MARSHFIELD AREA 2008 ECONOMIC INDICATORS

advertisement

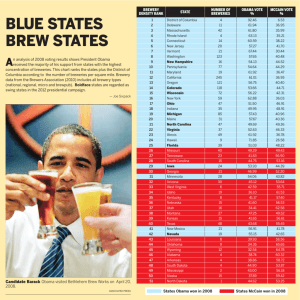

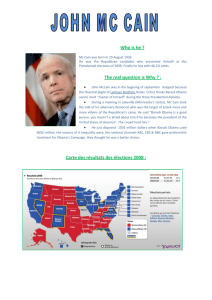

Marshall & Ilsley Bank Marshfield Area Chamber Of Commerce & Industry’s Marshfield Economic Development Association MARSHFIELD AREA 2008 ECONOMIC INDICATORS 2nd Quarter 2008 presented September 19, 2008 Presented by: Central Wisconsin Economic Research Bureau Randy F. Cray, Ph.D., Professor of Economics and Director of the CWERB Scott Wallace, Ph.D., Associate Professor of Economics and Research Associate of the CWERB Sarah J. Bauer, Research Assistant Special Report: Beyond the Sound Bites: The Real Economic Programs of John McCain and Barack Obama. Kevin Neuman, Ph. D., Assistant Professor of Economics – University of Wisconsin Stevens Point. TABLE OF CONTENTS National and Regional Outlook Table 1 1 Central Wisconsin Tables 2-6 4 Marshfield Area Tables 7-15 15 Special Report Beyond the Sound Bites: The Real Economic Programs of John McCain and Barack Obama 30 Association for University Business and Economic CWERB - Division of Business and Economics University of Wisconsin-Stevens Point Stevens Point, WI 54481 715/346-3774 715/346-2537 www.uwsp.edu/business/CWERB National and Regional Outlook Based upon the nation’s GDP growth in second quarter 2008 one might conclude that the national economy is performing nicely. For example real GDP grew by an annualized 3.5 percent during the April - June time frame. However, other economic indicators suggest that the economy is having a much harder go of it. For example, the national unemployment rate has been trending upward since early 2007 and by July 2008 reached 5.7 percent. Given the mixed message sent by GDP and the unemployment rate, I would like to explore the matter further and discuss other variables that will give us insight into the health and condition of the economy. As most everyone knows our current economic situation has been and will continue to be heavily influenced by the collapse of the sub-prime housing market. Many economists believe that it will be well into 2009 before the effects of the sub-prime housing market collapse on homeowners and its impact on the nation’s financial institutions cease to be a drag on the economy. Current housing indicators show that prices continue to tumble across the nation. Since mid 2007 housing prices have fallen each and every month. New single family housing starts have declined from about 1.4 million starts in July 2006 to 0.6 million starts in July 2008. Sales of existing homes in July 2006 were about 5.5 million units; by July 2008 only about 4.4 million homes were being sold. The contraction in housing activity hurts not only the construction sector, but the entire economy as well. For an excellent discussion of this one should read Kevin Bahr’s CWERB special report from May 2008. In the report he details the economic relationships among the housing market, homeowners, financial institutions and the overall economy. Other indicators of economic performance such as industrial production, capital investment, manufacturing, motor vehicles and parts, the stock market, consumer price index, and energy costs all suggest that the economy is doing more poorly than what the GDP figure alone says about the situation. Perhaps most importantly, employment at the national level has contracted by about 700,000 jobs since June 2007. Thus, it becomes apparent as to why most people feel that the economy is doing more poorly than what the GDP figure suggests. Given that the economy is now experiencing inflationary pressures and rising unemployment, the job of the Federal Reserve has become much more difficult than in past years. Our nation’s central bank must carefully weigh the risks of providing more liquidity and lower interest rates to stimulate economic growth against the inflationary pressure that this action would surely cause. Until very recently the Federal Reserve felt the greatest danger to the economy was recession. The Federal Reserve acted very aggressively in lowering interest rates and providing needed liquidity to ailing financial institutions. The stance of the Federal Reserve has changed to a degree. Our nation’s central bank’s monetary policy has shifted to a more neutral position. The FED now recognizes that inflationary pressure, even though inflation is expected to recede in the months ahead, needs to be monitored closely. Thus, it is unlikely the Federal Reserve will make a dramatic move to reduce interest rates in the months ahead. 1 Economic growth would have to take a huge nose dive before the Federal Reserve will provide more liquidity to the economy. On the fiscal policy front the tax rebate checks seemed to have had a smaller than hoped for impact on consumer spending. If the economy appears to be faltering we may very well see another round of rebate checks from Washington. But, until the housing market, consumer finances, and financial institution balance sheets become healthy the economy will continue to struggle. 2 TABLE 1 NATIONAL ECONOMIC STATISTICS 2007 2008 Second Quarter Second Quarter Percent Change Nominal Gross Domestic Product (Billions) $13,768.8 $14,256.5 +3.5 Real Gross Domestic Product (Billions of 2000 $) $11,520.1 $11,700.6 +1.6 Industrial Production (2002 = 100) 111.4 111.7 +0.3 Three Month U.S. Treasury Bill Rate 4.69% 1.90% -59.4 Consumer Price Index (1982-84 = 100) 208.4 218.8 +5.0 3 Central Wisconsin The unemployment rates are generally lower in Central Wisconsin compared to a year ago. In addition, total employment, whether measured by the survey of households or measured from employer payroll records, indicates an expansion in the number of jobs. Sales tax collections, however, were well off the pace of a year ago. This is especially true if the numbers are adjusted for inflation. Finally, regional business executives believe the economy is much weaker than it was a year ago. The CWERB Table 2 shows that unemployment rates for second quarter 2008 were lower than in second quarter 2007. The unemployment rate fell from 4.9 to 4.8 percent in Marathon County, from 5.3 to 5.1 percent in Portage County, and 6.1 to 5.6 percent in Wood County. This comes as a pleasant surprise. Moreover, Wisconsin’s unemployment rate contracted from 5.3 to 4.9 percent. The national unemployment rate, however, rose sharply from 4.7 to 5.7 percent. It is clear that the local area economy has held up well when compared to the nation. Additional good news comes from Table 3. Total employment in Central Wisconsin is estimated to have grown from 149.8 to 150.3 thousand over the past twelve months, a small, but respectable 0.3 percent change. Given the weakness of the national economy any gains in employment are to be appreciated. From second quarter of last year Wisconsin added about 14 thousand people to its payrolls, meanwhile the U.S. lost approximately 308 thousand jobs. The state of Wisconsin also estimates employment by collecting data from business establishments and government units. Over the past twelve months nonfarm employment in Central Wisconsin grew by a small but positive 0.3 percent. Sectors of the economy experiencing growth were financial activities, education & health services, leisure & hospitality, and information & business services. However, other sectors like construction & natural resources, manufacturing, trade, transportation & utilities, and total government lost employment. County sales tax data are used to judge the strength of the local economic scene. Collections in Portage County declined by approximately 7.9 percent since second quarter 2007. Likewise Wood County sales tax collections are estimated to have declined by 9.5 percent for the period. Marathon County collections were up by a scant 0.6 percent. Given that the inflation rate for the past twelve months was 5.0 percent, the real inflation adjusted collections for all three counties are much weaker than what they first appear. In sum, retail economic activity may have been fairly weak when compared to a year ago. The CWERB survey of business executives is presented in Table 6. This group believes that recent changes in economic conditions, whether of the national or local level, have deteriorated from a year ago. They were somewhat more upbeat about future economic conditions at the nation level, local level, and for their particular 4 industry. In other words they felt that economic matters would not become appreciably worse and that the economy was beginning to stabilize. 5 TABLE 2 UNEMPLOYMENT IN CENTRAL WISCONSIN Unemployment Rate June 2007 Unemployment Rate June 2008 Percent Change Portage County 5.3% 5.1% -3.9 City of Stevens Point 6.4% 6.5% +1.6 Marathon County 4.9% 4.8% -0.9 Wood County 6.1% 5.6% -7.1 Central Wisconsin 5.3% 5.1% -3.8 Wisconsin 5.3% 4.9% -6.7 United States 4.7% 5.7% +21.4 TABLE 3 EMPLOYMENT IN CENTRAL WISCONSIN Total Employment June 2007 (Thousands) Total Employment June 2008 (Thousands) Percent Change Portage County 38.9 40.1 +3.2 City of Stevens Point 13.6 13.9 +2.9 Marathon County 72.9 71.7 -1.7 Wood County 38.0 38.5 +1.3 Central Wisconsin 149.8 150.3 +0.3 Wisconsin 2,965.4 2,979.3 +0.5 United States 146,957 146,649 -0.2 * Percent change figures reflect data before rounding 6 TABLE 4 CENTRAL WISCONSIN EMPLOYMENT CHANGE BY SECTOR Employment June 2007 (Thousands) Employment June 2008 (Thousands) Percent Change Total Nonfarm 154.0 154.5 +0.3 Total Private 135.7 136.4 +0.5 Construction & Natural Resources 6.7 5.9 -11.5 Manufacturing 28.8 27.4 -4.8 Trade 25.3 24.5 -3.1 Transportation & Utilities 8.3 8.1 -2.2 Financial Activities 11.6 12.0 +3.8 Education & Health Services 23.2 24.2 +4.4 Leisure & Hospitality 13.2 14.0 +6.4 Information & Business Services 18.8 20.1 +6.9 Total Government 18.3 18.1 -1.1 Sales Tax 2007 Second Quarter (Thousands) Sales Tax 2008 Second Quarter (Thousands) Percent Change Portage County $1,301.3 $1,198.3 -7.9 Marathon County $2,674.8 $2,692.0 +0.6 Wood County $1,289.2 $1,166.9 -9.5 TABLE 5 COUNTY SALES TAX DISTRIBUTION * Percent change figures reflect data before rounding 7 TABLE 6 BUSINESS CONFIDENCE IN CENTRAL WISCONSIN Index Value March 2008 June 2008 Recent Change in National Economic Conditions 26 30 Recent Change in Local Economic Conditions 29 32 Expected Change in National Economic Conditions 50 50 Expected Change in Local Economic Conditions 46 47 Expected Change in Industry Conditions 51 50 100 = Substantially Better 50 = Same 0 = Substantially Worse 8 FIGURE 1 9 FIGURE 2 10 FIGURE 3 11 FIGURE 4 12 FIGURE 5 13 FIGURE 6 14 Marshfield A summary of the Marshfield results is as follows. Total nonfarm employment rose by approximately 1.0 percent. Retailer confidence about the future direction of store sales and traffic remains glum. Help wanted advertising has picked up over the past twelve months. However, unemployment claims in the county have risen substantially over the same period. Surprisingly, construction activity is generally above the levels of 2007. Wood County industrial sector employment is presented in Table 7. The national economy has lost hundreds of thousands of jobs since last year. However, employment in Wood County expanded by approximately 1.0 percent during the same period. Wood County employment sectors that experienced growth were transportation & utilities, education & health services, leisure & hospitality, and information & business services. Sectors that declined in employment were construction & natural resources, manufacturing, trade, financial activity, and government. The decline of 500 positions in manufacturing was the most negative aspect of the results. The CWERB survey of local merchants is given in Table 8. This group believes total sales were slightly ahead of last year’s pace, but store traffic was perceived to be about the same as a year ago. When they were asked about the future they indicated that sales and store traffic compared to a year ago at the same time would be lower for their establishment. Help wanted advertising is displayed in Table 9 for the Marshfield area. Economists use help wanted advertising as a barometer of future labor market conditions. The index rose from 86 to 92 over the past twelve months, a 7 percent increase in local advertising. The U.S. index, however, fell from 27 to 17 over the past twelve months, a decline of 37 percent. It is widely understood that web based job advertising has been displacing newspaper help wanted advertising. But most economists still believe that help wanted advertising serves a useful role in forecasting labor market conditions. Tables 10 and 11 give the reader insight into the amount of family financial distress being experienced in the county. Public assistance claims in Marshfield were virtually unchanged from a year ago, declining from 79 to 78. However, unemployment claims data on a county wide basis shows that new unemployment claims rose from 212 to 251 or by 18.4 percent. Likewise, total claims climbed from 1,339 to 1,499 or by 11.9 percent. This strongly suggests that layoffs in the southern part of Wood County are having a huge influence on the numbers. Table 12 shows that residential construction in second quarter 2008 was substantially above the total for 2007. The number of new residential permits increased from 2 to 9 and the estimated value of the construction rose from $585 thousand to $2.3 million dollars. The number of residential alteration permits also increased. The 15 number of permits went from 43 to 56. However, the estimated value of the alteration activity actually declined from $1.5 million to $474 thousand. The nonresidential construction figures are presented in Table 13 without percentage changes. Due to the large scale nature of these projects the number can be very volatile thus reducing the value of presenting percentage changes. The number of permits rose from 1 to 4 over the course of the year. The estimated value of the new permits climbed from $300 thousand to $1.7 million. Business alteration permits fell from 29 to 23 and the value of the alteration activity rose from $4.8 million to $5.6 million. In sum, nonresidential construction activity in the Marshfield area was stronger this year when it is compared to last year’s totals. Table 14 and 15 present Clark County economic data. Clark County’s total nonfarm employment grew by 3.9 percent from June 2007 to June 2008. Total employment in Clark is estimated to have expanded by 5.2 percent over the same time frame. In addition, the unemployment rate fell from 5.4 percent to 4.8 percent. By in large the June 2007 to June 2008 time frame was a period of expansion for Clark County. 16 TABLE 7 WOOD COUNTY EMPLOYMENT CHANGE BY SECTOR Employment June 2007 (Thousands) Employment June 2008 (Thousands) Percent Change Total Nonfarm 43.6 44.0 +1.0 Total Private 38.2 38.7 +1.4 Construction & Natural Resources 1.9 1.4 -28.4 Manufacturing 6.3 5.8 -8.7 Trade 5.5 5.3 -3.1 Transportation & Utilities 3.9 4.0 +1.6 Financial Activities 1.2 1.2 -2.6 Education & Health Services 10.8 11.7 +8.4 Leisure & Hospitality 3.3 3.3 +1.0 Information & Business Services 5.4 6.1 +13.7 Total Government 5.4 5.3 -1.9 TABLE 8 RETAILER CONFIDENCE IN MARSHFIELD* Index Value March 2008 June 2008 Total Sales Compared to Previous Year 46 59 Store Traffic Compared to Previous Year 40 50 Expected Sales Three Months From Now 46 45 Expected Store Traffic Three Months From Now 42 45 100 = Substantially Better 50 = Same 0 = Substantially Worse * Data collected by UW Marshfield-Wood County 17 TABLE 9 HELP WANTED ADVERTISING IN MARSHFIELD Index Value 2007 2008 Marshfield (June) 1980=100 86 92 U.S. (May) 1987=100 27 17 TABLE 10 PUBLIC ASSISTANCE CLAIMS IN WOOD COUNTY 2007 Second Quarter (Monthly Avg.) Total Caseload 79 18 2008 Second Quarter (Monthly Avg.) Percent Change 78 -1.3 TABLE 11 UNEMPLOYMENT CLAIMS IN WOOD COUNTY 2007 2008 Second Quarter Second Quarter (Weekly Avg.) (Weekly Avg.) Percent Change New Claims 212 251 +18.4 Total Claims 1339 1499 +11.9 TABLE 12 RESIDENTIAL CONSTRUCTION IN MARSHFIELD AREA* 2007 2008 Second Quarter Second Quarter Residential Permits Issued Percent Change 2 9 +350.0 $585.0 (thousands) $2,346.2 (thousands) +301.1 Number of Housing Units 2 9 +350.0 Residential Alteration Permits Issued 43 56 +30.2 $1,492.5 (thousands) $474.0 (thousands) -68.2 Estimated Value of New Homes Estimated Value of Alterations * Data collected by UW Marshfield-Wood County 19 TABLE 13 NONRESIDENTIAL CONSTRUCTION IN MARSHFIELD AREA* 2007 2008 Second Quarter Second Quarter Number of Permits Issued Estimated Value of New Structures Number of Business Alteration Permits Estimated Value of Business Alterations * Data collected by UW Marshfield-Wood County 20 1 4 $300.0 (thousands) $1,735.0 (thousands) 29 23 $4,846.6 (thousands) $5,575.7 (thousands) FIGURE 7 21 FIGURE 8 22 FIGURE 9 23 FIGURE 10 24 TABLE 14 CLARK COUNTY EMPLOYMENT BY SECTOR June 2007 June 2008 Percent Change Total Nonfarm 11.5 11.9 +3.9 Total Private 9.5 10.1 +5.9 Construction & Natural Resources 0.8 0.6 -20.8 Manufacturing 3.2 3.4 +5.5 Trade 1.7 1.6 -4.8 Transportation & Utilities 0.6 0.7 +15.8 Financial Activities 0.3 0.3 -10.0 Education & Health Services 1.6 1.9 +16.0 Leisure & Hospitality 0.6 0.6 -0.3 Information & Business Services 0.8 1.0 +26.5 Total Government 2.0 1.9 -5.7 TABLE 15 CLARK COUNTY EMPLOYMENT STATISTICS June 2007 June 2008 Percent Change 5.4% 4.8% -11.3 Total Employed 17,737 18,657 +5.2 Total Unemployed 1,014 940 -7.3 Labor Force 18,751 19,597 +4.5 Unemployment Rate 25 FIGURE 11 26 FIGURE 12 27 FIGURE 13 28 FIGURE 14 29 BEYOND THE SOUND BITES: THE REAL ECONOMIC PROGRAMS OF JOHN MCCAIN AND BARACK OBAMA Kevin Neuman, Ph.D. Assistant Professor of Economics Division of Business and Economics University of Wisconsin – Stevens Point INTRODUCTION Each presidential election cycle has its own character and hot-button issues, derived partly from the personalities of the candidates but also from the realities of the period. A year ago it appeared that the 2008 election would be a referendum on the resolution of the war in Iraq and that national security issues would once again carry the day. Today rising energy prices and the mortgage crisis have pushed economics to the forefront, with John McCain and Barack Obama charged by their parties to address the concerns of voters. A recent New York Times/CBS News poll clearly shows this shift in voter priorities with 40% of those polled citing the “economy and jobs” as their greatest concern, and an additional 15% citing the economic issue of “Gas prices, energy policy”. At the same time, only a combined 24% of those polled considered the “War in Iraq” (15%) or “Terrorism, national security” (9%) to be their top priority. The poll numbers show that “voters are more negative about the condition of the nation’s economy this election year than they have been at any time since 1992” (Cooper and Sussman, 8/21/08). As such the economic platforms of each candidate have been receiving increasing attention as the election enters the homestretch. Unfortunately, past experience suggests that voters can be assured of two things about the 2008 election: the candidates will disagree. Each candidate will have their positions distorted by the other. This report attempts to cut through this election year fog by revealing the real economic programs of Senators John McCain and Barack Obama. To accomplish this task the paper first lays the ground work for the analysis by examining the economic theory behind the candidates’ positions. It next examines some specific components of the platforms related to economic stimulus, tax policy, fiscal and spending policy, mortgage reform, and health care. While this is by no means a comprehensive list, these components are areas which highlight the major disagreements between the candidates. The final section concludes the report. IN SEARCH OF PLATFORM SUPPORT: THE ECONOMIC THEORY If asked to describe the economic policies of Republican John McCain or Democrat Barack Obama, it is likely that many people would respond based on the common stereotypes of the two parties. Republicans of course are the fiscal conservatives, working to balance the budget and stimulating economic growth through tax cuts. Democrats on the other hand are the interventionists, raising taxes to pay for increased government spending and more extensive regulation. In more technical terms the debate has the Republicans carrying the flag for the neoclassical supply side economists with the Democrats posing as the poster children for Keynesian economists. 30 While clearly a simplification of reality and generally outdated, each of these stereotypes has a well-rounded, supporting economic theory and ideology which at times has matched the actual policies quite closely. In short, supply side economists believe in free markets. Open competition between self-motivated individuals and businesses will allocate scarce resources efficiently as those with more valuable uses for the resources should be willing to pay more for them. Primarily government’s role in the economy is simply to stay out of the way. Governments also can encourage growth by providing incentives that influence individuals and businesses to act in a way which will not only benefit themselves, but also the economy as a whole. By and large they take the form of tax cuts, which provide financial incentives to targeted groups without interfering with or regulating the market in any way. The tax cuts simply change the relative profitability of different actions in the market. While tax cuts are not uniquely advocated by the supply-siders to stimulate economic activity, the types of tax cuts distinguish the group. Rather than use taxes primarily to stimulate aggregate demand, supply side economists believe that tax cuts encourage increased labor effort and capital formation leading to greater stocks of capital and labor that increase aggregate supply, thus avoiding the demand side’s tradeoff between unemployment and inflation. Of particular interest to the supply-siders are tax rate reductions on corporate income, capital gains, dividends, investment, and research and development as these create incentives to save and expand businesses, driving the economy’s capacity outward. Expanding economic capacity creates income not just for entrepreneurs, but also for those now working in the growing businesses. As a convenient side effect, the tax cuts should not even increase the budget deficit as surging economic activity expands the base, offsetting declines in tax revenue from pre-existing sources. Supply side economists do recognize that in the short run most of the tax incentives will tend to benefit the wealthier segments of society because they are the individuals with money to invest, but in the long run everyone will benefit from the overall economic expansion. On the other hand, Keynesian economists view markets with more apprehension and advocate a greater role for government in the economy. While the Keynesians do not completely reject the efficiency aspect of markets, they believe that there are significant imperfections in their functioning. Inspired by the events of the Great Depression, Keynesians believe that unfettered capitalist economies will be subject to extensive business cycles due to imperfectly functioning markets and human behavior. To Keynesians the belief that the economy has a system of natural stabilizers is completely wrong, as they see de-stabilizing elements deeply ingrained in the markets themselves. However, Keynesians believe that the market economy can be managed by a watchful government to capture the efficiency of markets without the devastating depressions. Unlike the supply-siders, Keynesians believe that tax cuts can be an effective means to increase personal income and aggregate demand rather than to encourage capital formation. In addition, Keynesians advocate aggregate demand stimulation through direct government spending to create jobs and replace the economic activity not being provided by the private sector. To encourage capital formation, and stimulate aggregate demand, Keynesians generally use interest rates as an incentive rather than tax cuts. With respect to the budget, Keynesians believe that sometimes deficit spending is necessary to stimulate aggregate demand, and that the deficit can be paid 31 for when the economy recovers. Keynesians do recognize that this type of intervention in the economy requires a careful, watchful eye, but believe that government with its elected officials and appointed experts is capable of playing this caretaker role. The key question is whether these stereotypes match the actual policies of the candidates and fairly represent their economic platforms. When one examines John McCain’s policies, as I do later in the report, it appears that his economic platform does seem to mesh relatively well with the supply side label. On the other hand, Barack Obama’s policies seem to represent a less consistent ideology than the simple Keynesian policies described above. In fact, while it can be argued that on social issues Obama is more liberal than many in the Democratic Party, on economic issues Obama in many ways appears much more conservative than other Democrats. This is not to say that Obama has rejected government spending as an effective method of economic stimulus, or that he believes all government regulation is distortionary and should be repealed. As I will show in more detail, Obama’s policies do make use of both of these methods and are cornerstones of his economic package. However, Obama’s policies do reflect a much greater level of comfort with the functioning of markets to reach favorable outcomes, a characteristic which seems to make some fellow Democrats uncomfortable. Obama’s economic policies have even earned him the label of a “University of Chicago Democrat” in reference to the market focused economics traditionally championed by the institution as well as his time spent teaching there (Leonhardt 8/24/08). But this philosophy is not due to a simple biographical link, and is not a simple mix of economic ideologies. Rather the combination of market and regulatory approaches suggests the influence of a third school of economic thought, known as behavioral economics. In general, behavioral economics is a market based approach to economic matters in that it does not call for intrusive government regulation 1 . Where it differs from neoclassical economics, likely due to its psychological roots, is in the deep questioning of a primary assumption of the rational economic individual. Behavioral economists recognize that individuals do not always make the “right” decision even when presented with all the information and do not always act solely out of self-interest as the theory says they should. For the behavioralists the challenge is to frame decisions or to give a “gentle nudge” so that individuals freely make their own decision, yet that the decision will tend to be the “correct” decision from the perspective of policymakers (Cassidy 6/12/08). As defined by two leaders in the field a “nudge, as we will use the term, is any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives” (as quoted in Cassidy 6/12/08). This combination of market utilization and government paternalism is the pragmatic mix of economic policy which makes some Obama policies look stereotypically un-Democratic. There are a few general principles which drive behavioral economics. One is inertia, which is the general insight that individuals do not always change their behavior even if 1 For a more thorough discussion of behavioral economics and the policies the school of thought might put forth see the book by Thaler and Sunstein entitled “Nudge: Improving Decisions About Health, Wealth, and Happiness”. 32 it is in their best interest. The key here is not to tell everyone what to do, but to make the default choice the appropriate one for most of the people involved and for the welfare of society. Another is the misuse of information when making decisions. Behavioralists speak of “anchoring” which is the inability of individuals to let go of even meaningless information and allowing it to influence a decision. Other examples are the “availability heuristic” which is the use of the most obvious information to make a decision even if it is not the most relevant and the “representativeness heuristic” which is where individuals are influenced by non-existent patterns that they think they see (Cassidy 6/12/08). The answer here again is not to fix decisions, but to make information easy to understand and relevant so that individuals can make better decisions on their own. These simple guidelines have shaped a number of Obama’s policies which I will examine in more detail in the next section. IN SEARCH OF VOTER SUPPORT: THE ECONOMIC PROGRAMS With the simple descriptions of economic theory from the previous section in mind, I now turn to specific components of the candidates’ plans. Before jumping into the analysis, it is worth mentioning a difference in style between the campaigns. While both candidates accuse the other of vague campaign promises, outside observers have noted a “paper gap” in the McCain camp, referring to the relative lack of specific policy papers detailing his proposals (Zenilman 8/2/08). While greater volume does not necessarily make for better public policy, the lack of details does mean that interpreting how McCain plans to accomplish his goals is more difficult. At the same time the flood of detailed briefs from the Obama camp makes it difficult to discern which policies are to be taken most seriously as it seems unlikely all are honestly expected to be implemented. With this in mind I examine the candidates’ platforms relating to immediate economic stimulus, tax policy, fiscal and spending policy, mortgage reform, and health care. Specific details of the candidates’ plans are presented in Table 1. Immediate Economic Stimulus As the economic situation in the country deteriorated during the spring and summer, how to stimulate the economy became a topic that the candidates increasingly had to address. During the contentious Democratic primary season Hillary Clinton and Barack Obama were more than happy to do so as the economy seemed to be a clear weakness for the incumbent party. Not surprisingly Obama emerged from the contest with a detailed plan to address the current economic conditions, which he updated further as the summer progressed. On the other hand, John McCain, whose policies more closely resemble those of George Bush, was more reluctant to outline a detailed stimulus plan since such a plan implies the failure of Bush’s economic policy. As such, McCain’s stimulus package is not as extensive as that of Obama. Both plans focus on rising energy costs, although the candidates approach the issue in different ways. From early in the spring McCain called for a suspension of the federal gas tax, a repeal of the tax on imported sugar-based ethanol and a roll back on cornbased ethanol mandates which he blamed for higher corn and food prices. While 33 McCain’s cornerstone policy of a gas tax holiday may have been popular with voters it was widely panned by economists of all persuasions as the reduction of the tax likely would be captured by the oil companies and have little effect on price. Obama on the other hand recently called for an energy rebate of $500 per individual and $1,000 per family to be financed by a tax on so called windfall profits of oil companies. Calling the rebate an “energy rebate” directs attention towards the concerns of voters although in reality the rebate is similar to the rebate checks sent out by the government earlier in the summer. In theory, if people spend the checks the economy would receive some stimulus. Critics argue though, that while a tax on oil companies may be politically popular, companies will simply pass the tax onto consumers through higher prices. To the extent that this is possible, those who consume a disproportionate amount of oil may actually see themselves hurt by the policy. An interesting area where the candidates initially disagreed dramatically was foreclosure assistance. Looking at Table 1 this may seem rather surprising as now the candidates’ policies are actually rather similar, with both advocating renegotiation of loans with varying degrees of public assistance. The main differences between the plans are the eligibility requirements and the level of support, with Obama’s plan tending to be more generous. The difference is that McCain initially declined to offer any assistance in the crisis, saying that the market would correct itself by punishing those who had made poor decisions. Although the stance likely seemed heartless to voters the position was clearly in line with his economic ideology. After McCain received enough pressure to finally offer a plan, he strongly emphasized that no speculators would be helped by the program, a principle also advocated by Obama. Obama clearly separates himself from McCain with the final segment of his plan which calls for extensive government spending. The two packages of $25 billion given to states to offset budget and infrastructure cuts are textbook government spending stimulus designed to prop up aggregate demand. When combined with the tax stimulus paid for by a regulatory style tax increase on a specific industry and a new government assistance program, Obama’s plan is stereotypically Democratic in its ideology and does not show much of the new thought that his other policies reflect. However, Obama’s package does address the current economic situation to a much greater degree and is likely to stimulate the economy much more than McCain’s plan. From a political perspective Obama’s package is also likely to attract voters who believe the economy is currently in a recession. Tax Policy Although the stimulus packages are highlighted in the candidates’ campaigns (particularly for Obama) it is the candidates’ tax policy that reveals their long term plans for the economy. It is also the candidates’ tax policy that we see the most consistent representation of the candidates’ economic ideologies. Not surprisingly, McCain’s platform details tax cuts of the supply side variety. The cornerstone of the package is to extend President Bush’s tax cuts on personal income, 34 but also on dividends and capital gains, two taxes vilified by supply-siders as disincentives to invest. McCain also plans new supply-side cuts, calling for significant reductions to the corporate income tax and the estate tax. Two other notable moves to encourage adoption of new technology are to expand and make permanent a credit for R & D, and to allow first year expensing of equipment and technology investments, a policy allowing companies to receive their tax breaks immediately rather than over time. In moves designed to impact the middle class McCain also supports phasing out the Alternative Minimum Tax (although his position on this has been inconsistent, shifting from “eliminate” to “phase out” over the campaign). He also supports doubling the dependent exemption. The only tax increase the campaign has mentioned is a vague reference to the elimination of oil company exemptions, a policy which is likely more political than economic. Overall McCain’s policies are consistent and for supporters of the supply-side paradigm, right on track. Obama’s plan also features a significant number of tax cuts although the focus is much more on middle to lower income tax payers. Like McCain, Obama supports extending Bush’s tax cuts for all but the top two tax brackets and supports permanent tax credits for R & D, although the credits are less generous than those proposed by McCain. Other cornerstone tax cuts or credits proposed by Obama are $500/$1,000 refundable tax credits for individuals/families based on payroll taxes paid, exempting seniors with incomes below $50,000 from paying taxes, a Universal Mortgage Credit to make it easier for families to claim interest payments, and other expansions of current programs. Obama has also advocated eliminating capital gains taxes for start-ups but has not clearly defined how this would be determined. To pay for the cuts there are tax increases as well. Along with the return to the higher rates for the top two tax brackets, Obama also supports increasing the rate on dividends and capital gains to 20% for those with incomes above $250,000, and a 45% top rate on estates above $7 million. Like McCain, Obama also makes vague political promises to eliminate tax loopholes for multi-national corporations and eliminate tax breaks for companies who send jobs overseas. By targeting his tax cuts and making many credits refundable Obama has shown that he plans to address the income inequality which he believes is a fundamental problem in the country. In their campaign rhetoric, Obama claims that he will cut taxes, while McCain’s campaign repeatedly states that Obama will raise taxes. On the surface it would appear that both of these claims cannot be true, but as in most political issues the answer of who is correct depends on your perspective and how you define the issue. Clearly the campaigns have differing views of what types of tax cuts should take place, but according to the Tax Policy Center, a nonpartisan group which has conducted an extensive analysis of both plans, both candidates would cut taxes overall, although McCain would cut them by a greater amount. Looking at the distribution of tax cuts however, Obama would cut taxes by a significantly larger amount for the bottom 80% of the income distribution (Burman et al. 2008). From the perspective of the vast majority of the population both candidates are tax cutters with Obama in the lead. On the other hand, where McCain would cut taxes for all income quintiles, Obama does raise taxes for the top quintile, and within the top quintile, particularly the top 1% of households 35 (Burman et al. 2008). From the perspective of the top earners, McCain’s claim about Obama is correct as well. Whose policy is better depends primarily on your economic ideology, and likely where you fall within the income distribution. Both candidates’ tax plans also make efforts to simplify the system. McCain has proposed an alternative system with only two tax rates and a generous standard deduction. People could pay taxes under the simplified system or opt to pay under the old system if they desired. McCain’s proposal rests on his belief that Americans do not mind paying taxes but dislike the complexity of the IRS code. In Obama’s plan we can see a bit of the behavioral economics ideology coming into play. Obama has proposed a policy where individuals with simple returns would receive a pre-filled tax form based on information the IRS already collects. Individuals could then simply verify and return the form to file their taxes. What makes the policy a “nudge” as defined above is that the current system is not altered in any way, nor is individual choice limited. Individuals are still subject to the same tax code as before, and importantly, individuals can choose to fill out their own forms if they wish. However, the default option will likely get more individuals to file their taxes and file their taxes correctly. Rather than completely reform the system like McCain’s policy would, Obama’s policy looks to frame behavior within the framework that already exists. Fiscal and Spending Policy The questions that naturally arise from the candidates’ tax cuts are: What will they do to the budget deficit? How do they intend to pay for them? In terms of a general fiscal stance both candidates have said that they will cut deficits even while cutting taxes, although McCain has taken a much stronger stance on the issue setting a 2013 date for a balanced budget. Obama has stated that his policies are self-funding and will cut into the deficit, but he has not given any specific dates for a balanced budget. Presumably if the budget is going to be balanced and taxes are to be cut, the difference must be made up by spending cuts. Each candidate has stated they intend to cut earmarks: McCain through line-veto power and Obama by publicly disclosing earmarks. McCain has also proposed a one year pause in discretionary spending to evaluate all programs, something which will likely be very difficult to accomplish. Obama’s centerpiece policies would put pay as you go rules into effect where any new spending or tax cuts would have to be paid from somewhere else in the budget. He also calls for competitive bidding for any contract above $25,000 to keep government accountable. Obama has also promised to cut “wasteful” spending, which for him likely includes spending in Iraq, while McCain has said that savings from victories in Iraq and Afghanistan would go directly towards cutting the budget. Unfortunately it is very difficult to definitively count on either of these areas as reliable spending cuts. Not surprisingly, numerous observers have questioned the ability of either candidate to meet their budgetary goals (Nicholas 7/8/08; Pear 7/8/08; Sasseen 8/7/08). Whether these doubts will hurt the candidates politically is unclear, although given McCain’s firm stance on balancing the budget doubts may raise greater skepticism by voters. 36 Mortgage Reform One issue which has been somewhat new to this election, given events over the past year, is mortgage reform. Both candidates have put forth policies to help with foreclosures as discussed previously, but the crisis has spurred the candidates to propose protections against future crises. Given the typical predilections of Democrats this would seem like an obvious time for direct government regulation of the industry, but Obama does not go this route. Instead the cornerstone of both campaigns is information. McCain calls for greater transparency and accountability although he does not outline how this would actually be implemented. Obama on the other hand has advocated creating something called a Homeowner Obligation Made Explicit (HOME) score to rate mortgages. The standardized HOME score would be mandated by the government, and would have to be reported on all mortgage materials. However, the proposal would not require companies to change the types of mortgages they offer as it is recognized that unconventional mortgages may be good choices for some consumers. The idea of the reform is simply that consumers when given better, more relevant information will make better mortgage decisions. Once again the policy is emblematic of a behavioral way of thinking. Rather than burden the industry with extensive, expensive regulation, government steps in only to frame the information in a better way. Consumers are pushed in the right direction by relevant information, but are still free to make poor choices. Given concerns about the financial health of Fannie Mae and Freddie Mac, it is likely that mortgage issues will be an important one for the next President. Health Care A final issue which has been very important in the election is health care. The debate has two areas of emphasis for both candidates: cost reduction and health insurance provision. In terms of cost reduction, both candidates advocate similar proposals. Both support reimportation of drugs, generic drugs (McCain through faster generic introduction and Obama through greater use), deployment of modern information technology, and greater transparency about treatment options, quality, and costs. The candidates take slightly different approaches to manage costs. McCain puts more emphasis on coordinated care as well as tort reform to protect doctors who follow clinical guidelines. Obama on the other hand takes a more interventionist approach by giving government the right to negotiate prices with drug companies and by forcing insurers to pay a portion of premiums for patient care. Much of the concern over health care inflation is over the accelerating cost of the Medicare program. As such, both candidates have made cost reduction an important part of their health plans. Turning to the health insurance provision side of the debate we see a greater divergence in tactics. Consistent with his economic ideology McCain focuses on competition and individual responsibility. A primary proposal is to allow greater competition in the market by allowing individuals to buy policies across state lines. McCain advocates competition to improve quality and variety as well, but he does not delineate any specific plans. Perhaps the greatest reform by McCain would be to alter 37 the tax treatment of health insurance premiums. McCain proposes removing the exclusion of employer-provided health insurance premiums from taxable income and instead give a $2,500 refundable tax credit per individual for premiums paid. Analysts have said that the $2,500 credit would initially be very generous particularly if the cost reduction efforts were successful, although whether it would maintain its generosity would depend on how the credit was indexed (Burman et al. 2008). The credit would also apply to insurance purchased outside of the job, giving people greater choices as well as helping alleviate the portability problems with health insurance. Obama’s program reflects his mixed economic ideology as well, combining government programs and mandates with the behavioral free choice approach. The primary focus of the plan is to create a national health plan which could be purchased by those who wished to do so, and to create a National Health Insurance Exchange (NHIE) which would help individuals buy private health plans by evaluating plans and regulating their quality and premiums. Obama’s plan would also mandate coverage for children and forces employers with no meaningful coverage to pay into the NHIE. Despite the government intervention Obama does keep a behavioral nuance to the program by not mandating adults to buy coverage for themselves. Once again the logic is that if costs are reduced and information about plans is available, individuals will tend to make the appropriate choice and sign up for insurance. The proposal would also in theory improve the variety of choices for individuals and would help with portability issues, but critics have argued that the government portion of the program would still be too expensive if costs did not actually go down as suggested. As with the mortgage reform issue, grave financial issues within the Medicare system are sure to make health care reform an important topic for many years to come. The effectiveness of the cost reduction policies put into place by the winner will go a long way towards determining what type of health care system we will see in the future. CONCLUSION While the above analysis is by no means a comprehensive list of all issues I believe that they represent the most interesting examples of their economic ideologies. I have left out other issues such as labor law reform, Social Security, and free trade, not because they are unimportant, but because the candidates have generally toed the party line on these issues. Likewise I have left out the candidates’ long term energy policies because it is very unclear how much of them are actual reforms and how much are purely political campaign promises. What should be said is that both candidates are trying to paint clean and alternative energy reforms as job growth machines. The spin on the energy issue displays the candidates’ efforts to combine the two most important issues for many voters. Overall the analysis suggests that McCain has stayed true to the recent supply-side leanings of the Republicans which he has been able to clearly convey to voters, while Obama has struggled somewhat to communicate his nuanced approach to voters and even other Democrats. Whether either economic platform will actually be successful in 38 terms of the short or long run I leave to other analysts to determine. Part of the difficulty in any analysis of the plans is that there is no way of knowing which reforms would actually be successfully implemented, particularly for McCain who would likely face Democratic majorities in the House and Senate. What can be said is whoever wins the Presidency this November will face daunting challenges in the economy and must be prepared to work with the other party to achieve solutions to very serious problems. 39 References “Barack Obama’s Emergency Economic Plan”. 2008. http://www.barackobama.com/2008/08/01/senator_barack_obama_announces. php. “Barack Obama’s Plan for a Healthy America”. 2008. http://www.barackobama.com/pdf/issues/HealthCareFullPlan.pdf. “Barack Obama’s Plan for Restoring Fiscal Discipline”. 2008. http://www.barackobama.com/pdf/issues/fiscal/ObamaPolicy_Fiscal.pdf. Burman, Len, Surachai Khitatrakun, Greg Leiserson, Jeff Rohaly, Eric Toder, and Bob Williams. 2008. “An Updated Analysis of the 2008 Presidential Candidates’ Tax Plans: Revised August 15, 2008”. Tax Policy Center Report. Cassidy, John. 2008. “Economics: Which Way for Obama?”. The New York Review of Books. Vol. 55(10): June 12, 2008. Cooper, Michael and Dalia Sussman. 2008. “Voters in Poll Want Priority to Be Economy, Their Top Issue”. The New York Times. August 21, 2008. “Jobs for America: The McCain Economic Plan”. 2008. http://www.johnmccain.com/Issues/jobsforamerica/ “Keeping America’s Promise: Strengthening the Middle Class”. 2008. http://www.barackobama.com/pdf/issues/economy/Obama_Keeping_Americas_ Promise.pdf. Leonhardt, David. 2008. “How Obama Reconciles Dueling Views on Economy”. The New York Times Magazine. August 24, 2008. Nicholas, Peter. 2008. “Adding up the Cost of Obama’s Agenda”. The Los Angeles Times. July 8, 2008. Pear, Robert. 2008. “Skepticism on McCain Plan to Balance Budget by 2013”. The New York Times. July 8, 2008. Sahadi, Jeanne. 2008. “McCain Outlines Plan for Economy”. http://money.cnn.com/2008/04/10/news/economy/mccain_econ_plan/index.htm. Sasseen, Jane. 2008. “Why Their Economic Plans Don’t Add Up”. Business Week. August 7, 2008. Zenilman, Avi. 2008. “McCain’s Camp Suffers from a Paper Gap”. http://www.politico.com/news/stories/0708/12215.html. 40 Table 1: Candidate Economic Programs McCain Immediate Economic Stimulus Obama Gas and Food prices: - - - Gas prices: Suspend 18.4 cent per gallon federal gas tax and 24.4 cent per gallon diesel tax Repeal 54 cent per gallon tax on imported sugar-based ethanol Roll back corn-based ethanol mandates - Foreclosure Assistance: - Foreclosure Assistance: - HOME plan for eligible homeowners to trade subprime mortgage for 30 year fixed rate mortgage - - Cuts and Credits: - - - $10 billion fund to help homeowners renegotiate their loans possibly through public agencies Spending: - Tax Policy Energy rebate of $500 per individual paid for by tax on windfall profits of oil companies ($1,000 per family)1 $25 billion to State Growth Funds to offset state budget cuts for services1 $25 billion to Jobs and Growth Fund to offset state cuts in infrastructure and school repairs1 Extended and expanded Unemployment Insurance benefits Cuts and Credits: Extend Bush tax cuts on personal income and keep 15% tax rate on dividends and capital gains Cut top corporate tax rate from 35% to 25% Phase out Alternative Minimum Tax Double personal exemption for dependents from $3,500 to $7,000 Reduce estate tax to 15% with $10 million exemption Permanent credit for 10% of wages spent on R & D 41 - - - - - Extend Bush tax cuts on personal income for all but top two brackets2 $500/$1000 refundable tax credit offsetting payroll taxes for individuals/families Expand and make refundable Child and Dependent Care Tax Credit Exempt seniors making less than $50,000 from income taxes Make R & D credit permanent Universal Mortgage Credit of 10% of interest (up to $800) Table 1 (cont.): Candidate Economic Programs McCain Tax Policy (cont.) Cuts and Credits (cont.): - Obama Cuts and Credits (cont.): First year expensing of equipment and technology investments - Eliminate capital gains taxes for start-ups Expand Earned Income Tax Credit Increases: - Elimination of oil company exemptions2 Simplifications: - Increases: - Simplified, optional alternative system with generous standard deduction and two rates - - Restore top personal tax rates to 36% and 39.6%2 Restore 45% estate tax rate for estates over $7 million2 Increase rates on dividends and capitals gains to 20% for incomes above $250,0002 Eliminate tax loopholes for multi-nationals End tax breaks for companies that send jobs overseas Simplifications: - Fiscal and Spending Policy Overall Fiscal Policy: - Pre-filled forms from IRS for simple filings that can be verified and returned Overall Fiscal Policy: Balance budget by 2013 - Deficit reduction without specific dates Spending Plans: - One year discretionary spending pause for review Eliminate earmarks with lineitem veto Reserve savings from victory in Iraq and Afghanistan for deficit reduction Spending Plans3: - - 42 PAYGO rules enforced Eliminate earmarks through public disclosure Make government more accountable by bidding out contracts over $25,000 Cut “wasteful” spending Table 1 (cont.): Candidate Economic Programs McCain Mortgage Reform Mortgage Reform: - Health Care Mortgage Reform Promote greater transparency and accountability Department of Justice task force to investigate fraud4 Cost Reduction: - Obama - - Mandated standardized Homeowner Obligation Made Explicit score to rate mortgages STOP FRAUD Act to fight mortgage fraud Cost Reduction: Reimportation of drugs Faster generic introduction Coordinated care Deployment of information technology Tort reform to protect doctors who follow clinical guidelines Transparency about treatment options, quality, and costs - Reimportation of drugs Increased use of generics Government right to negotiate with drug companies Force insurers to pay portion of premiums for patient care Deployment of information technology Transparency about treatment options, quality, and costs Health Insurance: - - Lower prices through competition and ability to purchase insurance across state lines Establish refundable tax credit of $2,500 per individual for insurance and include employer sponsored health insurance premiums as taxable income Health Insurance: - - Mandate coverage for children Establish national health plan for those who wish to purchase Establish National Health Insurance Exchange to help individuals buy private plans Employers with no meaningful coverage must contribute to NHIE5 Note: All information for McCain was taken from: “Jobs for America: The McCain Economic Plan” and all information for Obama was taken from: “Keeping America’s Promise: Strengthening the Middle Class” except where noted. 1 “Barack Obama’s Emergency Economic Plan” 2008 2 Burman et al. 2008 3 “Barack Obama’s Plan for Restoring Fiscal Discipline” 2008 4 Sahadi 2008 5 “Barack Obama’s Plan for a Healthy America” 2008 43