances or exemption from withholding is

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Your first name and middle initial

2

Last name

Home address (number and street or rural route)

3

Single

Married

2016

Your social security number

Married, but withhold at higher Single rate.

Note: If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

City or town, state, and ZIP code

4 If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card. ▶

5

6

7

Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2)

5

Additional amount, if any, you want withheld from each paycheck . . . . . . . . . . . . . .

6 $

I claim exemption from withholding for 2016, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

• This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . ▶ 7

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

(This form is not valid unless you sign it.)

8

▶

Original Signature Required

Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

9 Office code (optional)

Cat. No. 10220Q

Date ▶

10

Employer identification number (EIN)

Form W-4 (2016)

Page 2

Form W-4 (2016)

Deductions and Adjustments Worksheet

Note: Use this worksheet only if you plan to itemize deductions or claim certain credits or adjustments to income.

Enter an estimate of your 2016 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state

1

and local taxes, medical expenses in excess of 10% (7.5% if either you or your spouse was born before January 2, 1952) of your

income, and miscellaneous deductions. For 2016, you may have to reduce your itemized deductions if your income is over $311,300

and you are married filing jointly or are a qualifying widow(er); $285,350 if you are head of household; $259,400 if you are single and

not head of household or a qualifying widow(er); or $155,650 if you are married filing separately. See Pub. 505 for details . . .

$12,600 if married filing jointly or qualifying widow(er)

2

Enter:

$9,300 if head of household

. . . . . . . . . . .

$6,300 if single or married filing separately

3

Subtract line 2 from line 1. If zero or less, enter “-0-” . . . . . . . . . . . . . . . .

4

Enter an estimate of your 2016 adjustments to income and any additional standard deduction (see Pub. 505)

Add lines 3 and 4 and enter the total. (Include any amount for credits from the Converting Credits to

5

Withholding Allowances for 2016 Form W-4 worksheet in Pub. 505.) . . . . . . . . . . . .

{

6

7

8

9

10

}

Enter an estimate of your 2016 nonwage income (such as dividends or interest) . . . . . . . .

Subtract line 6 from line 5. If zero or less, enter “-0-” . . . . . . . . . . . . . . . .

Divide the amount on line 7 by $4,050 and enter the result here. Drop any fraction . . . . . . .

Enter the number from the Personal Allowances Worksheet, line H, page 1 . . . . . . . . .

Add lines 8 and 9 and enter the total here. If you plan to use the Two-Earners/Multiple Jobs Worksheet,

also enter this total on line 1 below. Otherwise, stop here and enter this total on Form W-4, line 5, page 1

1

$

2

$

3

4

$

$

5

6

7

8

9

$

$

$

10

Two-Earners/Multiple Jobs Worksheet (See Two earners or multiple jobs on page 1.)

Note: Use this worksheet only if the instructions under line H on page 1 direct you here.

Enter the number from line H, page 1 (or from line 10 above if you used the Deductions and Adjustments Worksheet)

1

2

Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if

you are married filing jointly and wages from the highest paying job are $65,000 or less, do not enter more

than “3” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter

“-0-”) and on Form W-4, line 5, page 1. Do not use the rest of this worksheet . . . . . . . . .

1

2

3

Note: If line 1 is less than line 2, enter “-0-” on Form W-4, line 5, page 1. Complete lines 4 through 9 below to

figure the additional withholding amount necessary to avoid a year-end tax bill.

4

5

6

7

8

9

Enter the number from line 2 of this worksheet . . . . . . . . . .

4

Enter the number from line 1 of this worksheet . . . . . . . . . .

5

Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . .

Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here . . . .

Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed . .

Divide line 8 by the number of pay periods remaining in 2016. For example, divide by 25 if you are paid every two

weeks and you complete this form on a date in January when there are 25 pay periods remaining in 2016. Enter

the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck

Table 1

Married Filing Jointly

6

7

8

$

$

9

$

Table 2

All Others

Married Filing Jointly

If wages from LOWEST

paying job are—

Enter on

line 2 above

If wages from LOWEST

paying job are—

Enter on

line 2 above

$0 - $6,000

6,001 - 14,000

14,001 - 25,000

25,001 - 27,000

27,001 - 35,000

35,001 - 44,000

44,001 - 55,000

55,001 - 65,000

65,001 - 75,000

75,001 - 80,000

80,001 - 100,000

100,001 - 115,000

115,001 - 130,000

130,001 - 140,000

140,001 - 150,000

150,001 and over

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

$0 - $9,000

9,001 - 17,000

17,001 - 26,000

26,001 - 34,000

34,001 - 44,000

44,001 - 75,000

75,001 - 85,000

85,001 - 110,000

110,001 - 125,000

125,001 - 140,000

140,001 and over

0

1

2

3

4

5

6

7

8

9

10

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this

form to carry out the Internal Revenue laws of the United States. Internal Revenue Code

sections 3402(f)(2) and 6109 and their regulations require you to provide this information; your

employer uses it to determine your federal income tax withholding. Failure to provide a

properly completed form will result in your being treated as a single person who claims no

withholding allowances; providing fraudulent information may subject you to penalties. Routine

uses of this information include giving it to the Department of Justice for civil and criminal

litigation; to cities, states, the District of Columbia, and U.S. commonwealths and possessions

for use in administering their tax laws; and to the Department of Health and Human Services

for use in the National Directory of New Hires. We may also disclose this information to other

countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal

laws, or to federal law enforcement and intelligence agencies to combat terrorism.

If wages from HIGHEST

paying job are—

$0 - $75,000

75,001 - 135,000

135,001 - 205,000

205,001 - 360,000

360,001 - 405,000

405,001 and over

Enter on

line 7 above

$610

1,010

1,130

1,340

1,420

1,600

All Others

If wages from HIGHEST

paying job are—

$0 - $38,000

38,001 - 85,000

85,001 - 185,000

185,001 - 400,000

400,001 and over

Enter on

line 7 above

$610

1,010

1,130

1,340

1,600

You are not required to provide the information requested on a form that is subject to the

Paperwork Reduction Act unless the form displays a valid OMB control number. Books or

records relating to a form or its instructions must be retained as long as their contents may

become material in the administration of any Internal Revenue law. Generally, tax returns and

return information are confidential, as required by Code section 6103.

The average time and expenses required to complete and file this form will vary depending

on individual circumstances. For estimated averages, see the instructions for your income tax

return.

If you have suggestions for making this form simpler, we would be happy to hear from you.

See the instructions for your income tax return.

Prairie View A&M University

Agreement of Understanding

Overtime Policy for FLSA Non-Exempt Personnel

I hereby agree to the following rules and regulations of the U.S. Government and

the State of Texas regarding overtime work (hours worked in access of 40 in a

workweek in a nonexempt position):

1. I will not work hours in excess of 40 in a workweek without the prior

approval of my supervisor.

2. When I work more than 40 hours in a workweek, I agree to be compensated

for those hours over 40 in the following manner:

a). I will be granted compensatory time off at the rate of 1 ½ hours for every

hour of overtime worked within 12 months of working the overtime, or

b). I will be paid for the overtime hours at the rate of 1 ½ times my regular

rate of pay, when in the judgment of my employer, granting

compensatory time off is impractical.

“Work” in the context of this document means the performance of assigned

duties. It does not include time away from work due to illness, holidays, and

other approved leaves of absence.

___________________________________

Employee Name (please print)

Original Signature Required

___________________________________

Employee Signature

___________________

Date

___________________

Social Security Number

Prairie View A&M University

Public Access to Employee’s Home Address and Telephone Number

Public law, effective September 1, 1985, allows State employees to choose whether

they wish to keep confidential their home addresses and telephone numbers, and

requires that State agencies record the employee’s decision within fourteen days of the

date of employment.

If you do not want your employer to make your home address and telephone number

available to the public, you must notify your employer in writing. Once notification is

received, it will remain in effect until you provide written notice to your employer that you

wish to reverse your decision.

If you ask your employer to deny public access to this information, it will not be used in

published directories, not included on lists of employees secured from our files under

the Open Records Act by private firms or individuals. The information will not be given

to anyone else who may request it, so long as your authorization to deny access has

not been reversed. The information can be used by the employer, however, for any

official business purpose, including mailing correspondence and informational materials

to the employee at the home address.

Please complete and sign the following form:

____________________________________

_____________________________

Print Name

Social Security Number

Date of Employment by the Texas A&M System: ________/________/__________

Mo

Day

Year

Please Check one of the Following Statements:

____ I do wish to allow public access to my home address and telephone number.

____ I do not wish to allow public access to my home address and telephone number.

Signed:

Original Signature Required

_________________________________

Date Signed: __________

LISTS OF ACCEPTABLE DOCUMENTS

All documents must be UNEXPIRED

Employees may present one selection from List A

or a combination of one selection from List B and one selection from List C.

LIST A

Documents that Establish

Both Identity and

Employment Authorization

1. U.S. Passport or U.S. Passport Card

2. Permanent Resident Card or Alien

Registration Receipt Card (Form I-551)

3. Foreign passport that contains a

temporary I-551 stamp or temporary

I-551 printed notation on a machinereadable immigrant visa

4. Employment Authorization Document

that contains a photograph (Form

I-766)

5. For a nonimmigrant alien authorized

to work for a specific employer

because of his or her status:

a. Foreign passport; and

b. Form I-94 or Form I-94A that has

the following:

(1) The same name as the passport;

and

(2) An endorsement of the alien's

nonimmigrant status as long as

that period of endorsement has

not yet expired and the

proposed employment is not in

conflict with any restrictions or

limitations identified on the form.

6. Passport from the Federated States of

Micronesia (FSM) or the Republic of

the Marshall Islands (RMI) with Form

I-94 or Form I-94A indicating

nonimmigrant admission under the

Compact of Free Association Between

the United States and the FSM or RMI

LIST B

LIST C

Documents that Establish

Employment Authorization

Documents that Establish

Identity

OR

AND

1. Driver's license or ID card issued by a

State or outlying possession of the

United States provided it contains a

photograph or information such as

name, date of birth, gender, height, eye

color, and address

2. ID card issued by federal, state or local

government agencies or entities,

provided it contains a photograph or

information such as name, date of birth,

gender, height, eye color, and address

3. School ID card with a photograph

4. Voter's registration card

5. U.S. Military card or draft record

1. A Social Security Account Number

card, unless the card includes one of

the following restrictions:

(1) NOT VALID FOR EMPLOYMENT

(2) VALID FOR WORK ONLY WITH

INS AUTHORIZATION

(3) VALID FOR WORK ONLY WITH

DHS AUTHORIZATION

2. Certification of Birth Abroad issued

by the Department of State (Form

FS-545)

3. Certification of Report of Birth

issued by the Department of State

(Form DS-1350)

7. U.S. Coast Guard Merchant Mariner

Card

4. Original or certified copy of birth

certificate issued by a State,

county, municipal authority, or

territory of the United States

bearing an official seal

8. Native American tribal document

5. Native American tribal document

9. Driver's license issued by a Canadian

government authority

6. U.S. Citizen ID Card (Form I-197)

6. Military dependent's ID card

For persons under age 18 who are

unable to present a document

listed above:

10. School record or report card

7. Identification Card for Use of

Resident Citizen in the United

States (Form I-179)

8. Employment authorization

document issued by the

Department of Homeland Security

11. Clinic, doctor, or hospital record

12. Day-care or nursery school record

Illustrations of many of these documents appear in Part 8 of the Handbook for Employers (M-274).

Refer to Section 2 of the instructions, titled "Employer or Authorized Representative Review

and Verification," for more information about acceptable receipts.

Form I-9 03/08/13 N

Page 9 of 9

Article IX, HB1

75 Legislature (1997).

th

Article IX of the Appropriations Act passed by the 75th Legislature requires that The

Texas A&M University System distribute to you the information printed below. In

addition, we are required to collect from you your signed statement that you have

received this information. Please read the information below, sign the statement, make

a copy for your records and return the signed original to your Human Resources Office

at the above address.

Political Aid and Legislative Influence Prohibited (Section 5).

None of the moneys appropriated by this Act, regardless of their source or character,

shall be used for influencing the outcome of any election, or the passage or defeat of

any legislative measure. This prohibition shall not be construed to prevent any official

or employee of the state from furnishing to any Member of the Legislature or committee

upon request, or to any other state official or employee or to any citizen information in

the hands of the employee or official not considered under law to be confidential

information. Any action taken against an employee or official for supplying such

information shall subject the person initiating the action to immediate dismissal from

state employment.

No funds under the control of any state agency or institution, including but not limited to

state appropriated funds, may be used directly or indirectly to hire employees or in any

other way fund or support candidates of the State of Texas or the government of the

United States.

None of the funds appropriated by this Act shall be expended in payment of the salary

for full-time employment of any state employee who is also the paid lobbyist of any

individual, firm, association or corporation. None of the funds appropriated by this Act

shall be expended in payment of the partial salary of a part-time employee who is

required to register as a lobbyist by virtue of the employee’s activities for compensation

by or on behalf of industry, a profession or association related to operation of the

agency or institution for which the person is employed. A part-time employee may

serve as a lobbyist on behalf of industry, a profession or association so long as such

entity is not related to the agency with which he or she is employed.

Except as authorized by law, none of the funds appropriated by this Act shall be

expended in payment of membership dues to an organization on behalf of the agency or

an employee of an agency, if the organization pays all or part of the salary of a person

required to register under Chapter 305, Government Code.

No employee of any state agency shall use any state-owned automobile except on

official business of the state, and such employees are expressly prohibited from using

such automobile in connection with any political or any personal or recreational activity.

None of the moneys appropriated by this Act shall be paid to any official or employee

who violates any of the provisions of this section.

Standards of Conduct for State Employees (Section 6).

None of the funds appropriated by this Act shall be expended to pay the salary of a

state employee who:

(1) Accepts or solicits any gift, favor, or service that might reasonably tend to

influence the employee in the discharge of official duties or that the employee

knows or should know is being offered with the intent to influence the employee’s

official conduct;

(2) Accepts other employment or engages in a business or professional activity that

the employee might reasonably expect would require or induce the employee to

disclose confidential information acquired by reason of the official position;

(3) Accepts other employment or compensation that could reasonably be expected

to impair the employee’s independence of judgment in the performance of the

employee’s official duties;

(4) Make personal investments that could reasonably be expected to create a

substantial conflict between the employee’s private interest and the public

interest, or

(5) Intentionally or knowingly solicits, accepts, or agrees to accept any benefit for

having exercised the employee’s official powers or performed the employee’s

official duties in favor of another.

Acknowledgement

I have received and read the above excerpts of Sections 5 and 6 of Article IX, HB

1, 75th Legislature (1997).

Original Signature Required

___________________________________

Signature

_________________________

Date

THE TEXAS A&M UNIVERSITY SYSTEM

System Risk Management

NOTICE TO EMPLOYEES OF WORKERS' COMPENSATION INSURANCE

Notice is hereby given to all persons employed in the service of and on

the payroll of the institutions and agencies under the direction and

governance of the Board of Regents of The Texas A&M University System

that Workers' Compensation Insurance coverage is provided in

accordance with Chapter 502 of the Texas Labor Code.

I hereby acknowledge receipt of this notice that Workers' Compensation

Insurance has been provided as above stated.

Date: ____________________

Employee's Printed Name: ___________________

Original Signature Required

Employee's Signature: _________________________

UIN: ____________________

System Member: ____________________

Department: _____________________

TAMUS Form - 8

This form may not be altered.

Retain in Employee’s Personnel File

Rev 06/12

301 Tarrow Street, 5th Floor • College Station, Texas 77840-7896

979.458.6330 • 979.458.6247 fax • www.tamus.edu

Statement of Previous State Employment

With a few exceptions, you have the right to request, receive, review and correct information about yourself,

that was collected using this form.

Name

Social Security No.

Department

Please select the appropriate response.

I have not been employed by the State of Texas at any time prior to employment at Prairie View A&M

University.

I have been employed by the State of Texas at any time prior to employment at Prairie View A&M

University (including employment in a student status).

The state agencies at which I was employed are listed below.

Agency Name

Department

Address

Employment Date (From)

Employment Date (To)

Name used during Employment

Agency Name

Department

Address

Employment Date (From)

Employment Date (To)

Name used during Employment

Agency Name

Department

Address

Employment Date (From)

Employment Date (To)

Name used during Employment

I hereby authorize the state agencies listed above to verify the above information. If I am transferring

from within the Texas A&M University System, I authorize the release of my personnel/payroll file to

Prairie View A&M University and the Office of Human Resources.

Original Signature Required

Employee Signature: ____________________________________

Date: __________________________

Clear Fields

Print Form

HR 203 (10/01)

The Texas A&M University System

Statement of Selective Service Registration Status

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

Under HB 558, enacted by the 76th Texas State

Legislature, if you are currently of the age and gender

requiring registration with Selective Service, but

knowingly and willfully fail to do so, you are ineligible

for employment with an agency in any branch of Texas

state government. Any offer of employment is

contingent on your compliance with Selective Service

law.

Exemptions

Almost all male U.S. citizens, and male aliens living in

the U.S., who are 18 through 25 years of age, are

required to register with Selective Service. Some noncitizens are required to register and others are not.

Non-citizens not required to register include men who

are in the U.S. on student or visitor visas, and men

who are part of a diplomatic or trade mission and their

families. Almost all other male non-citizens are

required to register, including illegal aliens, legal

permanent residents, and refugees.

Non-Registrants

If you are not registered as required, you are presently

not eligible to be hired and should register promptly at

a United States Post Office. A Certificate of Mailing

may be obtained from the Post Office at such time that

you mail your registration and may be used as proof of

your application until you receive your Selective

Service Registration Card.

Privacy Act Statement

Because information on your registration status is

essential for determining whether you are in

compliance with Selective Service law, failure to

provide the information requested by this statement will

prevent any further consideration of you for

employment. This information is subject to verification

with the Selective Service System and may be

furnished to federal agencies for law enforcement or

other authorized use in implementing the law.

False Statement Notification

A false statement may be grounds for not hiring you, or

for dismissal, if you have already begun work.

Review

Should any question arise regarding your registration

or eligibility for an exemption, you may request an

official "status information" letter from the Selective

Service System by calling 1-847-688-6888. As an

alternative, you may send a written request to the

Selective Service System at P.O. Box 94638, Palatine,

IL 60094-4638.

Certification of Registration Status

( )

I certify that I am a male age 18 through 25 and am properly registered with the Selective Service System.

( )

I certify that I am not currently of the age required to register with Selective Service.

( )

I certify that I have been determined by the Selective Service System to be exempt from the registration

provisions of Selective Service law.

( )

I certify that I have not reached my 18th birthday and understand I may be required by law to register at that

time.

I understand that under HB 558, enacted by the 76th Texas Legislature, I must be registered with the Selective Service

System according to the requirements of federal law in order to be employed with an agency in any branch of Texas

state government. I further certify that the information provided on this form is true, complete and correct to the best of

my knowledge. I understand that any false statements may void my application for employment and that the

information provided on this form will be used only for evaluation of eligibility for employment.

______________________________________________

Name (please print)

___________________________

Social Security Number or UIN

Original Signature Required

_____________________________________________

Signature

___________________________

Date

________________________

Date of Birth

TEACHER RETIREMENT ELIGIBILITY FORM

EMPLOYEE NAME

SOCIAL SECURITY

EMPLOYER NAME

DATE ISSUED:

POSITION

DEPARTMENT

TEACHER RETIREMENT SYSTEM (TRS) ELIGIBILITY (check only one)

I am a new employee in a State Institution. To the best of my knowledge,

I am not a member, nor have I been a member of the Teacher

Retirement System of Texas.

I have taught or worked for a school district in Texas/and or a State Institution. I am

a member of the Teacher Retirement System of Texas.

I have retired from the Teacher Retirement System of Texas

as of _____________________ (date). I will complete a TRS 667 form,

for the purpose of TRS-Care benefits.

I have retired from a State Institution as of:

_______________________ (date)

Original Signature Required

Signature of Employee

Date

Clear Fields

Print Form

The T

exas A&M University System

Texas

HR 11 (3/08)

Prior ORP Participation Acknowledgment Form

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

____________________________________________________

________________________________________________

Name (Print)

Social Security number or UIN

____________________________________________________

________________________________________________

Department

Telephone number

ORP RETIREE (Skip this section if you are not an ORP retiree.)

Did you enroll in retiree group insurance provided by the Employees Retirement System of Texas, The University of Texas System or The

Texas A&M University System as an ORP retiree on or before June 1, 1997?

Yes. If yes, you are required to participate in ORP if you meet ORP eligibility criteria. Please complete the remainder of this form.

No. If no, you are not eligible to participate in ORP and do not need to complete the remainder of this form. Simply sign it and

return to your Human Resources or Payroll office.

Please mark appropriate box:

PREVIOUS ELIGIBILITY—DID NOT ELECT ORP

I certify that I have previously been eligible to elect participation in the Optional Retirement Program (ORP), but I elected to continue

membership in the Teacher Retirement System (TRS) in lieu of ORP as my one-time irrevocable choice between ORP and TRS, or I did

not exercise my option to elect ORP within my 90-day enrollment period and was subsequently defaulted into TRS.

PREVIOUS PARTICIPATION—VESTED IN ORP

I certify that I have previously been enrolled in ORP for at least one year and one day through previous State of Texas employment

and am therefore fully vested in ORP. I further acknowledge that I have had no intervening employment with the Texas Public

School System and have not participated in TRS since becoming a member of ORP. I understand that I am required to remain in

ORP for the duration of my employment in an institution of higher education in the State of Texas and that I must submit ORP

enrollment forms immediately.

Previous Texas Higher Education Employer(s)

Title(s)

Employment Period(s)

_______________________________________

________________________________

___________________________

_______________________________________

________________________________

___________________________

PREVIOUS PARTICIPATION—NOT VESTED IN ORP

I certify that I have participated in the ORP through previous State of Texas employment. I have less than one year and one day of

prior ORP participation and am now re-employed in an ORP-eligible position. In order to continue my ORP eligibility and become

vested I must submit the appropriate enrollment forms immediately. When I have completed one year and one day of cumulative

ORP-eligible employment, I will be considered vested and will continue to participate in ORP for the duration of my employment

with the State of Texas (except for employment with the Texas Public School System).

Previous Texas Higher Education Employer(s)

Title(s)

Employment Period(s)

_______________________________________

________________________________

___________________________

_______________________________________

________________________________

___________________________

INTERVENING TRS PARTICIPATION

I certify that since participating in ORP I have been employed by the Texas Public School System and have participated in the TRS. I

understand that because of my intervening TRS membership I must remain in TRS and will not be allowed to enroll in ORP.

NOT VESTED IN ORP—INELIGIBLE POSITION

I certify that I have participated in ORP for less than one year and one day through previous State of Texas employment. I am now reemployed in a position that is not eligible for ORP. I acknowledge that I am not vested in ORP and that I must now enroll in TRS and

must remain in TRS for the duration of my employment in an institution of higher education in the State of Texas.

I hereby authorize my previous Texas Higher Education employers to verify and release information to The Texas A&M University

System regarding my employment and participation in the ORP and/or TRS.

Original Signature Required

____________________________________________________________________

_____________________

Employee signature

Date

To be completed by your Human Resources or Payroll office:

I have verified the accuracy of the above information and certify this employee, if eligible for ORP participation, should receive an employer

contribution rate of 6.4% or 8.5%.

_______________________________________________________________________________________________

A&M System-authorized representative’s name and title

__________________________________________________________________

_____________________

Signature

Date

Clear Fields

The T

exas A&M University System

Texas

Print Form

HR 12 (8/05)

ORP Infor

mation Acknowledgment For

m

Information

Form

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

If you have previously participated in or have been eligible to participate in the Texas Optional Retirement Program (ORP), or if you

think you may have previous participation, you will need to complete the Prior ORP Participation Acknowledgment Form.

1. Selection of ORP in lieu of the Teacher Retirement System (TRS) entails certain responsibilities for the employee, including

selection and monitoring of ORP companies and investments.

2. The Texas A&M University System has no fiduciary responsibility for the market value of ORP participants’ investments or for

the financial stability of the ORP companies selected by the participants.

3. The amount the state contributes to ORP is determined by the Texas Legislature and may change over time.

4. I certify that I have never been given the opportunity in the past to enroll in ORP in Texas. I understand that I have 90 days from my

date of eligibility, which is (mm/dd/yy) ___________________________, to enroll in ORP, that this time limit will expire on

(mm/dd/yy) ___________________________, and that this is a one-time irrevocable choice between the ORP and the TRS. I

understand I will be automatically enrolled in TRS until I enroll in ORP prior to the expiration date listed above. I further understand

that failure to enroll in ORP prior to the expiration date listed above will automatically and permanently enroll me in the Teacher

Retirement System of Texas for the remainder of my employment in Texas public higher education.

5. If I am in a visiting, adjunct, temporary or any other ORP-eligible position that may not be expected to last for more than 12

months, I understand that this is my one and only opportunity to elect ORP in lieu of TRS. In addition, I understand that

failure to enroll in ORP at this time will eliminate any future opportunities to enroll in ORP even if I have an extended break in

service from Texas institutions of higher education. This is my one-time, irrevocable choice, and I understand that I will not

have another opportunity to enroll in ORP if I return to an ORP-eligible position in Texas.

6. I understand that all necessary and properly completed ORP enrollment forms must be received by the appropriate Personnel/

Human Resources or Payroll office within the 90-day election period and before the monthly payroll calculation in order to be

effective that month. Forms received prior to the expiration of my ORP election period but after the monthly payroll calculation will

be effective on the first of the following month.

I have read and understand the above statements concerning responsibilities that an employee undertakes upon selection of the Optional

Retirement Program (ORP) in lieu of the Teacher Retirement System (TRS). I have been furnished a copy of “An Overview of TRS and ORP” as

a source of information about my retirement decision.

____________________________________________________________

__________________________________

Name (Print)

Social Security number or UIN

______________________________________________________________

___________________________________

Position or title

Telephone number

____________________________________________________________

__________________________________

Department

E-mail address

Original Signature Required

______________________________________________________________

___________________________________

Employee signature

Date

Original Signature Required

______________________________________________________________

___________________________________

Witness

Date

The T

exas A&M University System

Texas

HR 14 (4/13)

ORP Salar

endor

Salaryy Reduction Acknowledgment/Change of V

Vendor

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

____________________________________________________

________________________________________________

Name (Print)

UIN

____________________________________________________

Prairie View A&M University

________________________________________________

Department

Institution or agency name

INSTRUCTIONS

1. Complete Section A or B as appropriate, then sign Section C and complete Section D.

2. Attach copy of vendor application.

3. Attach TRS-28 form for initial Optional Retirement Program (ORP) election.

4. Make a copy for your records.

5. Return to your Human Resources or Payroll office.

A. ELECTION TO PARTICIPATE

As my initial election to participate in the A&M System ORP, I select (name of vendor) _____________________________________

and certify that:

1.

I understand that my decision not to become a member or not to continue membership in the Teacher Retirement System of Texas

(TRS) is irrevocable as required by law, unless I become an eligible employee in the Texas Public School System, other than in a

Texas institution of higher education, or before my vesting date become employed in a position not eligible for continued

participation in ORP. By electing to participate in the ORP, I relinquish all rights to TRS benefits that I previously accrued. I also

understand that my previous contributions to TRS may not be rolled over to my ORP account.

2.

I have been provided information regarding the benefits available through the Teacher Retirement System of Texas, including the TRS’s

life insurance and disability benefits, and it is my decision to select the ORP.

3.

I understand and acknowledge that both my contribution and the State of Texas’ contribution to the ORP will be treated as

nonelective contributions under Section 403(b) of the Internal Revenue Code (IRC). Additionally, my contributions to the ORP will

be made by salary reduction as required by Texas law. The contribution rates are subject to change at the discretion of the Texas

Legislature. This agreement is irrevocable as long as I am a participant in the ORP or until it is determined by the appropriate

authority that employee ORP contributions are elective within the meaning of Section 402 of the IRC.

4.

I understand that the System is not responsible for determining whether an employee is in compliance with the §415(c) maximum

contribution limits when the employee has additional outside compensation and has not informed the System of his/her previous

contributions to a §403(b) ORP account through another institution of higher education in Texas in the current fiscal year.

I further understand that it is my responsibility to disclose 403(b) ORP salary reduction contributions with employers other than

the A&M System in the fiscal year (Sept. 1 to Aug. 31) for which this agreement applies.

In the fiscal year for which this agreement applies (Sept. 1 to Aug. 31), have you made 403(b) ORP salary reduction contributions

with a Texas public institution of higher education other than the A&M System?

Yes (Amount contributed to ORP: $_____________________)

No

B. CHANGE OF VENDOR

I elect to change my ORP vendor from _____________________________________________________ to

(name of new vendor): _______________________________________________________

(continued on back)

Clear Fields

Print Form

C. EMPLOYEE SIGNATURE

This election supersedes all previous elections. I understand that my election will become effective on my day of hire or eligibility,

provided all necessary and properly completed ORP enrollment forms are signed and received by the appropriate Human Resources or

Payroll office before the monthly payroll calculation for that month. Forms received after the monthly payroll calculation will be effective on the first of the following month.

I understand that I bear the risk of the product(s) of my choosing, that The Texas A&M University System has no fiduciary responsibilities

in this area, and that The Texas A&M University System is not liable for any tax consequences occurring under these programs.

Original Signature Required

____________________________________________________

_______________________________________________

Employee signature

Date

D. VENDOR INFORMATION (required if using individual vendor representative)

_____________________________________________

_________________________________________________________

Name of Representative

Company

_______________________________

_______________________________

_______________________________

Telephone number

Fax number

E-mail address

E. TO BE COMPLETED BY YOUR HUMAN RESOURCES OR PAYROLL OFFICE

Processed by ____________________________________________________

Date ____________________________