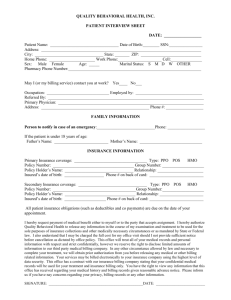

Early Intervention Central Billing Office BILLING INFORMATION FOR PROVIDERS

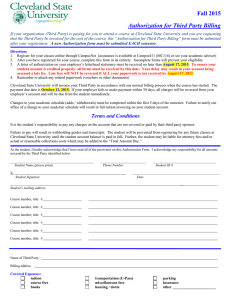

advertisement