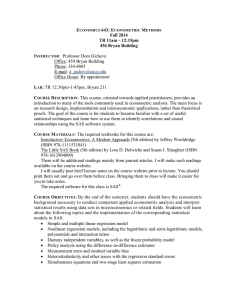

ECO644-01: Econometric Theory Fall 2014 Instructor: Martijn van Hasselt

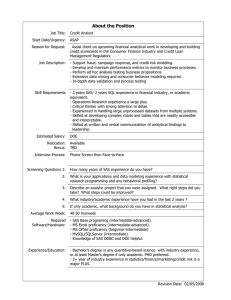

advertisement

ECO644-01: Econometric Theory Fall 2014 Instructor: Martijn van Hasselt Office: Bryan 446 Phone: TBA Email: mnvanhas@uncg.edu Office hours: Tuesdays 10:00AM – 11:00AM, Thursdays 3:30PM – 4:30PM Graduate Assistant: Maozhao Zheng Email: m_zheng@uncg.edu Office hours: TBA Class times: Location: Tuesday, Thursday, 2:00PM – 3:15PM (lecture) Tuesday, 12:30PM – 1:45PM (computer lab) SOEB 219 (lecture [School of Education building]) Bryan 211 (computer lab) Course description This course provides an introduction to mathematical statistics and econometrics for students in the Master’s program in economics. It emphasizes the theoretical underpinnings of econometrics and is taught concurrently with ECO643 (which is a course in applied econometrics). Topics include fundamental concepts of mathematical statistics (probability distributions, expected value, hypothesis testing, sampling distributions, asymptotic analysis), linear algebra, and the linear regression model. On completion of this course, students will have a thorough understanding of some basic tools of mathematical statistics; learned how these tools are used to analyze and understand the statistical properties of linear econometric models; applied these tools and techniques using SAS statistical software. Course requirements We will meet twice a week for a 75 minute lecture. The lectures are complemented by computer labs, which are held on Tuesdays every 2-3 weeks. When a lab is scheduled, it replaces the lecture on that day. The labs provide an introduction to the software (SAS, see below) and will give you an opportunity to apply some of the material covered in the lectures. Students are required to attend and actively participate in the lectures and labs. Cell phones must be turned off. Laptops may be used for note taking but not for surfing the web or other distracting activities. In addition to these responsibilities, students are expected to conform to the University’s Student Code of Conduct (http://sa.uncg.edu/handbook/student-code-of-conduct/) and to the Bryan School’s Faculty and Student Guidelines (http://www.uncg.edu/bae/faculty_student_guidelines.pdf). The grade for this course is based on the following components: Problem sets: 20% Midterm exam: 30% Final exam: 50% Problem sets will be given approximately every 2 weeks. They will receive a grade of 0, 1, or 2 (0 = no work or insufficient work; 1 = substantial work but many incorrect answers; 2 = complete work with (mostly) correct answers). To receive credit, problem set answers need to be turned in by the specified due date and time. Late answers will not be accepted without prior approval of the instructor. The problem sets will cover a combination of theory questions and computer assignments, based on the material discussed in the labs. The midterm exam, scheduled for the week of October 7, will cover all the material discussed up to that point. The final exam is cumulative and covers material from the entire semester. Software The software package used in this course is SAS. SAS is installed in the UNCG computer labs. SAS licenses for personal computers are available for UNCG students through ITS. To begin the license process, connect to https://web.uncg.edu/research-access/secure/sas/sas.asp. Academic Integrity Students are expected to be familiar with and abide by the University’s Academic Integrity Policy (see http://academicintegrity.uncg.edu/). Collaboration on problem sets and lab exercises is allowed, but students must turn in their own work. Collaboration on exams is not allowed and will be treated as a violation of the Academic Integrity Policy. Course readings We will use the following texts in this course (both are available at the campus bookstore). Arthur S. Goldberger: A Course in Econometrics, Harvard University Press, 1991. Rick Wicklin: Statistical Programming with SAS/IML Software, SAS Institute, 2010. Course outline Below is a list of topics and readings that will be covered during this course, together with a tentative schedule. The schedule is subject to change, depending on whether extra time is needed to cover certain topics. However, the exam dates are fixed and will not be moved. Week (1) Aug. 19, 21 (2) Aug. 26, 28 (3) Sep. 2, 4 Topics Univariate probability and random variables Discrete and continuous random variables Probability mass function, density, cumulative distribution Expected values Mean and variance Univariate normal distribution Lab: introduction to SAS IML Bivariate distributions Joint, marginal and conditional distribution Readings Goldberger, ch.2 Goldberger, ch. 3.1-3.4, 7.1 Goldberger, ch. 4, 5, 6, 7.27.4 (4) Sep. 9, 11 (5) Sep. 16, 18 (6) Sep. 23, 25 (7) Sep. 30, Oct. 2 (8) Oct. 7, 9 (9) Oct. 14, 16 (10) Oct. 21, 23 (11) Oct. 28, 30 (12) Nov. 4, 6 (13) Nov. 11, 13 Conditional expectations and linear prediction Independence Bivariate normal distribution Sampling distributions Random sampling Sample statistics (mean, moments) Normal, student-t and chi-squared sampling distributions Lab: statistical functions and simulation Asymptotic analysis Law of large numbers Central limit theorem Asymptotics of sample moments Sampling distributions and asymptotic analysis: the bivariate case Lab: sampling distributions Estimation Bias, efficiency, consistency Analogy principle, method of moments, maximum likelihood Matrix algebra: basic concepts Midterm – October 7 Matrix algebra for least squares (LS) estimation and random variables Fall break: no class on October 14 The classical linear model Assumptions Properties of the LS estimator Gauss-Markov theorem Lab: matrix calculations The classical linear model Estimating linear functions of the parameters Goodness-of-fit Short and long regression The classical linear model Residual regression Lab: matrix calculations in the linear model The normal linear model Multivariate normal distributions Maximum likelihood estimation Sampling distributions Goldberger, ch. 8 Goldberger, ch. 9 Goldberger, ch. 10 Goldberger, ch. 11, 12.4, 13.113.2 TBD Goldberger, ch. 14 Goldberger, ch. 15 Goldberger, ch. 16, 17.1-17.2 Goldberger, ch. 17.3-17.5 Goldberger, ch. 18, 19.1-19.4, 20.1-20.3, Hypothesis testing and confidence intervals (14) Nov. 18, 20 The normal linear model (continued) Inference with unknown variance Hypothesis testing and confidence intervals Lab: multiple linear regression (15) Nov 25, 27 Topics: TBD Thanksgiving break: no class on November 27 FINAL EXAM: December 6, 2014, 3:30PM – 6:30PM Goldberger, ch. 21 TBD