Document 11679384

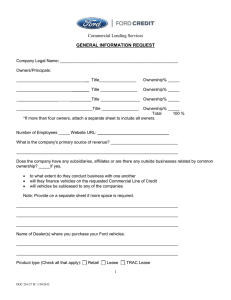

advertisement