3 The Phillips curve 3.1 The Phillips curve version of the main-course model

advertisement

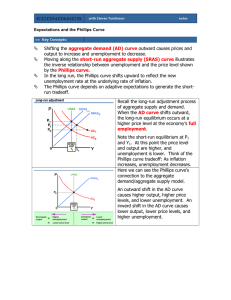

3.1 3 The Phillips curve The Phillips curve version of the main-course model We focus on the wage Phillips curve, and recall that according to Aukrust’s theory it is assumed that In the 1970s, the Phillips curve and Aukrust’s model were seen as alternative, representing “demand” and “supply” model of inflation respectively. However, as pointed at by Aukrust, the difference between viewing the labour market as the important source of inflation, and the Phillips curve’s focus on product market, is more a matter of emphasis than of principle, since both mechanism may be operating together. 1. we∗ = me,0 + mc, i.e., H1mc above. 2. the causal structure is “one way” as represented by H4mc and H5mc above. 3. Unemployment, ut has a stable long-run mean. A Phillips curve system which is consistent with this is Moreover, modern derivations give the Phillips curve a supply side interpretation! We now show formally how the two approaches can be combined . ∆wt = βw0 + βw1∆mct + βw2ut + εw,t, βw2 ≤ 0, ut = βu0 + αuut−1 + βu1(w − mc)t−1 + εu,t (8) (9) 0 < αu < 1, 28 where we have simplified the notation somewhat by dropping the “e” sector subscript. On the other hand, since we are considering a system, we have added a w in the subscript of the coefficients. Note that compared to (4) the autoregressive coefficient αw is set to unity in (8). It represent an important restriction since it rules out that wages error-correct with respect to deviations from the main-course directly. Instead, unemployment now corrects, as captured by the second equation (9). Equation (9) represents the idea that low profitability leads to high unemployment (if the wage share is too high relative to the main-course unemployment will increase in most situations, i.e., βu1 > 0.) 30 29 (4) and (8) is an example of a dynamic system. For known initial conditions (w0,u0, mc0), the systems determines a solution (w1, u1), (w2, u2), ...(wT , uT ) for the period t = 1, 2, ...., T . The solution also depends on the values taken by mct, εw t, εu,t over that period. Without further restrictions on the coefficients, it is too complicated to derive the final equation of for example wt. This is frequently the case for systems! However, we are usually able to characterize the steady state, assuming that it exists (the solution is stable). Usually we can also discuss the dynamics qualitatively. We follow this approach in the following. 31 Assume that the system has a stable solution The solution based on εw t = εu,t = 0 and ∆mct = gmc (the constant growth rate of the main course) then approaches the following steady state: ∆wt = gmc, ut = ut−1 = uphil , the equilibrium rate of unemployment. Substitution into (4) and (8) gives the following long run system: gmc = βw0 + βw1gmc + βw2uphil Given (10), the second line in the long run system can be solved for the equilibrium wage 1 − αu phil −βu0 + mc + u w= βu1 βu1 uphil = βu0 + αuuphil + βu1(w − mc) The first equation gives βw0 β −1 + w1 gmc), (10) −βw2 −βw2 which is the natural rate of unemployment in this model. We can also call the “main-course rate of unemployment”, since it is the rate of unemployment required to keep wage growth on the main course. uphil = ( 32 33 Qualitative discussion of dynamics and stability. Consider the solution based on ∆mct = gmc, and εw t = εu,t = 0 in all periods. In this case (4) becomes wage growth ∆wt − gmc = βw0 + (βw1 − 1)gmc + βw2ut, for t = 1, 2, ...T ∆wt − gmc = βw2(ut − uphil ) Assuming that βw2 < 0, wage growth is higher than the main-course growth as long as unemployment is below the natural rate. long run Phillips curve ∆ w0 g mc Moreover, from the second equation of the system: ut = βu0 + αuut−1 + βu1(w − mc)t−1, βu1 > 0 it is seen that unemployment is increasing form period to period, if w is grew higher rate than mc in the previous period. This suggest that from any starting point on the Phillips curve, stable dynamics leads to the steady state solution. u 0 u phil log rate of unemployment Figure 3: Open economy Phillips curve dynamics and equilibrium. Hence we conclude that βw2 < 0 and βu1 > 0 are important for stability. And that for example βw2 = 0 is harms stability. 34 35 Short and long run Phillips curves The short-run Phillips curve is in this model given by (8). The slope coefficient is βw2 < 0 The long run Phillips curve characterizes a steady state situation in which ∆wt = ∆mct. Replacing ∆mct on the right hand side of (8) by ∆wt implies that the slope of the long run Phillips curve is βw2 <0 1 − βw1 Showing that the long-run Phillips curve is steeper that the long-run Phillips curve, i.e., as long as 0 < βw1 ≤ 1. In textbooks it is often asserted that the long run Phillips curve “has to be” vertical, which corresponds to βw1 = 1. No such implication in the main-course model–the hypotheses hold good also for the case of βw1 < 1 In many instances expectations term are included on the right hand side of the Phillips curve. For example, instead of (8) we might have ∆wt = βw0 + βw1∆wte + βw2ut + εw,t, e or ∆wt+1 for that matter. However, as long as expectations are influenced by the main-course, we get the same conclusion as above. For example ∆wte = ϕ∆mct + (1 − ϕ)∆wt−1, 0 < ϕ ≤ 1 In steady state there are no expectations errors, so ∆wte = ∆wt−1 = gmc 36 37 Price Phillips curve A relationship between domestic inflation ∆pt and the rate of unemployment is implied by the main course model. From the definitional equation pt = φqs,t + (1 − φ)qe,t, 0 < φ < 1. obtain ∆pt = φ∆qs,t + (1 − φ)∆qe,t In the simplest case, s-sector price growth is given by ∆qs,t = ∆wt − ∆as,t Since ∆wt depends on ut, so do ∆qs,t and eventually inflation. 4 Some evidence Based on estimated versions of Phillips curve and the more general dynamic battle of mark up model. Data: Annual Norwegian data from mid 1960s to the end of the last century. You may want to keep the details for later reference, here and now we consider some graphs that have close correspondence to the main concepts introduced in the note. The steady state rate of inflation: ∆qs,t = gmc − gas , ∆qe,t = gqe ⇒ ∆pt = φ(gmc − gas ) + (1 − φ)gqe = gqe + φ(gae − gas ) since gmc = gqe + gae . 38 39 ∆p t 0.08 tu t 0.10 −3 Actual rate of unemployment 0.05 0.07 −4 1970 0.06 1980 1990 2000 ∆wc t 0.20 1970 1980 1990 2000 1980 1990 2000 wc t −a t −q t −0.2 0.15 0.05 −0.3 0.10 0.05 +2 se 0.04 −0.4 1970 u phil 0.03 −2 se 0.02 1980 1990 tu t : Cumulated multiplier 0.050 1990 1995 0.025 −0.005 0.000 −0.010 wc t −a t −q t : Cumulated multiplier −0.015 0 2000 1970 0.000 −0.025 1985 2000 10 20 0 30 10 20 30 Figure 4: Sequence of estimated wage Phillips curve NAIRUs (with ±2 estimated standard errors), and the actual rate of unemployment. Wald-type confidence regions. Figure 5: Dynamic simulation of the Phillips curve model. Panel a)-d) Actual and simulated values (dotted line). Panel e)-f): multipliers of a one point permanent exogenous increase in the rate of unemployment 40 41 ∆p t 0.10 −3 0.05 −4 0.20 ∆wc t Phillips-curve: tu t 1970 1980 1990 + Reasonable estimate on the natural rate, around 2.5% 2000 1970 wc t −a t −q t −0.2 1980 1990 2000 - Actual rate crosses natural rate too seldom to be credible.! 0.15 −0.3 0.10 0.05 −0.4 1970 1980 tu t : Cumulated multiplier 0.04 1990 1970 1980 wc t − a t −q t : Cumulated multiplier 2000 0.000 1990 2000 - Dynamic multipliers show that steady state was not even “in sight” within the 35 years simulation period. Must question the stability of this system. −0.001 0.03 −0.002 0.02 Modernized main-course model: −0.003 0 10 20 30 40 0 10 20 30 40 + 80% of the long-run effect is reached within 4 years, and the system is clearly stabilizing in the course of a 10 year simulation period. Figure 6: Dynamic simulation of the ECM model Panel a)-d) Actual and simulated values (dotted line). Panel e)-f): multipliers of a one point increase in the rate of unemployment + This system is more convincingly stable than the Phillips curve version of the main-course model. + 42 Stability is due to direct response of wages with respect to profitability 43