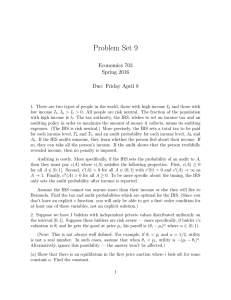

Answers to Problem Set 9 Economics 703 Spring 2016

advertisement

Answers to Problem Set 9 Economics 703 Spring 2016 1. The IRS chooses Th , T` , Ah , and A` to maximize λ(Th − c(Ah )) + (1 − λ)(T` − c(A` )). The constraints: First, we have IR constraints Ih ≥ Th and I` ≥ T` . Second, we have incentive compatibility. If you tell the truth, you don’t care if you’re audited so your payoff is your income minus your taxes. If you lie, then there’s a chance that you lose all your income. So your payoff is the probability you aren’t audited times income minus taxes. In short, the incentive compatibility constraints are Ih − Th ≥ (1 − A` )(Ih − T` ) and I` − T` ≥ (1 − Ah )(I` − Th ). Now let’s determine which constraints bind. First, note that the IR constraint for the high type cannot bind. Reason: Incentive compatibility says that Ih − Th ≥ (1 − A` )(Ih − T` ). But Ih > I` ≥ T` where the last inequality uses IR for the low type. Hence (1 − A` )(Ih − T` ) ≥ 0. So IC for the high type implies IR for the high type. There are several ways to solve from here. My choice: Consider various relationships between T` and Th . First, suppose that T` > Th (implausible, of course). In this case, the high type has no incentive to imitate the low type so that incentive compatibility constraint won’t bind. But then the only remaining constraint with Th is the incentive compatibility condition for the low type and increasing Th helps with that one. Hence the IRS would gain by increasing Th , a contradiction. Second, suppose Th = T` . In this case, neither incentive compatibility constraint binds. Clearly, the IRS will set Ah = A` = 0 and will set the highest possible T` , which is I` . In this case, the IRS’s payoff is I` . Below, we’ll check to see if this is optimal. Finally, then, suppose Th > T` . In this case, the low type has no incentive to imitate the high type, so we can drop that constraint. Given this, the IR constraint for the low 1 type must bind — otherwise, the IRS could increase T` , help on the incentive constraint for the high type, and not violate IR for the low type. So T` = I` . If we substitute this into the incentive compatibility constraint for the high type and rearrange, we get Th ≤ A` Ih + (1 − A` )I` . Clearly, this constraint must bind — otherwise, the IRS could increase Th and be better off. Hence this equation holds with equality. Substituting, then, we see that the IRS will choose Ah and A` to maximize λ [A` Ih + (1 − A` )I` − c(Ah )] + (1 − λ)[I` − c(A` )]. Ah has no effect other than to add to costs, so Ah = 0. The first order condition for the optimal A` is λ[Ih − I` ] − (1 − λ)c0 (A` ) = 0. (1) Our conditions on c ensure that there is an A` ∈ (0, 1) satisfying this equation. Is this better than Th = T` = I` and Ah = A` = 0? Yes, it must be since this is what we’d get in the last step above if we chose A` = 0. Hence the solution is T` = I` , Ah = 0, Th = A` Ih + (1 − A` )I` and A` given as the solution to equation (1). 2. (a) Fix a bidder i with valuation θi and assume all other bidders use a strategy of the form σj (θj ) = aθj . Then i’s expected payoff to a bid of b is α (θi − b) b a !I−1 . The first–order condition is −α(θi − b)α−1 b a !I−1 + (I − 1)(θi − b)α bI−2 aI−1 ! = 0. Rearranging, we get I −1 θi . I −1+α So there is an equilibrium where everyone bids aθi for a = (I − 1)/(I − 1 + α). b= (b) It’s still a dominant strategy to bid θi . The dominant strategy argument has nothing to do with risk attitudes since it says you get a higher payoff for every possible bids by the other players. (c) Since the equilibrium for the second price auction hasn’t changed, the expected revenue is still (I − 1)/(I + 1). For the first price auction, the expected revenue is (I − 1)/(I − 1 + α) times the expected value of the first order statistic. That expected value is Z 1 I θIθI−1 dθ = . I +1 0 2 So the expected revenue in the first price auction is higher if I(I − 1) I −1 > (I + 1)(I − 1 + α) I +1 or α < 1 which holds by assumption. Expected revenue in the second price auction is independent of α, while expected revenue in the first price auction is decreasing in α. 3. Whoever wins the first auction certainly loses the second. So if A wins the first auction, B will win the second one and pay A’s valuation for a second unit, namely 10. If B wins the first auction, A wins the second and pays 5. Given this, if A gets the first object, his payoff for the two auctions together is v1A minus his payment. If he loses the first auction, his payoff is v1A − 5. Hence the value to him of winning the first auction is 5 so this is what he bids. Similarly, B bids 10. Hence B wins the first auction paying 5 (the second highest bid), so A wins the second one, also paying 5. The seller’s revenue then is 10, regardless of the values of v1A and v1B . 4. (a) Suppose the seller knows the buyer is following the strategy of offering b2 (θ2 ) = α2 + β2 θ2 . If the seller offers b1 , then he earns zero if b1 < α2 + β2 θ2 and earns b1 + α2 + β2 θ2 − θ1 2 if α2 +β2 θ2 ≥ b1 . Hence, assuming β2 > 0 (which we’ll see it will be), the seller’s expected payoff is " # Z 1 b1 + α2 + β2 θ2 − θ1 dθ2 2 (b1 −α2 )/β2 if (b1 − α2 )/β2 ∈ [0, 1]. For the moment, assume b1 is in this range. Hence we can do the integration to rewrite the seller’s expected payoff as 1 [b1 + α2 ] − θ1 2 " # b1 − α2 β2 b1 − α 2 1− + 1− β2 4 β2 !2 . Note that this is just a quadratic in b1 . I’ll omit the algebra, but if you maximize this with respect to b1 , you get 2 1 b1 = θ1 + (α2 + β2 ). 3 3 This only applies when this gives us a b1 with (b1 − α2 )/β2 ∈ [0, 1] — that is, b1 ≥ α2 and b1 ≤ α2 + β2 . As we’ll see momentarily, the first of these inequalities will always be satisfied. The second is trickier though. Intuitively, if the second one is violated, so b1 > α2 + β2 , this says that the seller is offering a price that is above every offer the buyer will make and so is certain to not be accepted. Note that the seller’s offer is a convex combination of θ1 and α2 + β2 . So if his bid ends up above α2 + β2 , it must be true that his bid is below θ1 . That is, he is offering to trade at a price below his costs. Hence his optimal bid in this case is anything that isn’t accepted and α2 + β2 is good enough. 3 So now consider the buyer. He knows that the seller’s bid will take the form b1 = α1 + β1 θ1 . Again assuming β1 > 0, this means that his expected payoff can be written as Z (b2 −α1 )/β1 θ2 − 0 1 (b2 + α1 + β1 θ1 ) dθ1 2 assuming (b2 − α1 )/β1 ∈ [0, 1]. Performing the integration, we get 1 1 b2 − α1 β1 [θ2 − α1 − b2 ] − 2 2 β1 4 b2 − α 1 β1 !2 . Again, this is a quadratic in 2’s strategy. Maximizing with respect to b2 yields 2 1 b2 = θ2 + α1 . 3 3 Analogously to the above, this only applies if b2 is in the right range. For the same reasons as above, though, we don’t need to worry about these conditions. Summarizing, we get b1 = β1 θ1 + α1 where β1 = 2/3 and α1 = (1/3)(α2 + β2 ). Also, b2 = β2 θ2 +α2 where β2 = 2/3 and α2 = (1/3)α1 . Solving these equations simultaneously, we see that β1 = β2 = 2/3, α1 = 1/4, and α2 = 1/12. To see what social choice function this implements, note that it implements q = y = 0 if b1 > b2 or 1 2 1 2 θ1 + > θ2 + . 3 4 3 12 That is, we implement q = y = 0 if 1 θ2 − θ1 < . 4 If θ2 − θ1 > 14 , we implement q = 1 and 1 1 b1 + b2 = (θ1 + θ2 ) + . 2 3 6 This social choice function is not ex post efficient, since ex post efficiency would call for q = 1 whenever θ2 > θ1 , not just when θ2 > θ1 + (1/4). y= (b) Take the direct mechanism where seller and buyer both report their θ’s. Let θ̂i denote the reported value of θi (since this might differ from the true value). The seller’s payoff as a function of his true θ1 and his report is Z 1 θ̂1 +(1/4) i 1h 1 θ̂1 + θ2 + − θ1 dθ2 . 3 6 Ignoring (as before) the implicit constraint that this only applies when θ̂1 + (1/4) ∈ [0, 1], if we perform the integration, we get 1 1 θ̂1 + − θ1 3 6 " 3 1 − θ̂1 + 4 6 4 1 1 − θ̂1 + 4 2 # . This is a quadratic in θ̂1 . The first order condition for maximizing this with respect to θ̂1 is 1 1 2 1 1 − + θ1 − θ̂1 − θ̂1 + =0 4 6 3 3 4 which is easily rearranged to θ̂1 = θ1 . Similarly, the buyer’s payoff as a function of his true θ2 and his report is Z θ̂2 −(1/4) 0 1 1 θ2 − (θ1 + θ̂2 ) − dθ1 . 3 6 Performing the integration gives 1 1 θ2 − θ̂2 − 3 6 1 1 1 θ̂2 − θ̂2 − − 4 6 4 2 . Again, the first order condition for the optimal choice of θ̂2 reduces to θ̂2 = θ2 . 5