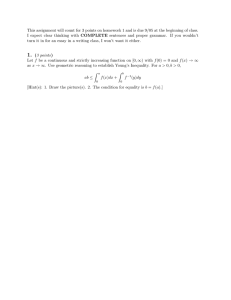

Economic Indicators Report conmic Research Bureau Central Wisconsin E First Quarter 2013:

advertisement