New Financial Aid “Satisfactory Academic Progress Policy” Tightened by Federal Government

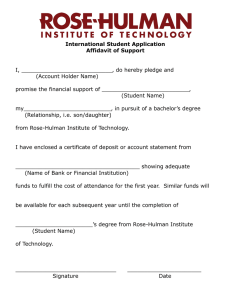

advertisement

Financial Aid Newsletter SPECIAL POINTS OF INTEREST: V O L U M E Office Hours Monday—Friday 8:00 am—5:00pm 1 S U M M E R 2 0 1 1 Tightened by Federal Government Workstudy positions are still available. Check them out on Financial Aid website. I S S U E New Financial Aid “Satisfactory Academic Progress Policy” Classes begin September 1 2 , Graduation May 26, 2012 INSIDE THIS ISSUE: Parent Loans for Undergraduates 2 Report your Outside Scholarships 2 FAQs 2 Book Money 3 How is Finan3 cial Aid Eligibility Determined Stafford Loans 3 Scholarship Math Problem 4 Federal regulations require that a student receiving federal financial aid makes satisfactory academic progress in accordance with the standards set by Rose-Hulman and the federal government. These limitations include all terms of enrollment, whether or not aid was awarded or received. At Rose-Hulman, Satisfactory Academic Progress (SAP) standards also apply, to non-federal aid, including state funds, institutional funds and foundation scholarships. Progress is measured at the end of the academic year by the student’s cumulative grade point average (qualitative) and by credits earned as a percentage of those attempted (quantitative). In addition, students must complete their programs of study before attempting 150% of the credits required to complete the program. Quantitative Standards Completion Rate (67%): Students must, at a minimum, receive satisfactory grades in 67% of cumulative credits attempted. This calculation is performed by dividing the cumulative number of successfully completed credits by the cumulative number of credits attempted. All credits attempted at Rose-Hulman are included. All transfer credits accepted count as both attempted and successfully completed credits. This evaluation will be made prior to aid being awarded and after grades are posted at the end of each academic year. required for that program. GPA Requirement is based on the Rose-Hulman standards. This will be monitored by the Financial Aid Office at the end of each academic term. If the student doesn’t make the GPA standards, the student will need to appeal his/her financial aid and may be put on an academic plan. This plan will need to be followed during the academic year to maintain financial aid. Once the student has increased their GPA to the standard, then he/she will be put back on good standing with financial aid. If you have any questions regarding the SAP policy, please contact the Financial Aid Office. Maximum Hours (150% rule): a student must complete his/her program of study before attempting 150% of the credits Repeated Courses and Financial Aid The Federal Government has put a limitation on repeating courses and financial aid. If a student retakes a course in which he/she have received a passing grade (Dor higher), the course cannot be counted as part of the student’s course load which determines the eligibility for financial aid programs. If the student fails a class, he/she may repeat that course and receive financial aid. Also, federal regulations stipulate that students cannot be awarded financial aid for course work that is not applicable to the student’s current degree program. For example, if a student is enrolled in a total of 12 credit hours for a quarter and 6 of those credit hours are not applicable to the student’s degree program, the student will only be eligible to receive financial aid for the courses that are applicable to the student’s degree program. PAGE 2 Parent Loans for Undergraduates A parent* of an undergraduate student may borrow a Federal Direct PLUS Loan to pay the educational expenses of a dependent student who is enrolled at least half time (six credit hours). The loan application must be completed each year that the parent wishes to borrow. The maximum loan amount is the student’s cost of attendance minus any other financial aid for the loan period. *The parent-borrower must be the student’s biological or adoptive mother or father. The spouse of a parent who has remarried (i.e., a stepparent) also is eligible to borrow a PLUS Loan on the student’s behalf, if his/her income and assets are included in the student’s expected family contribution (EFC). A legal guardian is not considered a parent for federal student financial aid purposes. Therefore, a legal guardian cannot borrow a Federal Direct PLUS Loan. To ensure that the dependent undergraduate student receives the maximum financial aid for which he/she is eligible, the student must file a FAFSA before a PLUS Loan will be processed. To make application to the PLUS loan, the parent must go to www.studentloans.gov and use he/she pin number to sign in and apply. Rose-Hulman will receive the application electronically. Report your Outside Scholarships The surest way not to fail is to determine to succeed! If you receive a scholarship for the 2011-2012 academic year from an organization other than Rose-Hulman Institute of Technology, you need to share your good news with the Office of Financial Aid as early as possible. Complete a Scholarship Contact Information form available on our website at www.rose-hulman.edu, under Financial aid, then Financial Aid Forms. State and federal regulations require us to consider outside sources of financial assistance when preparing a financial aid package for you. Late addition of an outside scholarship could cause your award package to exceed the maximum allowed based on educational cost. We use the term “overawarded” to describe this situation. If you have an overaward, a reduction to your aid package could be necessary. By submitting your Scholarship Contact Information form early, you reduce the likelihood that your financial aid package will change. When filling out the form, please indicate if the check was issued to the student directly or if the school will receive the check. FAQs My parents did not claim me on their tax return this year. Can I file my FAFSA as an independent student? Probably not. To determine if you are independent or dependent, review the FAFSA. If you can answer “YES” to any questions in Section D, you FINANCIAL AID NEWSLE TTER are considered independent for financial aid purposes. If you cannot answer “YES” to any of those questions, you are considered dependent for financial aid purposes. Can I access my financial aid funds to purchase my books? You may stop by the Financial Aid Office to see if your financial aid exceeds your invoice from Student Financial Services. If your financial aid does exceed, you can pick up a credit voucher to take to the bookstore to purchase your books. VOLUME 2, ISSUE 1 PAGE Book Money If you have a credit on your account for books, please stop by the Office of Financial Aid once you come back on campus for the fall. The staff will give you a credit voucher to purchase your books. If you don’t have a credit voucher and need help purchasing your books, there is a Bucks for Books loan available. The student must be an undergraduate student. Students can borrow up to $650, and the loan must be paid off before the end of the term. The loan is interest free. For more information, contact the Financial Aid Office. How is Financial Aid Eligibility Determined? Cost of Attendance (COA) reflects average costs. Tuition and fees are a fixed cost for any given academic year. For the 2011-2012 academic year the tuition is $37,197. Books and supplies are variable costs and depend upon particular programs of study. Room and board costs are also variable. When living on campus, students are billed directly for room and board. Those amounts will vary depending on the meal plan, residency, etc. You can ask about the meal plan by visiting the Rose-Hulman website or contacting Aramark in the Union Build- Stafford Loans Future Newsletters If you are a returning student and would like to take out the Stafford Loan, make sure you have go on BannerWeb and accepted the loan. To do that you must select Financial Aid, then My Award Information, Accept/Decline Award Offer by Aid year and 2011-2012 Academic Year. In accordance with our campuswide commitment to sustainability, future issues of the Financial Aid Newsletters will be put on the Financial Aid Website. The information students and parents report on the FAFSA is used in a formula established by Congress to determine Expected Family Contribution (EFC). This is the first component of determining financial aid eligibility. Parents will be notified via postcard when the next newsletter will be available. Students will be notified via email. ing. Miscellaneous expenses such as pizza, laundry coins are variable costs that can consume a large part of the educational costs if not budgeted carefully. If you have any questions regarding your EFC number or your COA number, please contact the Financial Aid Office located in Hadley Hall. The best motivation always comes from within! 3 Financial Aid Staff: Melinda Middleton middleto@rose-hulman.edu Luann Hastings hastings@rose-hulman.edu Jill Mishler mishler@rose-hulman.edu Rose-Hulman Institute of Technology 5500 Wabash Ave. CM 5 Scholarship Searches www.finaid.org/scholarships/ www.fastweb.com www.scholarships.com Terre Haute, IN 47803 www.collegeboard.org Phone: 812-877-8672 www.brokescholar.com Fax: 812-877-8838 E-mail: middleto@rose-hulman.edu www.upromise.com FinAID…. Math Problem With each published RHIT Financial Aid Newsletter there will be a challenge. The first 10 undergraduate students that correctly answer the challenge question will win a $50 scholarship. You will need to email the answer to Melinda Middleton at middleto@rose-hulman.edu. The first 10 correct answers received by Melinda will be the winners of the $50 scholarship. Winners will be notified by email. BAILEY CHALLENGE WATCH FOR THE NEXT FINANCIAL AID NEWSLETTER FOR A NEW CHALLENGE Challenge was by Professor Emeritus Herb Bailey