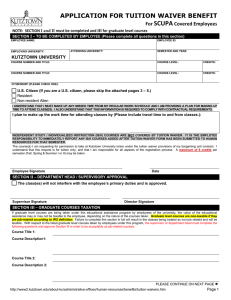

A PPLICA KUT TZTOWN U

advertisement

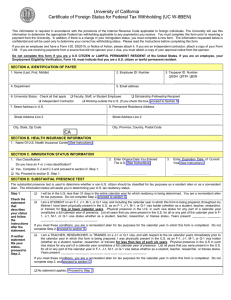

APPLICA ATION FOR TUITION N WAIV VER BE ENEFIT T For A APSCUF Covered EEmployeess NOTEE: SECTION I and II must be completed d and approvved if applicaable SECT TION I – TO BE B COMPLET TED BY EMP PLOYEE (Ple ease complette all questio ons in this se ection) EMPLO OYEE NAME: EMPLO OYING UNIVERSITY Y: KUT TZTOWN UNIVERSITY Y BARGA AINING UNIT: ULTY ONLY) EMPLO OYEE ID: ATT TENDING UNIVER RSITY: SEM MESTER AND YEAR COURS SE AND TITLE: COURSE E LEVEL: CREDITS: COURS SE AND TITLE: COURSE E LEVEL: CREDITS: CITIZEN NSHIP (PLEASE CH HECK ONE): U.S S. Citizen (If you y are a U.S S. citizen, ple ease skip the e attached p pages 3 – 5.) Re esident No on-resident Alien I unde erstand it is my responsibility to mee et the deadlines for tuitio on and fee pa ayments at tthe university y attended. oyee Signaturre Emplo Date SECT TION II – DEP PARTMENT HEAD / SUPERVISORY APPROVAL A Th he class(es) will w not interrfere with the e employee’s s primary dutties and is approved. Signature – Chair / Supervisor an / Director Siignature – Dea Signature – Provost / VP SECT TION III – GR RADUATE CO OURSES TAX XATION If grad duate level cou urses are being g taken under this educational assistance program by em mployees of th he university, th he value of the e educattional assistance may or ma ay not be taxab ble to the emp ployee, depend ding on the na ature of the co ourses taken. Graduate leve el course es are non-taxa able if they are job-related acc cording to IRS definition. Fai lure to complette this section in full will resullt in the classes s being ttreated as non n-job related an nd will be taxable. With resp pect to the liste ed graduate le evel courses ta aken by employyees under this s progra am, the supervisor or departm ment head mustt complete the following questtions: Course e Title 1: Course e Description1:: Course e Title 2: Course e Description 2: 2 PLEASE C CONTINUE ON N NEXT PAGE http://ww ww2.kutztown.edu/about-ku/a administrative-o offices/human--resources/ben nefits/tuition-wa aivers.htm Page 1 Name: Line 1: Semester: Line 2: 1. Are these courses required by the university, or by law or regulation, to keep the employee’s current salary, status or job? Yes No 2. Do these courses maintain or improve skills required in the employee’s present work? Yes No 3. Are these courses required in order to meet the minimum educational requirements to qualify the employee in his/her work or business? Yes No 4. Are these courses part of a program of study that will lead to qualifying the employee in a new trade or business? Yes No Courses meet the IRS definition of job-related if the answer to either questions 1 or 2 is yes and the answers to questions 3 and 4 are both no. Below, provide any additional information about the employee’s job, and how the course relates to his/her work. If the education provides the employee in the new profession, trade or business, it is taxable even if they do not intend to enter that trade or business. I certify that this form is completed accurately and the course is job-related. Signature – Department Chair / Supervisor Signature – Dean / Director ReturntoKutztownUniversity’sHumanResourcesDepartmentattheKempBuilding SECTION IV – TO BE COMPLETED BY HUMAN RESOURCES Graduate level section completed: Yes No Faculty is tenured/on tenure track or has a 1 year full-time contract: Yes No Coach has full-time regular status: Yes No Verified by: Initials____________ Date____________ Entered____________ The employee’s eligibility for the tuition waiver has been reviewed, and I hereby certify that the information submitted is true and accurate to the best of my knowledge. Executive Director of Human Resources Date SECTION V – TO BE COMPLETED BY THE BUSINESS OFFICE AT THE UNIVERSITY ATTENDED BY THE EMPLOYEE Number of Credits Per Credit Charge Total Waiver Taxable Amount Non-Taxable Amount http://www2.kutztown.edu/about-ku/administrative-offices/human-resources/benefits/tuition-waivers.htm Award Code Page 2 STATEMENT OF CITIZENSHIP STATUS and TAXATION \Payroll\DM\International\Statement of Citizenship Status State System of Higher Education, University For Tax Year 20 In order to comply with the applicable provisions of the U.S. Internal Revenue Code, the information requested on this form is necessary for the University to determine my proper rate of Federal tax withholding. DIRECTIONS: 1. 2. 3. U.S. residents complete sections A, B, C and G (as applicable) Permanent U.S. resident immigrant, complete sections A, B, C, D and G, and attach a photocopy of your alien registration card (green card). All others, complete entire form, and attach a copy of your I-94 (Arrival and Departure Record) and if an employee or contractor, your work authorization paper work (IAP66, Notice of Action, Employment Authorization Card). A. Personal Information Name (last, first, middle) Date of Birth Street address while in U.S. Street address in country of residence City State Zip Code B. Employment Information Faculty/Staff Employee Local Phone # Candidate for a degree? YES NO City Province Country Postal Code Non-employee Student Employee C. Social Security Information Have you applied for either a Social Security Number (SSN) or an Individual Tax Payer Identification Number? (ITIN) Yes My number is No I have not applied. (In order to be paid you are required to have a SSN and in order to receive a scholarship you are required to either have a SSN or ITIN. Your university Payroll Office can direct you to the university representative who can assist you with this requirement. Please notify the Payroll Office when you receive your number.) D. Citizenship and Visa Information Citizen of (Country) Resident of (Country) What country issued you a passport? Passport Number Is this your first visit to the U.S.? Most recent date entered U.S. Yes Visa type on I-94 What is the primary purpose of your Visit to the U.S.? No If no, please list all entries into the U.S. and the previous visa types: Expiration date of I-94 Intended length of stay in U.S. Anticipated departure date (if known) Page 3 of 5 E. Certification of Tax Exemption Note 1: This does not apply to Commonwealth of Pennsylvania or Local Withholding Taxes. Note 2: Certification of Federal tax exemption must be renewed each tax year. Note 3: Annually, employees receiving payment for services must complete IRS Form 8233 and the tax treaty statement to claim tax treaty benefits. Note 4: Non-employees receiving payment for independent personal services must complete IRS Form 8233 to claim tax treaty benefits. You may be eligible for exemption from Federal Tax withholding because there is an applicable tax treaty between your country of residence and the U.S. and your duties while in the U.S. are: Yes, I certify I am not a citizen or resident of the U.S., that I am eligible for tax exemption because there is a current tax treaty between my country of residence and the U.S., and my duties while in the U.S. are: Treaty Article Teaching Student Other (describe) No, I am not exempt from Federal Tax withholding. F. Determination of Federal Tax Withholding Status. (To be completed by alien.) Follow directions for each test. Complete Summary of Tax Status. Test 1: Exemption from Substantial Presence Check any applicable statement: I have a Type A visa or Diplomatic or Consular status. I have a J-1 visa and I was in the U.S. as a teacher, trainee, researcher, or student on a J-1 or F-1 visa for less than 2 calendar years of the preceding six years. I am a student on an F-1 or J-1 visa and have been in the U.S. for five or fewer calendar years. I am a student on an F-1 or J-1 visa and have been in the U.S. for more than five calendar years, and I have established with the IRS that I do not plan to reside in the U.S. when my education is completed. (Attach IRS notification letter) If you marked any box, you are a nonresident alien for tax purposes. Please complete Summary of Tax Status. If you did not mark a box, go to Test 2. Test 2: Substantial Presence Test (SPT) I have been present in the U.S. during the current and the previous two years as follows: Enter year Date Entered U.S. Date Departed U.S. Number of Days in U.S. Computation of SPT Current Year x1 = 1st preceding Year x 1/3 = 2nd preceding Year x 1/6 = Total: Days Check One: Total less than 183 days. You are a nonresident alien for tax purposes. Please complete Summary of Tax Status. Total equal to more than 183 days, go to Test 3. Page 4 of 5 Test 3: Exception to the Substantial Presence Test Check applicable box: Have you been in the U.S. for less than 183 days during this calendar year? AND do you pay taxes in your country of residence? AND do you have a closer connection to that country than to the U.S.? Yes If yes to all, you are a nonresident alien for tax purposes. Please complete Summary of Tax Status. No If no to any, you are a resident alien for tax purposes. Please complete Summary of Tax Status. SUMMARY OF TAX STATUS Mark appropriate Federal Tax withholding status: Resident alien (complete W-4) Nonresident alien G. Signature I declare under the penalties of perjury that this statement, to the best of my knowledge and belief, is true and correct. Department Contact: Phone: Signature Date PRIVACY NOTIFICATIONS Pursuant to the Federal Privacy Act of 1974, you are hereby notified that disclosure of your Social Security Number is mandatory. Disclosure of the Social Security Number is required pursuant to sections 6011 and 6051 of Subtitle F of the Internal Revenue Code and with Regulation 4, Section 404.1256, Code of Federal Regulations under Section 218, Title II of the Social Security Act, as amended. The Social Security Number is used to verify your identity. The principal uses of the number shall be to report (1) state and federal income taxes withheld, (2) Social Security contributions, (3) state unemployment and Workers' Compensation earnings, and (4) earnings and contributions to participating retirement systems. University Use: Determination of Value of Scholarship/Waiver Award Recipient: Relationship: Award Type: Award Name: Semester: Status: STAFF or STUDENT UNDERGRADUATE or GRADUATE Taxable Amount: Benefit Code: Authorized By: Date: Page 5 of 5 Payroll Dept. Only Date input in HRS Pay Date Initials