BUSINESS OWNERSHIP AND OPERATIONS

advertisement

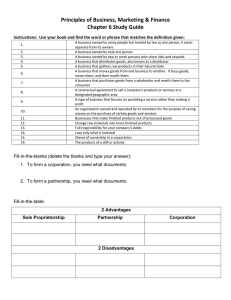

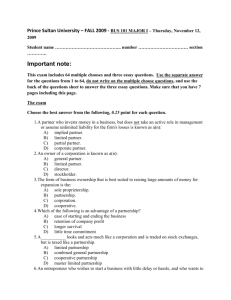

BUSINESS OWNERSHIP AND OPERATIONS BUSINESS PRINCIPLES A, CHAPTER 6 SOLE PROPRIETORSHIP • Def: business owned by only one person; about ¾ of all businesses in the US are sole proprietoships • Advantages – Easy to start – Might need a license orpermit – Be your own boss – You get to keep all profits – Taxes may be lower; paid on personal profits SOLE PROPRIETORSHIP • Disadvantages: – Must pay for everything yourself – Capital may be limited or not enough • Common cause of failure – You may lack business Skills – Unlimited Liability • Full responsibility for you company’s debts PARTNERSHIP • Def: Business owned by two or more persons who share the risks and reward • Share the rewards • Income taxed only once • Must start with a partnership agreement – Contract that outlines the rights and responsibilities of each partner PARTNERSHIP • Advantages • Disadvantages: – Might need a license to start – Must share the profits – Pay taxes only on your personal profits – Might not get along with your partner – Each partner can contribute money (capital) to start the business – Banks often are more willing to lend to a partnership – Share unlimited legal and financial responsibility – If one partner makes a bad decision, all are equally responsible – All partners are responsible for debts that result from bad decisions CORPORATION • Def: business owned by many people but treated by law as one person • Can own property, pay taxes, make contracts, be sued just like a person • Exists separate from the owners • Must get a corporate charter from the state in which your headquarters reside – Charter: a license to run a corporation • Can raise money by selling stock: shares of ownership in your corporation • Stockholders pay a set price for each share and usually get to vote on how the business is run • Must have a board of directors who control the corporation • Hire officers to run the business CORPORATION • Advantages: • Limited liability: if company loses money, the stockholders lose only what they invested • Personal property or savings cannot be taken away from you • The corporation doesn’t end if the owners sell their shares • Shares can be resold and the company continues • Disadvantages: • Double taxation – Corporate profits are taxed – Owners are taxed on their income from the corporation • Government closely regulates corporations • More difficult to start a corporation than a sole proprietorship or partnership • Running it can be more complicated ALTERNATIVE WAYS TO DO BUSINESS • Franchise-contractual agreement to sell a company’s products or services in a designated geographic area • You must invest money and pay the franchisor an annual fee or a share of the profits • Franchisor offers a well-known name and a business plan • They provide management training, advertising, and a system of operation • Can be operated as proprietorship, partnership, or corporation FRANCHISE • Advantages: • Disadvantages: • Easy to start • Proven methods and product • Franchisor is often very strict about how the business is run • Name of parent company can be a big draw for customers • Business must operate like every other franchise • Might be limited in what products or services you can offer your customers COOPERATIVE • Def: an organization owned and operated by its members for the purpose of saving money on the purchase of certain goods and services • Like a corporation in that it exists as a separate entity from the individual business • Need a government charter to start one • Can also sell stock and choose a board of directors to run it • Small farmers, book dealers, or antique merchants can pool their resources • Save money by buying insurance, supplies, and advertising as a group • Share factory facilities and warehouse space • Cooperatives also pay less in taxes than regular corporations do • Examples: Ocean Spray, Ace Hardware, and Welch’s TYPES OF BUSINESSES • Group by the kind of products they provide: – Producing raw goods – Processing raw goods – Manufacturing goods from raw or processed goods – Distributing goods – Providing services TYPES OF BUSINESSES P RO D U C E R S P RO C E S S O R S • Def: a business that gathers raw products in their natural state • Raw goods are materials gathered in their original state from natural resources such as land or water • Examples: • Def: change raw materials into more finished products – farmer growing wheat – Miner digging for iron ore – Petroleum worker drilling for crude oil • Processing of raw goods • Examples: – Wheat turned into flour – Crude oil into gasoline – Iron ore into steel TYPES OF BUSINESSES M A N U FAC T U R E R S S E RV I C E BU S I N E S S • Def: businesses that make finished products out of processed goods • Def: business that provides services rather than goods • They turn raw or processed goods into finished goods that require no further processing and that are ready to market • Services are the products of a skill or an activity • Examples: – Bakery makes bread out of flour – Automotive plant makes cars out of steel, glass, and plastic • Examples: – Hairstyling – Car repair – Dry cleaning – Massage TYPES OF BUSINESSES I NT ER M EDIARIES • Def: business that moves goods from one business to another • Buys goods, stores them, and then resells them • Wholesaler: a distributor who distributes goods; buys from manufacturers in huge quantities and resells them to companies in smaller quantities • Examples: clothing wholesaler buys thousands of jackets and them sells them to retailers • Retailer: purchases goods from a wholesaler and resells them to the consumer, or the final buyer of the goods • Examples: services stations, record stores, and auto dealers