Rose-Hulman Office of Financial Aid Manual of Financial Aid

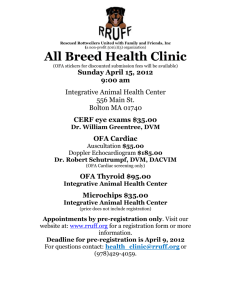

advertisement