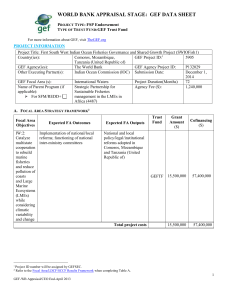

NBER WORKING PAPER SERIES COFINANCING IN ENVIRONMENT AND DEVELOPMENT:

advertisement