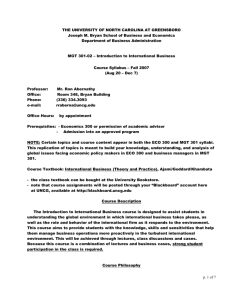

University of North Carolina at Greensboro Department of Accounting and Finance

advertisement

University of North Carolina at Greensboro Bryan School of Business and Economics Department of Accounting and Finance ACC 420: Federal Tax Concepts - Syllabus for FALL 2015 T / R 12:30 - 1:45PM in Bryan 105 T / R 3:30 – 4:45pm in Bryan 111 Instructor Office Location *Office Hours Office Phone Email Tutoring Hours Last updated Dr. Jenna Meints Bryan 339 Tuesdays and Thursdays, 9:30AM – 10AM and 1:30 - 2PM; appointment. *Changes posted to Canvas and/or announced in class 336-334-5647 jmmeints@uncg.edu TBD. In Bryan 335. July 26, 2015 Prerequisite ACC 318, Intermediate Accounting I, or equivalent, with a grade of C or better Course Description The goal of this course is for you to be able to recognize and to analyze issues that carry tax implications for individual taxpayers. This course will cover technical details of various tax laws. You will utilize tax research resources. You will prepare at least one individual federal income tax return with tax software. You will present tax information to your class colleagues. Course Objectives By the end of the course, you should be able to identify the tax reporting implications of the following issues. 1. Filing status, standard deduction, personal exemptions, dependency exemptions, filing the return, tax rates, tax rate tables/schedules, and tax rate computation. 2. Definition of gross income, year of inclusion, income sources, items specifically included in gross income. 3. Items specifically excluded from Gross Income. 4. Classification of deductible expenses, timing of expense recognition, and disallowance possibilities. 5. Personal casualty gains and losses, personal thefts. 6. MACRS depreciation, ACRS, amortization, and concepts relating to depreciation. 7. Transportation expenses, moving expenses, education expenses, entertainment and meal expenses, other employee expenses, self-employed expenses, retirement plan contributions, accountability of the reimbursement plan, and the 2% floor on certain itemized deductions. 8. General classification of expenses, medical expenses, taxes, interest, charitable contributions, and miscellaneous itemized deductions. 9. Tax policy considerations, individual tax credits, specific business-related tax credits, other tax credits, and tax payments. Fall 2015 ACC 420 Syllabus for Meints, page 1 10. Passive, Active, and Portfolio Income. 11. Determination of gains or losses, basis considerations, concepts of nontaxable exchanges, like-kind exchanges, involuntary conversions, personal residence sale, and other nonrecognition provisions. 12. Rationale behind separate reporting of capital gains and losses, capital assets, sales/exchanges, capital gains and losses tax treatment. 13. Individual AMT. 14. Current topics and issues. In addition, you should be able to … 1. …utilize tax software to complete tax returns. 2. …utilize tax research resources. 3. …identify tax issues in the media. 4. …prepare and deliver an oral presentation. Textbook and Required Course Materials TEXTBOOK: Prentice Hall's Federal Taxation 2016 Comprehensive. By Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson. Published by Prentice Hall. Copyright © 2016. Published Date: Apr 6, 2015. ISBN-10: 0-13-410437-4. ISBN-13: 978-0-13-410437-9. - See announcement posted to Canvas in June 2015 SOFTWARE: H&R Block Premium (Home, not Business) 2015 Edition (for all taxpayers). Or, 2016 Cengage Learning Tax Media Pack (for students). - See announcement posted to Canvas in June 2015 INTERACTIVE CLASSROOM TOOL: i>clicker2: ISBN: 1429280476. - See announcement posted to Canvas in June 2015 Bring a calculator, your i>clicker2, and any relevant handouts from Canvas and/or from me with you to each class. If you miss a class, then it is your responsibility to get materials and information from another student. You are encouraged to bring your textbook to class. Course Website https://canvas.uncg.edu Fall 2015 ACC 420 Syllabus for Meints, page 2 Course Grading Your final course grade will be determined as follows: Group Work: Practice Exam 1 Exam 1 Group Work: Practice Exam 2 Exam 2 Group Work: Practice Exam 3 Exam 3 Tax Return 1 Presentation i-Clicker responses to presentations Class Participation Tax Return 2 Total Possible 2% Thurs Sep 10 – in class 18% Tues Sep 15 – in class 2% Thurs Oct 1 – in class 18% Tues Oct 6 – in class 2% Tues Nov 3 – in class 18% Thurs Nov 5 – in class 15% Mon, Nov 16 by 12PM 15% As assigned 5% All presentation dates 5% Every class 1%- 3% extra credit added to final grade; 11/16 by 12P 100% (103% with XC) Rough grading distribution A / A- , 93% / 90%; B+ / B / B- , 88% / 83% / 80%; C+ / C / C- , 78% / 73% / 70%; D , 65% Participation Your participation grade will be based on your contributions to class. Please note that attendance alone does not equal contribution. Attendance is a critical precursor to active and fruitful contributions. If you have three absences from class, then you automatically will receive a grade of failure (F) and you cannot attend any class sessions or receive class materials after that point. Likewise, you are allowed to be late to class twice. A third tardy will result in the same treatment as three absences. I expect you to read relevant materials before class, speak up in the majority of class sessions, participate in group discussions and activities, bring tax-related topics to share with the class, follow along and help with in-class exercises, and be an active contributor in class in every sense. Excellent participation also means that your comments are thoughtful, focused, and respectful. Points will be deducted from the base score of 100% if you miss class, are late, leave early, disappear for long periods on break, or do not follow the contribution guidelines above for any reason. Please turn off cell phones during class and limit your computer use to note taking or looking up information only when required by class activities. The development of a supportive learning environment is fostered by respectfully listening to the ideas of others, being able to understand and appreciate a point of view which is different from your own, clearly articulating your point of view, and linking experience to readings and assignments. We will cover a great deal of information in each class. If you will not be able to attend a class, then let me know as soon as possible. It is your responsibility to obtain all information/content from your classmates. As part of your participation grade, you should e-mail me a digital photo of yourself (or something that has meaning for you) as an attachment to the e-mail message with a brief introduction of yourself by the start of Class #2. At least, tell me your name, your year in school, your past experience with taxes (academic, professional, and/or personal), your professional interests, and something unique about you that will help me remember who you are. Fall 2015 ACC 420 Syllabus for Meints, page 3 If you plan to miss a class, then you may attend the respective class taught for the other section of ACC 420. This said, you will be responsible for the materials covered during the classes of your assigned section. You must take exams and attend presentations at your assigned section times. Homework and In-class Exercises There is no graded homework required for this course. That said, during some class periods we will do (ungraded) in-class exercises together that illustrate various parts of the federal income tax law. These exercises will be technical, textbook-related problem sets as well as questions that are meant to solidify your understanding of broad tax issues. The exercises will be posted to Canvas ahead of each relevant class time for you to print out, if you so choose. I will not provide physical handouts in class, nor will I circulate or post the solutions to the in-class exercises after class. It is your responsibility to be present and attentive for each class and/or to contact a classmate who can provide you with the information and materials that you missed. Your quizzes and exams will be based in large part on the concepts and topics covered in these exercises. Exam Policies You must take each exam to pass this course. Makeup exams are not allowed. Exams are multiple choice, closed book, proctored, and no notes are allowed. Each exam will list taxpayer scenarios in which you need to identify the issues that carry tax implications. You will be given a description of several events in the life of a Taxpayer. You must then indicate which events carry which tax implications. For example, a tax issue that carries tax implications is the possible taxation of some social security benefits received by certain taxpayers, or the ability of a taxpayer to claim one’s daughter as a qualifying child and thus claim a dependency exemption. Other multiple choice questions will test facts, concepts, ideas, and issues that have been covered in the course textbook, class discussions, and all materials referenced in class. Exam 2 will focus on coverage from classes only after Exam 1. This said, the system of individual taxation builds upon itself in complexity. You will need to master the basics covered by Exam 1 to master the content tested on Exam 2. Likewise, Exam 3 will focus on content since Exam 2. You will need to use skills learned prior to Exam 2 to be successful on Exam 3. All exams should be completed on your own. If your cell phone makes any noise during an Exam, then your Exam will be collected at that time and you will leave the testing area. You will not be allowed to continue working on the Exam. Once exams have been distributed, you may not leave the classroom at any time before submitting your exam. If you leave the classroom, then your testing time ends at that point regardless of the amount of the test that you actually have finished then. On any exam, if you do not receive credit for a question for which you have valid supporting evidence/logic for your response, then you may e-mail me a brief description of what you answered and why. I will read this description and determine whether you will be awarded credit for the question. You are fully empowered to think critically and form logical, reasonable conclusions from respectable resources provided for the class. Fall 2015 ACC 420 Syllabus for Meints, page 4 Tax Return Project Toward the middle of the semester, you will be given information about two taxpayer scenarios. You will be required to utilize the most recent edition of H&R Block Premium edition home software for Individuals to complete the first of these tax returns. The second return can be done for up to 3% of extra credit added directly to your final course grade. You must complete these tax returns on your own. I will provide a light introduction to the software in class as well as cover tips for preparing the return. It is critical that you attend this class to get that information. If you miss the class, then plan in advance to have a colleague take excruciatingly detailed notes for you. I will not cover the tips again with any student after that class session. I expect you largely to navigate this software on your own. You will be prompted by the software program to answer a series of questions and input information from the scenarios that you will be given. Any prompt that you encounter for which you have no information given in the scenario means that the issue being brought up by that prompt is not relevant for your taxpayer’s return. Learning new software feels awkward and uncomfortable at first. This is the classic learning curve of any new technology that you encounter in life. I encourage you to push through the initial discomfort. You may be surprised at how quickly it all starts to “make sense” if you just keep working through the software’s natural progression of questions and prompts. I expect that you will have questions about the tax scenario itself and completing the respective tax return with the H&R Block software. It is up to you to plan in advance to meet with my teaching assistant about those questions. I suggest that you write down a list of questions that arise for you from initially reading through the problem, and then go talk with my teaching assistant about those questions during the assistant’s open tutoring hours. I suggest that you then attempt the entire tax return with H&R software. I cannot underemphasize the fact that you need to attempt the entire tax return before going to the TA for help. The software prompts you for various information at various points in the process. You will not know where to report everything unless you work through the entire process of creating a return with the software. I suggest that you then budget time for a second short meeting with my assistant after completing the full return with the H&R software so that you and that assistant can clear up any small issues that may arise for you with the software. You almost undoubtedly will have small technical questions. These will be frustrating. I apologize for this. Every software package has bugs and blips. I suggest that if you are stuck on one or two items for the tax return, then simply complete the rest of the return and have the assistant help you with that one (or two) item(s). No single item is worth you spending hours on it. I cannot overemphasize the fact that this is not a Night Before It Is Due project. Plan ahead. You have the information necessary to acquire the tax return software on Day One of class. There is no reason that you cannot become familiar with it before receiving the specific taxpayer information for this assignment. Keep in mind that if you wait until the last minute to bring your questions to my assistant, then you most likely will be competing with many other students for those minutes. Again, plan ahead and start the project well before it is due. By Monday, November 16 at 12PM, you should turn in a physical copy of IRS Form 1040 pages one and two, and any relevant Schedules A-E for the required tax return. These must be produced with the most recent edition of H&R Block Premium edition home software for Individuals required for the course. You must also e-mail me a PDF file of all Forms, Schedules, and Worksheets by the same time. You should put your completed tax return in the manila envelope (provided for you in class). Seal the envelope. Sign across the seal, such that opening Fall 2015 ACC 420 Syllabus for Meints, page 5 the envelope would break through your signature. Turn this in to me or slide this under my office door by the deadline. Early submissions are fine. Late returns will not be accepted. Extra credit returns are due at the same time and in the same manner as the regular tax returns. Please note that I have gone out of my way to make my teaching assistant available to only ACC 420 students throughout the semester for approximately eight hours per week. Take advantage of this wonderful resource, especially with respect to the tax return. Tax Topic Presentation You will be required to make a five minute oral presentation on a tax topic of your choice. There is a detailed grading rubric for this presentation at the end of this syllabus, as well as a more detailed description of relevant deadlines and actions of which one needs to be aware. You can choose a broad or narrow topic. I highly suggest choosing a topic that has *not* been covered at all in class. The point of this assignment is for you to present a tax issue for which you have some passion, personal interest, and/or a strong opinion. This project is structured to be flexible, open-ended, individualized, creative, original, and engaging. Each of you has the option to present a topic on your own or with up to three other classmates. If you decide to present with someone else, then each student in that group needs to e-mail me confirmation of the partner(s) by the beginning of class start time on Tuesday, September 1, 2015. Students who decide to present in pairs will be responsible for eight minutes of content, trios for twelve minutes, and quadruples for sixteen minutes. Individual presenters will be responsible for five minutes of content. The deadlines and processes remain the same for both groups and individuals. If you decide to present in a group, be careful of the partners you choose. It is up to you to ensure that your group works altogether effectively, fairly, and timely. Some questions that may direct your thinking about a topic may include… What aspects of the tax law seem unfair to you? Who benefits and who loses from certain provisions? How have certain tax law cases been decided in the favor of a party? How do certain aspects of the tax administration system and its enforcement function (well or not)? What frustrates you and/or what seems to make sense to you about certain individual tax laws? Which human behaviors are taxed as sins and which human behaviors are rewarded as good? Who determines these societal rights and wrongs? Who defines what you can and cannot do with income? (How) Is a rent on profits in the best interest of society / a party? What tax issues and events have been highlighted in the media? What are some recent tax-related scandals? Tax Presentation Deadlines Summary of Dates: (1) Two weeks prior to presentation: Topic due via e-mail with short descriptions of each Tax Court case and each media source that you plan to use. (2) Three nights before presentation: Complete presentation file is due via e-mail. (3) 8AM on your presentation date: Final presentation file(s) reflecting relevant feedback and due via e-mail. Fall 2015 ACC 420 Syllabus for Meints, page 6 (1) You must clear your topic with me at least two weeks before your presentation. This is the most time consuming process of this project. I encourage early submissions. When you identify your topic and clear it with me, you should be able to tell me what two Tax Court cases you plan to use, including an overview of each. You must also identify what media coverage you plan to use. In essence, you must do the research for your presentation before you can lock in a topic. You are encouraged to check in with me during that planning process to see if your topic will be possible before you do the extensive research leading up to your final topic selection. For example, send me an e-mail long before the topic deadline and before spending much time researching a topic asking me if someone else already claimed three topics of interest to you. List at least three topics of interest. I will respond about which ones are available. First come, first serve.) Presentations lasting 45 seconds more or less than allowed time will automatically be docked a certain percentage based on the length of the actual presentation. Students are allowed to ask questions throughout your presentation, which count toward the five minute limit. Afterward, there will be an additional two minute Q&A period that is allowed, ungraded, and separate from the five minute limit. You then are required to present three i-clicker questions to the class. Two questions should test the students on something(s) that you covered in your presentation. The other question should poll the students about their opinion or behavior related (or not) to something in your presentation. If an individual presenter presents, handles a full two minutes of Q&A, and then covers i-clicker questions, this student will be in front of the classroom for nine or ten minutes. Group times will be adjusted accordingly. (2) You must e-mail me a complete version of whatever presentation files you plan to use in your class presentation by 11:59PM three nights before you are scheduled to present. I encourage early submissions. This includes i-clicker questions that you plan to ask and all appropriate citations. The file *must* be submitted complete and on time for you to receive feedback from me. I will review your work and then send you detailed feedback, with time for you to make any respective changes before presenting to the class. (3) You must e-mail me the final version of any electronic files that you plan to use in your presentation by 8AM on the day of your presentation. Files sent (or not sent) after 8AM on your presentation date will be ignored. Here is an example of how the two latter deadlines work. Say you are scheduled to present on Wednesday, April 30. Your files are due to me via e-mail by 11:59PM Sunday, April 27. I will respond to you by the end of April 29. You need to be able to update your file with any suggestions that I make in the review process before your presentation on the 30th. You must send me the final version of whatever electronic files you plan to use on the 30th by 8AM on the 30th. I will have them ready for you in class on the 30th. Here is another example of how the two latter deadlines work. Say you are scheduled to present on Monday, April 28. Your files are due to me via e-mail by 11:59PM Friday, April 25. I will respond to you by the end of April 27. You need to be able to update your file with any suggestions that I make during the review process before your presentation on the 28th. You must send me the final version of whatever electronic files you plan to use on the 28th by 8AM on the 28th. I will have them ready for you in class on the 28th. Please keep in mind that no late assignments are accepted in this course. Thus, if you miss even one deadline of the three deadlines for the tax presentation, then you miss out Fall 2015 ACC 420 Syllabus for Meints, page 7 on the opportunity to present altogether and you miss out on all credit for the presentation. No exceptions. To make sure that expectations are abundantly clear to each student, I have outlined key deadlines for each presentation date in the day-to-day schedule located here. Extra Resources (1) Past Homework Assignments and Keys are posted to Canvas. (2) Past Textbook Resources and Powerpoints are posted to Canvas. (3) Podcasts available through iTunes: Tax Accounting: (a) Novogradac Tax Credit Tuesday Podcast. Novogradac & Company LLP’s audio broadcast offers an in-depth weekly look at tax credit topics. A new podcast is posted by 1PM Pacific Time every Tuesday. (b) Federal Tax Update Podcast The Ohio Society of CPAs. A new podcast is posted every Monday. (c) FICPA: Federal Tax Updates The Florida Institute of CPAs. Podcasts posted one to three times per month. (d) KPMG’s This Week in State Tax (TWIST) A tool from KPMG’s State and Local Tax practice to help keep you up to date on the latest in state and local tax. TWIST features a series of short podcasts hosted by our Washington National professionals who will cover state and local tax developments dating from the previous week. If interesting, then International and General Accounting: (a) Advice Worth Keeping A podcast series featuring Stan Lepaek, Director of Global Research in KPMG’s Management Consulting group, in conversation with subject matter experts, industry leaders, and eminent researchers who are at the front line of efforts to drive evolutionary and revolutionary changes in the way organizations are structured and operate globally. (b) Accounting Best Practices with Steve Bragg Discussions about accounting management, best practices, controls, throughput accounting, and GAAP for the accountant, controller, or CFO. (c) CPA Exam Preparation Podcast (d) Deloitte IFRS (e) Deloitte Global Insights (f) International Accounting Standards Board: Developments in IFRS (g) IFAC Accountancy Podcast – International Federation of Accountants Fall 2015 ACC 420 Syllabus for Meints, page 8 The following presentation rubric is only representative of how presentation grades will be determined and what is expected of each student. One does not necessarily need to meet all conditions specified in each box to earn that level of credit. Again, this is only a guide for what one can expect and for what one should accomplish with one’s presentation. The key things that matter for the presentation are (1) the creativity and (2) planning that go behind the student’s topic choice, (3) meeting all deadlines with complete files at each step, (4) quality of legal research, (5) quality and quantity of respectable authoritative research, (6) research on what is happening in the media, (7) appropriate legal citations, and (8) an appropriately MLA or APA formatted Works Cited. Topic Choice (Critical) Legal research (~30%) Media coverage (~15%) Excellent Average Minimal Has personal interest in the topic. States an opinion about the tax matter. Encourages students to think about the tax issue from multiple perspectives. Creative and original topic. Meets all deadlines. The topic is directly from the textbook and/or has been covered in class, but expands on and does not duplicate class coverage. Has personal interest in the topic. Meets all deadlines. The topic is directly from the textbook and/or has been covered in class. The topic coverage is primarily what has been covered during class time already. Includes coverage of at least two Tax Court cases. Includes coverage of at least two recent and relevant events and activities captured by the news media. These may be journal articles, newspaper articles, radio interviews, market coverage, company publications, or similar valid and reputable media sources. These may not cover any part of your Tax Court cases. Includes coverage of one Tax Court case decision and one legal case, decision, or activity. Includes coverage of one recent and relevant event or activity captured by the news media. This may be from journal articles, newspaper articles, radio interviews, market coverage, company publications, or similar valid and reputable media sources. These may not cover any part of your Tax Court cases. Fall 2015 ACC 420 Syllabus for Meints, page 9 References two legal sources but does not cite them appropriately nor explain their merits. Perhaps little or no legal research coverage. References only historical events, Tax Court case information, and/or no media coverage. Content (15%) References, Citations, and Formatting (25%) Other factors (15%) Excellent Good Minimal Information is complete, up to date, valid, from respectable outlets, and correct. At least 5 sources of information are referenced. Information is from respectable outlets. One or two pieces may be out of date with current practice and events. Most information is from respectable outlets, but out of date, not relevant, or otherwise not helpful. Tax Court cases are properly cited, per Chapter C1. References slide conforms to MLA or APA formatting. Properly cites and references all sources (min = 5). Some issues with references and citations. Clarity, organization, timing, logic, length, i-clicker questions, general effectiveness of presentation information, and issues addressed during feedback. Fall 2015 ACC 420 Syllabus for Meints, page 10 Minimal proper references/citations. Course Feedback Informally, I welcome constructive criticism at any time about the course, specific assignments, my role as your instructor, topical coverage, or about anything related to the classroom environment and/or federal income taxation at the individual level. Your feedback would never be held against you in my class. Likewise, it will not earn you any favorable treatment. (If you are concerned about either possibility, then you may submit anonymous feedback to me. To do so, write down (or type up) your constructive comments, put them in an envelope, and give that envelope to the Department secretary in Bryan 383 to put in my mailbox. Your name is not needed on those comments.) Formally, I will ask you for anonymous feedback at least once, near mid-semester. Students in Distress / Eustress The most meaningful part of my job is having the opportunity to meet and to get to know each student. Arguably, I learn more from each student who feels comfortable enough with me to share parts of one’s life – class related or not – than a student learns in my classroom. I have been teaching at UNCG since fall 2012. I have met many, many amazing people over the semesters. I continue to be a big fan of each. I adore being able to cheer on (or listen to) students long after our class time together. This connection, of course, is absolutely not necessary. Nor will there be any special treatment for such. Other resources that I encourage each of you to seek out if needed: student services support, counseling, medical care, any adult you trust (including any faculty and/or staff), and my teaching assistant. I will not know of your interactions with any of these resources, unless you specifically tell me. What is at the same time good and bad is that my career continues to unfold in several directions and in various places in and away from Greensboro. This means that my time on campus at UNCG is extremely limited. Please keep in mind that I am available by e-mail. If you would like to talk telephonically, then you can send me an e-mail with your phone number and I will call you. I ask that if you are experiencing a personal, non-class related emergency, and you decide to relay this to me via e-mail, then indicate such by including “EMERGENCY” in your email subject line. I give first priority to these messages. Please be very careful with listing messages as emergencies. Almost always, nothing related to the course constitutes an emergency. Academic Integrity You and I are expected to abide by the UNCG Academic Integrity Policy as well as by the UNCG Codes of Conduct. I respect and expect you to uphold the UNCG Honor Code that includes, among other things, that you complete your own work on your own to the best of your ability. Cheating in my class results in automatic failure of the course. I will report the incident to the Honor Court for full due processing. This ends up being a lengthy and stressful process for both the student and the instructor. Please visit the following link to remind yourself of the full Code. http://bae.uncg.edu/assets/faculty_student_guidelines.pdf Policy on Accommodations for Students with Disabilities Students with disabilities that affect their participation in the course must notify me if they wish to have accommodations in instructional or examination format. I will work with the Office of Disabilities and the student to make appropriate accommodations. Fall 2015 ACC 420 Syllabus for Meints, page 11 Late Work Late work is not accepted. Cell Phone Policy It is preferred that cell phones be turned off during class times. This said, I understand that each student is juggling multiple responsibilities. If you need to keep your cell phone on during class, then please put it in vibrate or silent mode. If you decide to text in class, then you will be dismissed for the rest of the class period. I will adjust your participation grade accordingly. E-mail Policy Please allow at least 24 hours for me to respond to any e-mail(s) that you send to me. I try my best to respond as soon as possible, but this does not always happen as quickly as I wish it could. I apologize in advance for any delayed responses. Please note that I rarely have the chance to read or respond to e-mails over the weekend. Because of the volume of e-mails that I receive throughout the semester, I highly suggest that you send me just one message with multiple questions/issues at a time, if possible, rather than a sending me a series of e-mails in a short period of time each with one issue. For example, if we cover chapter three in class, then first bring your questions to that class session and ask them while we are all in class together. Most likely, someone else will have the same question. Questions will (and should) benefit the class. Class Time and Environment We have very limited time together for class sessions. I will respect you and your time. In return, I expect you to do the same for me and for your fellow classmates. Please do not have side conversations in class. Please do not pack up early. If you are distracting others in class, then I will tell you to leave the classroom immediately and your participation grade will be adjusted accordingly. If you do not want to come to class, then simply do not come. As in all of life, spend your time on what matters to you. The one thing that I took away from my own college advisor was this: “Time is the one thing that you can never get back.” Student Study Program through the Student Success Center As a student in this course, you have the opportunity to participate in the Student Study Program (SSP), which is one of the four programs housed in the Student Success Center located in the McIver Building. SSP is designed to offer additional academic support for students enrolled in historically challenging classes that have high drop, failure, and/or withdrawal rates. The purpose of SSP is to offer students the opportunity to form collaborative study groups of up to 4 of their peers. Students will be matched by the program coordinator with other students in the same course and section. To sign up or to learn more about SSP, go to http://success.uncg.edu/ssp/. If you have further questions, you may also contact the Coordinator of the Student Study Program at ssp@uncg.edu. Canvas and Technology For those who are not familiar with or have issues with Canvas, please empower yourself with resources provided by UNCG. For technology concerns and issues, contact 6-TECH: (336) 256-TECH (8324) or 6tech@uncg.edu. Plan ahead; anticipate last minute technology glitches. Fall 2015 ACC 420 Syllabus for Meints, page 12 SCHEDULE OF CLASS TOPICS AND ASSIGNMENTS (subject to change at instructor’s discretion) DATE TOPIC CHAPTER ASSIGNMENT DUE Tues Aug 18 Introduction to Class NA Thurs Aug 20 Essentials and History Tues Aug 25 Tax Research C-1 READ C-1 Thurs Aug 27 Income Formula I-2 READ CH I-2 READ Syllabus I-1, I-11 Intro DUE READ I-1 and 11-1 - 11-10; 11-25, 11-26, 11-27 *Tues Sep 1 Group Work - Supreme Court Cases READ (Canvas): Citizens United v. Federal Election Commission - Slip Opinion January 2010 Obergefell et al. v. Hodges, Director, Ohio Department of Health, et al. – S.Op. June 2015 Thurs Sep 3 Gross Income Inclusions 3 READ CH I-3 Tues Sep 8 Gross Income Exclusions 4 READ CH I-4 *Thurs Sep 10 Group Work: Practice Exam 1 *Tues Sep 15 Exam 1: Chapters I-2, I-3, I-4 and SC cases. Bring basic calculator (no graphing function; no phones), Red Scantron, and pencil. Thurs Sep 17 Exam 1 Review. H&R Block software and tax return tips. Tues Sep 22 Deductions and Losses Losses and Bad Debts 6 8 READ CH I-6 READ CH I-8 Thurs Sep 24 Itemized Deductions 7 READ CH I-7 Tues Sep 29 Itemized Deductions 7 READ (Canvas): NC Tax Reform; NC and the Federal Marketplace Exchange; NC and Medicaid expansion *Thurs Oct 1 Group Work: Practice Exam 2. *Tues Oct 6 Exam 2: Chapters I-6, I-7, I-8, NC materials. Thurs Oct 8 Exam 2 Review Tax credits 14 READ CH I-14 *Tues Oct 13 and *Thurs Oct 15 – Fall break; NO CLASS Fall 2015 ACC 420 Syllabus for Meints, page 13 DATE TOPIC CHAPTER ASSIGNMENT DUE Tues Oct 20 Employee Expenses 9 READ CH I-9 Thurs Oct 22 Depreciation 10 READ CH I-10 Tues Oct 27 Depreciation 10 Capital Gains 5 READ CH I-5 as follows: First 5 pages, stop before Basis Considerations; 5-7 and top of 5-8 Gifts; 5-13 and top of 5-14; 5-16 tax treatment to 5-20. Thurs Oct 29 Capital Gains AMT 5 14 *Tues Nov 3 Group Work: Practice Exam 3. *Thurs Nov 5 Exam 3: Chapters I-5, I-9, I-10, I-14. Tues Nov 10 Exam 3 Review Presentations – Date A (Topic due by Oct 27; Final File due by Saturday, Nov 7) Thurs Nov 12 Presentations – Date B (Topic due by Oct 29; Final File due by Monday, Nov 9) Mon Nov 16 Tax Returns Due by 12PM Tues Nov 17 Presentations – Date C (Topic due by Nov 3; Final File due by Saturday, Nov 14) Thurs Nov 19 Presentations – Date D (Topic due by Nov 5; Final File due by Monday, Nov 16) Tues Nov 24 Presentations – Date E (Topic due by Nov 10; Final File due by Saturday, Nov 21) If needed, then presentations during respective final exam periods: 12:30PM Section – Thursday, December 3 12P - 3P in Bryan 105 3:30PM Section - Thursday, December 3 3:30P – 6:30P in Bryan 111 * = Change in Office Hours Fall 2015 ACC 420 Syllabus for Meints, page 14