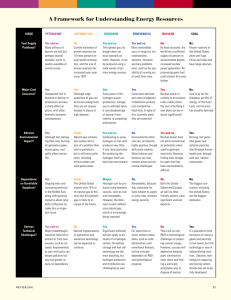

RESOURCES E N E R GY P O L... T H E 2 1

advertisement