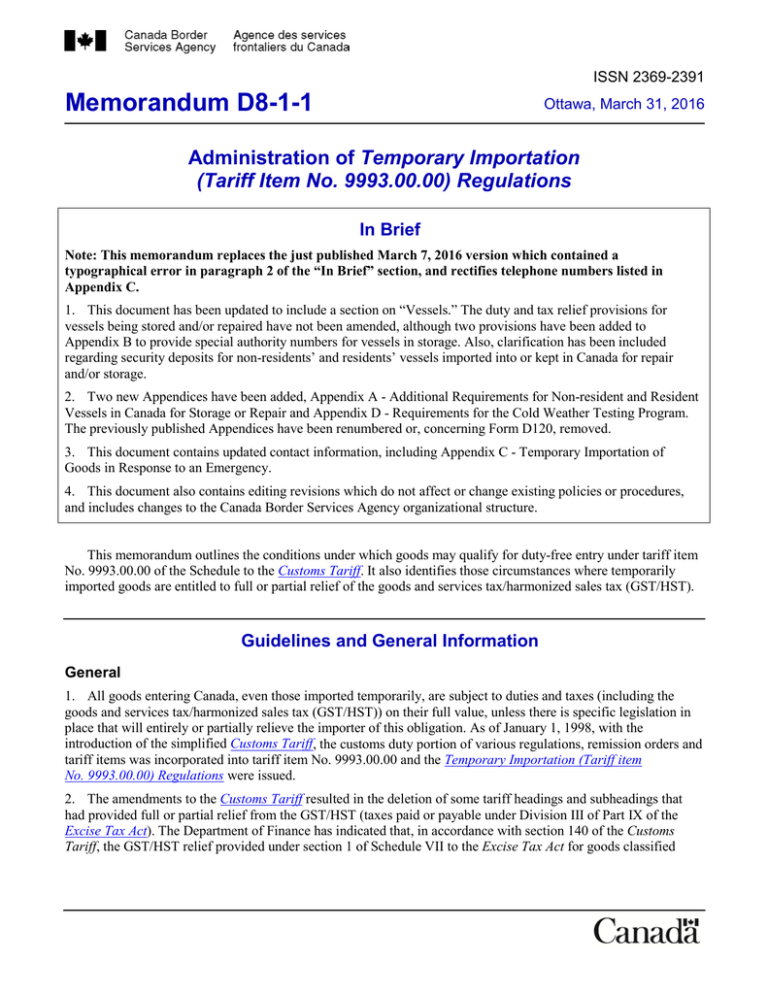

Memorandum D8-1-1 Temporary Importation (Tariff Item No. 9993.00.00) Regulations In Brief

advertisement