University of North Carolina at Greensboro Department of Accounting and Finance

advertisement

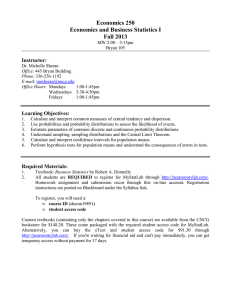

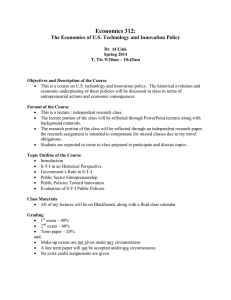

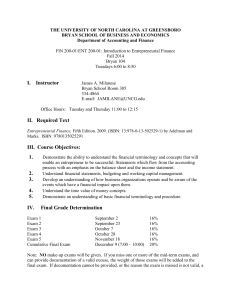

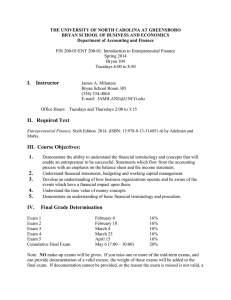

University of North Carolina at Greensboro Bryan School of Business and Economics Department of Accounting and Finance Spring 2016 ACC 600: Professional Accounting Research (3 credit hours) Tuesdays and Thursdays 3:30pm -4:45pm; Bryan 205 INSTRUCTORS: FINANCIAL Dr. Venkat Iyer, Ph.D., CPA Office: 335 Bryan Building Phone: 256-0187 Email: vmiyer@uncg.edu (best way to contact me) Office Hours: Tuesdays/Thursdays 12:30 – 2:00 pm or by appointment TAX Mr. Samuel M. Moore Office: 387 Bryan Building Phone: 334-5690 (no voice mail) Email: smmoore@uncg.edu (best way to contact me) Office Hours: By appointment PREREQUISITE: ACC 420, Federal Tax Concepts or equivalent. COURSE OBJECTIVES: 1. To develop and enhance your skills in identifying tax questions and planning opportunities; in locating and using tax authority to respond to these questions and plans; and in using the law to prepare a response to a question or to formulate a planning strategy. 2. To develop and enhance your skills in identifying financial research issues; in locating and using financial accounting authority to address the issues; and in using the authority to prepare a response to a question or to formulate a suggested solution. 3. Expand your communication skills, especially written. 4. Provide an environment in which you can a. Learn to analyze facts, distinguish relevant information from irrelevant, recognize and state the issues, and reduce the rules to succinct statements. b. Develop reasoning skills, planning skills, and synthesis skills. REQUIRED MATERIALS: Tax Textbook: Prentice Hall’s Federal Taxation 2015 Comprehensive, by Pope, Anderson, and Kramer (many of you already have a copy - earlier editions are acceptable – you will also use it for ACC 655 and 656 - ACC 600 uses 2 chapters and an appendix.) Financial Textbook: Skills for Accounting and Auditing Research. 2014 by Shelby Collins. Cambridge Publishers. ISBN: 978-1-61853-074-5 Laptop that can be connected to Network: We will be connecting to various databases and completing assignments in class. You will need to bring a laptop to class. It is also recommended to have access to an intermediate financial accounting text. ACC 600 Syllabus, Page 1 of 5 You will also find Wall Street Journal, Business Week, and other similar news sources useful. ELECTRONIC RESOURCES: Please note that the course materials will be available on Canvas. You are responsible for checking this site for announcements, readings, power point slides, and other materials relevant to the course. You are also expected to check your UNCG email regularly. We will use a number of electronic resources for this course. Access information and external links will be provided when necessary in Canvas. For tax research, we will access resources including CCH Tax Research, RIA Checkpoint, LexisNexis Academic and the IRS. For financial research, we will access resources including FASB Accounting Standards Codification, IFRSs, and the SEC Edgar database. GRADING: Grading Scale A = 93-100 A- = 90-92 B+ = 88-89 B = 83-87 B- = 80-82 C+ = 78-79 C = 70-77 F = Below 70 Grade Composition FINANCIAL: 50% of Total Grade Homework and in-class assignments – 12.5% Research & Writing Assignments – 12.5% Group Research & Writing Assignment w/Presentation – 12.5% Final Exam – 12.5% TAX: 50% of Total Grade The grade for tax will be composed of an average of Research & Writing Assignments and Examinations. The number and time of these components will be announced. Please note that we will combine financial and tax grades to arrive at the final class grade. ACADEMIC INTEGRITY: Students are expected to abide by the UNCG Academic Integrity Policy. All examinations are expected to be done honestly and by your own efforts. For all written homework and assignments, students need to be careful to avoid plagiarism and to cite references. The UNCG ACC 600 Syllabus, Page 2 of 5 Academic Integrity Policy can be found at http://sa.uncg.edu/handbook/academic-integritypolicy/. EXAMS and QUIZZES: Exams and quizzes may be a combination of multiple choice, fill-in-the-blank, short answer, and essay questions. Make-up quizzes will not be given. One excused quiz is allowed in determining the student’s quiz average. The weight of any missed quiz will be attributed to the other quizzes. More than one missed quiz will result in a grade of 0 for that and any subsequently missed quiz. Make-up exams other than the final exam will only be given if the instructor is notified before the scheduled exam time and the instructor accepts the reason for the make-up exam as valid. HOMEWORK: Homework will be assigned 5-7 days prior to the due date. It will be posted on Canvas and explained in class. RESEARCH & WRITING ASSIGNMENTS: These assignments will be longer than the homework and you will generally have at least a week to complete an assignment. Some of the assignments are completed in two parts. LATE ASSIGNMENTS: Late assignments will not be accepted. WRITING: This course is writing intensive. A portion of your grade will be based on how well written your work is including: spelling, grammar, word usage, and writing style. If you need assistance with your writing, make use of the Writing Center located at 3211 MHRA Building. For more information please visit http://www.uncg.edu/eng/writingcenter/. If you use the Writing Center, please inform them of the class and instructor for notification purposes. SPEAKING: This course includes class discussions and a formal presentation. If you need assistance with your speaking and presentation skills, make use of the Speaking Center located at 3211 MHRA Building. For more information please visit http://speakingcenter.uncg.edu. If you use the Speaking Center, please inform them of the class and instructor for notification purposes. STUDENT RESPONSIBILITIES: Students are expected and required to be prepared for every class. Students are responsible for all assigned readings and other materials assigned without regard to whether the material is mentioned or covered in class. For all Bryan School expectations please visit: http://bae.uncg.edu/assets/faculty_student_guidelines.pdf Disruptive Behavior in the Classroom: Please familiarize with the disruptive behavior policy which is available on‐line at http://sa.uncg.edu/handbook/policies/. It states that “The instructor may withdraw a student from a course for behavior that is deemed by the instructor to be disruptive to the class. The grade assigned will be “W” if the behavior occurs ACC 600 Syllabus, Page 3 of 5 before the deadline for dropping a course without academic penalty, and the instructor has the option of giving a “W” or a “WF” if the behavior occurs after the deadline.” Adverse Weather: The University of North Carolina at Greensboro will remain open during adverse weather conditions unless an administrative decision on changing work and class schedules is made by the Chancellor. Students can receive details on the UNCG home page (www.uncg.edu), or by dialing three campus telephone numbers: Adverse Weather Line (336334-4400); Campus Switchboard (336-334-5000); and University Police (336-334-5963). Important Dates: Please refer to http://www.uncg.edu/reg/Calendar/acaCal/sp16.html for important dates. TENTATIVE SCHEDULE The Topics appearing below do not indicate nor represent class periods nor meeting dates nor order of presentation. The Topic designations are primarily and essentially for convenience of reference and identification. A particular Topic designation may extend over more than one class period; more than one Topic designation may be covered and considered at one class meeting date. All Topics and Readings will be announced in advance of the time of requirement. FINANCIAL Tentative Schedule TIME SENSITIVE CLASSES: Tuesday, January 12 Tuesday, February 23 Thursday, February 25 Tuesday, March 1 FIRST CLASS – Financial Research Group Presentations Group Presentations Final Exam for financial Topics: Authoritative Financial Sources & History Research Process Codification of US GAAP International Financial Reporting Standards FASB and International Convergence Audit and Professional Services Research SEC Reporting NOTE: A detailed schedule will be posted on Canvas. ACC 600 Syllabus, Page 4 of 5 TAX Tentative Schedule Thursday, March 3 TBA Thursday, April 21 Tuesday, May 3 FIRST TAX CLASS CCH & RIA Last Tax Class 3:30 pm Final Exam Topics: Introduction to Professional Tax Research Computerized Tax Research Constitutional Sources of Federal Tax Law Legislative Sources of Federal Tax Law Administrative Sources of Federal Tax Law Judicial Sources of Federal Tax Law Executive Sources of Federal Tax Law Working with the IRS 1) Administrative Aspects of Tax Practice 2) Appeals Process --- Administrative 3) Appeals Process --- Judicial 4) Federal Tax Assessment and Federal Tax Lien Rules, Sanctions, Agreements, and Disclosures Tax Planning NOTE: Please refer to the Tax Research Functional Assignments posted in Canvas for further details. ACC 600 Syllabus, Page 5 of 5